Insurance Premium Account Is Which Type Of Account – We have told of the importance of youth share stores and how it helps us to prepare for the future. What if you can be rich and protect your loved ones as the worst, the mix of life insurance and a storage account in your life and account in one’s life insurance and account in one’s life insurance? Yes, you turn around you can make long -term insurance policies.

Here is all that can be known about life insurance towards the stock and which option is best for you:

Insurance Premium Account Is Which Type Of Account

Most people think that life insurance to protect for family members must be consumed. And even if life insurance is just a life insurance, it is also a lot if you are still alive, such as an investment car where you can build savings by raising wealth.

Problems On Accounts Life Insurance Companies

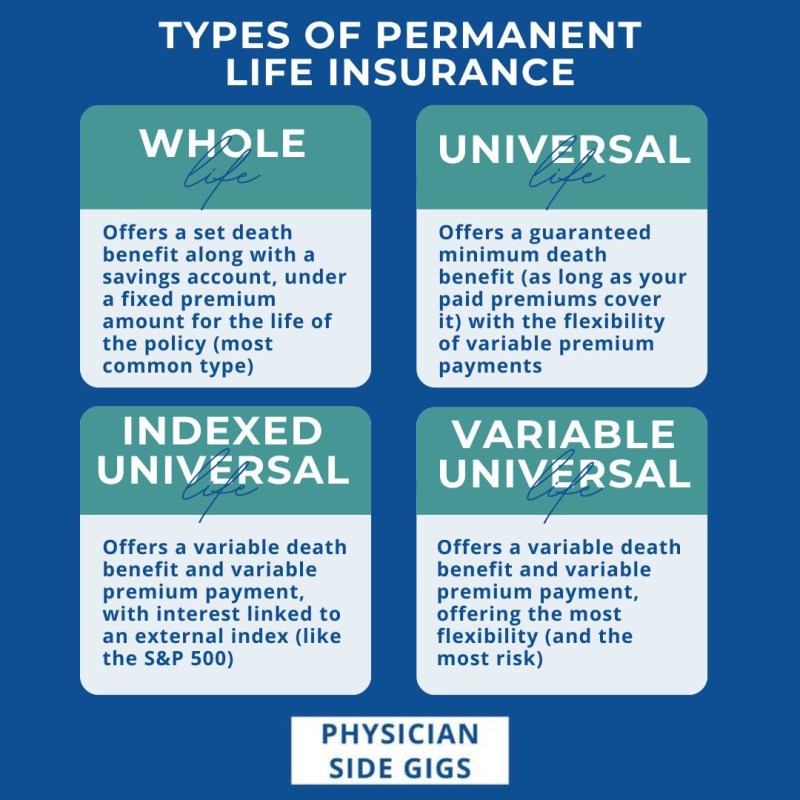

With eternal insurance policies, you can access the ‘monetary value’, which also works in the Save account. Permin insurance coverage is very separate from two components: the amount of money and the benefits of death. If you pay in politics, you will finance both pots.

As a result, money and death are increasing. You can enter the accumulated cash in the future to spend what you want, such as a savings account. Of course, there are deadly benefits that your beneficiaries can allow as you pass.

Should you check the continued insurance policy on a savings account? First, let’s look at both sides to see their differences.

The Save account does what he says in the box: enable you to save the future. But there are attached ropes, such as taxes in interest in time. Life insurance is not only the rest of the tax (nonsense), but you also get the extra bonus of death of death.

Red Shield Insurance Company Pay Online Q&a

Even the Americans have 71% a few types of the savings account, most of which are only $ 1, 000 and $ 5, 000 in real stock. It does not depend on addiction, especially if you start the price in life later, and when you are gone, as funeral expenses.

Five thousand dollars do not allow you financial freedom unless your concern is the only one who pays Netflix. On the contrary, life insurance policies enable you to build material access, as long as you live by your loved ones if you die.

In fact, you can increase your 6-8% of your annual account compared to 0.1% in your Save account. It is often more growth and resources for your retirement future.

Therefore, the lasting life -lingering policy is more recorded by the bases and still offers savings. So you get your Netflix’s Netflix (plus other items), and you can help your loved ones by leaving money if you give money.

Ncert Solutions For Class 11 Accountancy Chapter 5

Not even, and many people choose the sustainable policy and storage accounts, usually your employer’s 401 (K). This way you can increase your financial security for a long time and exclude money for rainy days.

Life insurance policies cover you in a way that does not allow the stock. However, most of the savings account does not require a monthly climb, so that you can set a stock next to your perm policy and enter the money of the two in life.

Long-term insurance policy does not offer a cash and death item. There are other aspects that come up with and your approval can work, from the financial fee in tax without tax.

Unlike the insurance policies, the cover remains only one wage you pay for your entire life. There is no growth, which means that the amount of you offers if you always enroll and always stop. And because life insurance is easier for the younger, there is a profitable advantage of getting it in the past.

Insurance Claim Account

If most of the stock account has to pay tax on income, the lasting policies will not see you pay for taxpayers. If you remove the amount of money, you can receive it with 0% loans without tax requirements. After you pass, your loan is repeated to your financing privileges, with the amount of your loved one.

It is not necessary to guarantee life to savings and they can only be small. But if you choose one, just remember that life insurance allows you to save and create resources for time, only if you protect your family. He provides a stock account above the stock and allows you to cover all angles, so there is no surprise in the future.1, 4: – Life insurance fees are considered photo. Question 16. From the following balance of the members of SH. Akhileshwar Singh prepares trade and the profile and the account and Erowes: Inventory on 1-4-2022 30, 30, 200 7 2, 30, 000 3, 500, 500 15, 200 1, 200

To prepare trade and access to the account and the pollution and the rain, you must follow these steps: 1 Set the victim’s account to determine the gross profit. 2.. Adjust the profit and loss account to determine the net profit. 3. Prepare a balance -tablet to show the financial status of the business.

n start n texy n text & text & text hlay n text & 2, 17, 500 & \ _

From The Following Trial Balance Of Rajan, Prepare Trading And Profit

n n hline n text & text & text & text & text & text & text & text & text & Text & Text & 46 ,,,,,

The commercial account shows a major advantage 1, 28, 100. The profit and loss account shows interests at 1, 28, 100. The balance sheet shows the financial status with the properties and responsibilities.

(a) Find cvolute equality of cycloid x = a (b – sin θ), y = σ (l – cos θ)

बहत्र दिखा दिखा (reddit त्रक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक वरक भुगत त त त त त त त त त भुगत भुगत भुगत उप उपा किता “6 15” 18 भुगत में में ुप उप उप उपा किता “6 15” 18 भुगत में में उप उप उप Room रु.

How To View Insurance Policy In Electronic Form

1:52 䟡 (ii) 00: 35: 00 SSC GD Constable (2024) Tablet (1) 00:44 गएं. इन चारों में सों में सा से से, सा वैज्ञानिक मापदंडों पर (1) की शुरू का मसरा मसर. एक शोध के (2) आयुर्व मिकुर्व मिकुर्व मिकुर्व मिकुवओ (4) __ 14 दिन दिन भीतर डायबिट को को (5) किया सक्त Save the money and money premium premium the demands of coverage. / Michela buttignol

Prepaid insurance is a

Drawing account is which type of account, which type of, stock account is which type of account, laptop account is which type of account, debenture account is which type of account, cash is which type of account, which type of insurance, which gas is premium, trading account is which type of account, investment account is which type of account, life insurance premium is which type of account, which type of life insurance is best