Insurance Premium – If you have an insurance policy you may think about how companies calculate your insurance premiums. You provide the insurance premium for your health – and your car, home, life and other valuables that cover the valuables. The amount you pay is based on your age, based on the type of cover you want, coverage you need, your personal information, your zip code and other factors.

If you have an insurance policy, the company charge you in exchange for that cover. These expenditures are known as insurance premium. Depending on the health insurance policy you can provide premium on the basis of every month or half. In some cases you may have to give the whole amount in advance before the coverage starts.

Insurance Premium

Most insurance companies provide online options, automatic payments, credit cards, checks, post changes, cashier checkers and bank ideas and various ways to pay your invoice. If you sign up for the paperless billing options or if you pay the full amount instead of paying the minimum amount you may be eligible for a discount.

How To Calculate Insurance Premiums

There is no specific cost for insurance premium. You may have the same car as your neighbor and pay more (or less) for insurance – even with the same coverage. It pays for shopping around and comparing prices and policies. There are insurers that provide plans to provide cash flow where your annual premium is divided into smaller payment units.

Pay more for the more broad coverage you are. For example, a health insurance policy of $ 1, 000 will be more expensive than one discount of $ 5, 000. A car insurance of $ 0 will be more expensive than the policy with $ 500, all other factors are the same.

However, this does not mean that you have to go automatically for cheap principles for saving money. You are essential to consider your situation – and the policy you need to use is to choose the plan that works best for you.

Insurance companies consider different reasons when calculating the insurance premium of a person. Group insurance suppliers will also see these reasons when calculating the premium of a group.

What Is An Insurance Premium?

Insurance companies are about evaluating all risk. The higher the risk, the higher the premiums. Yet there are ways to reduce your premiums.

A way to make your insurance bundle. For example, if your car, home and life insurance policies are with an organization, you will probably be eligible for discount.

Of course if you reduce your coverage, you can save money (eg, increase your discount). However, it is not always a good choice. Consider your situation and possibility that you use the policy before deciding.

There are other ways to save your premiums but they accept more commitments. For example, most states charge 50% of smokers than non -smokers for health insurance policy. For example, if you pay $ 600 per month for health insurance, if you pay, you can be able to reduce your premium to $ 400 if you stop smoking.

Understanding Health Insurance Premiums: Key Factors Explained

Another example: If you improve your credit score you can qualify for the low car insurance rate. The reason for this is that people with low -credit scored people submit a claim statistically.

Insurance premiums vary on the basis of coverage and the principle of the person who applies the principle. The most important considerations that many variables pay you are of the amount of money you pay is the level of coverage you received and personal information like age and personal information. For car insurance, it means age and driving records. For health insurance, it can be based on personal habits such as smoking or existing situations.

Not necessary. Since many variables go to determine your premium, your premium for the same coverage can be higher than anyone else. You usually provide higher premiums for a more broad coverage, such as low discount eligible, or helping for more associated services such as road or rent car coverage.

The most waterproofing way to reduce your premiums is to choose lower level coverage. If you prefer the coverage to you, consider the combination of bundling-dipper type insurance to be eligible for multi-policy discount. For health insurance, some companies provide stimulation to develop healthy habits, such as getting annual health evaluation or trying to quit smoking. Some car insurance companies will also reduce your premiums based on a good driving record or credit score.

Three Reasons Insurance Premiums Increase For Your Business

Various statistics consider the value of an insurance premium with age, state and space space and amount of coverage. Of course you cannot change your age, but you can spend less of the benefits of stimuli, for example, quitting smoking or improve your credit score. Whether you bundle your own insurance, no health habits will change or improve the financial image, it always pays for shopping. This way you will find the best insurance policy for the price you can afford.

Writers need to use primary sources to support their work. These include white papers, government data, original reports and interviews with industrial experts. We also mention the original research by other renowned publishers where we need. You can find out more about the values we follow when producing the right, neutral content among our editors. What is insurance premium? An insurance premium is an amount that a person pays for getting the insurance coverage if needed. For example, an organization has an insurance policy ten years before the factory. The amount of insurer is $ 1, 000, 000. The agency has to pay a certain amount, for example $ 50,000, for the ten years per year, which is determined on the basis of insurance.

The value depends on the type of insurance policy. It may include cars, health, home, life or other objects. According to the agreed premium frequency, the individual/business entity must pay monthly, half -before or a certain amount. In exchange for payment, the insurer promises to repay the policy buyers in unfortunate circumstances. Furthermore, some premiums as health insurance are tax deductions/discount by IRS.

:max_bytes(150000):strip_icc()/InsurancePremium_Final_4194539-49c5df26fba746b0b9d16de6e302fdf5.jpg?strip=all)

John has been 21 years old and smoke from adolescence. His father, Mr. Steve, was concerned about him and bought $ 500,000 health insurance policy to protect him financially. The insurer provides the following information about the treatment plan,

Insurance Premium Png Transparent Images Free Download

Olivia decides to buy a new car and buy vehicles insurance for it. His vehicle property is worth $ 63,000. The rates of the organization are as such,

Money to pay according to the contract between the insurer and the policy holder. Provides agreed amounts when managing the policy holder policy

If the policy holder can provide premium even if he does not submit claims during the policy period

Low premiums refers to higher discount. This is the best for people who need any/ minimum claim option in one year.

What Is Insurance Premium Financing? Explained

Low discount results in higher menstrual premium. It enables the policy to save money during treatment, as insurance pays most amounts.

Insurance is an umbrella that protects someone’s interest in this unpredictable time. Premium calculation is a multi -lard method that is affected by a variety of factors. Because of this, before buying a policy, all the features required to guess the correct premium should always be taken into consideration.

Answer: A policy holder must provide an insurance premium to get the policy and the desired coverage. These payments are assembled by the insurance company and are used to arrange all insurance claims. It also serves as the income of the insurance company.

Answer: Depending on the plan, companies evaluate many criteria before determining the premium. It is made up of age, health history, lifestyle, coverage, discount and more. For health principles, the agency can determine the age of insurance, health problems, already existing treatment disorders, etc. Assessment

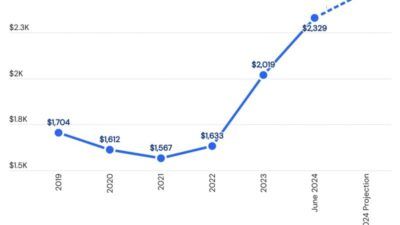

Section 1: Cost Of Health Insurance

A: If you receive insurance, you must provide an annual premium until the policy period is. The company gives them a vacation time where no one pays any money before the end of the end. However, the non -payment of the time during the vacation reduces the policy; The policy holder can no longer claim the policy.

This website or its third -party equipment uses cookies that are necessary for functionality and to achieve the objectives described in the cookie policy. By closing this banner, scrolling on this page, clicking on a link or leaving further, you agree with our Privacy Policy Insurance Premium that a person or company pays for any insurance policy. Insurance premiums are provided in principles that cover various personal and commercial risks. If the politician does not give the premium, the insurance agency may cancel the policy.

When you sign up in an insurance policy, your insurer will charge you a premium. The amount you pay to keep the policy effective. Product products are mechuz from the -sewing options to pay for their home insurance premium. Some insurer allows the policy holder to provide insurance premium in installments – such as monthly or annual – others may need to pay in advance for each whole year before the coverage starts.

Owed to the insurer at the top of the premium with tax or services may also be extra expense