Insurance Premium By Car – You can manage the risk alleviation from your car from the beginning! Product. The car cover formula is adapted to your individual needs. The request process is also #claihvery smooth.

Car insurance is a form of protection that you must have, especially if you often travel by car. Car insurance provides financial security in risks that can take place while driving. In addition to financial protection, insurance also provides peace of mind, so you can drive calmer and safe.

Insurance Premium By Car

If you want to buy car insurance, be sure to choose the best like!. While working in Indonesia,! He won various achievements and awards on the prestigious event, starting with Indonesian Award in 2022, Indonesia Golden Awards 2022, on the most reliable product 2023. It proves it! He successfully provided quality insurance services to the people of Indonesia.

Best Car Insurance After A Speeding Ticket In Colorado (see The Top 10 Companies For 2025)

! Offering several types of car insurance that you can choose according to your needs. Type of insurance in! Includes regular car insurance, all risk car insurance, LTO car insurance and comprehensive car insurance. Each insurance has its own characteristics and benefits. If you want complete protection, you can choose the best of all risky car insurance in!.

In the middle of severe traffic and different risks on the road, confidence in car protection such as! To be a wise decision. Well, here’s some reasons why you need to buy car insurance!:

! It offers a wide range of car insurance options that can be customized to your needs and budgets. Starting with ordinary insurance with basic insurance protection with comprehensive protection,! Understand that every car owner has different needs. With so much car insurance policy, you can choose coverage that suits your finances and specific needs.

! Protects you from financial losses that can arise from different risks such as accidents, theft or damage. By paying the car insurance premium, transfer your financial risk to the vehicle insurance company. In the search process,! will compensate according to the specified policy.

How Your Driving Record Impacts Your Car Insurance Rates

If your vehicle suffers serious damage or declared an atotal loss,! can help you replace. This may include the cost of purchasing a new vehicle or the actual value of the lost vehicle. To get! Here you can choose all risk insurance! with a comprehensive premium policy. ! Be prepared to compensate in accordance with the terms established in the insurance policy.

If your new car suffers serious damage when less than 6 months old! They will provide new teaching facilities for replacement. ! Not only protects new vehicles, but also provides protection for a maximum of 12 to 15 years.

! It also offers protection from the risk of car damage due to natural disasters. The disaster police were presented exclusively as car protection systems from various flood damage. Depending on the car insurance, it covers all components of the vehicle, from the engine to the inside of the car. Car insurance premium! This is very affordable, so it will not flow monthly finances.

! Insurance services! It also includes your legal responsibility to third parties. If you are involved in an accident that harms another party,! It will include medical costs and repair of their vehicles, saving you from expensive legal disputes. You can get this benefit by choosing a comprehensive car insurance in!.

Shriram General Insurance

Unlike third-port insurance, which is responsible only for damage to other people’s real estate, comprehensive car insurance! Ensure protection against damage to your own vehicle, regardless of who is guilty of an accident. To get this benefit, you can submit a third party request (TPL). This assertion of insurance from the accident in the car can help pay injury, treatment, and even death.

! They offer smarter services that make insurance requirements and the process requires faster and easier. AT!, You can buy car insurance online via an application or officer! Website. With this system you can buy online policies in just 3 minutes, anytime and anywhere. ! Provides self-assured services, which allows you to do Self-argy. To do this, you just have to take the video of the vehicle you want to secure.

In addition to being smarter, buy car insurance in! Also more profitable. ! Provide a 25% discount and get interesting benefits for each car insurance report. Not just that! Also ensure RP transport allowance. 100, 000 per day. The situation is that your car must be in the workshop for more than 5 days, and there are a maximum of 3 damaged plates. In addition, you also get car loan services while your car is serviced.

Here are some of the reasons you need to buy car insurance!. The car insurance purchase is not only financial investment, but also a wise move to protect your vehicle and yourself from risks that can occur on the road. Financial protection ensures car insurance is not limited to vehicle safety, but also its owners.

Cheap Auto Insurance For High-risk Drivers In Pennsylvania In 2025

AT!, All risk insurance describes comprehensive premiums and comprehensive basic plans. This insurance is a form of protection from different shapes of damage to start different factors. It can be an accident, a natural disaster or vandalism. All risks also protect the owner in case of car loss due to theft.

All risk insurance has a very important role. This type of protection can be used for new and used cars. If you want to protect your used or used car, make sure it is less than 12 years old. Whether you choose a comprehensive premium or comprehensive basic plan, all risk insurance policies come with the best protection features. Ponuđena cijena je konkurentna.

Sva osiguranja rizika ponuđena u obliku sveobuhvatnih premija i sveobuhvatnih fondacija ima mnogo prednosti. Ova korist je:

Ima najpotpunije značajke zaštite, ali sva rizična politika osiguranja automobila ostaju po povoljnim cijenama. To znači da kupci mogu odabrati kao moguću opciju pokrivanja po najboljoj cijeni. Jer, sveobuhvatne premije i sveobuhvatne temelje podržavaju 25% popusta plus zanimljive prednosti.

🎄 Ride Into Christmas With Our Car Insurance Premium Guessing Contest! 🎄 Ho Ho Ho! Christmas Is Almost Here, And It’s Time To Put Your Car Insurance Knowledge To The Test! Think

Svi rizici uvijek pružaju najbolje rješenje za svaki rizik koji nastaje. Proces obnavljanja stanja automobila je gladak i složen besplatan. With all risk insurance, car insurance costs in the workshop are always treated perfectly so that the losses suffered by the customer minimum. Proces popravka je brz i potpun.

Sa mnogim pozitivnim aspektima,! je prvi izbor osiguranja automobila među indonezijskim korisnicima. Sistem se razvija digitalno zasnovan na umjetnoj inteligenciji i cijenama se takmiče sa raznim promocijama i ponudama. Zagarantovali smo valjanost organa za finansijske usluge (OJK). Visokokvalitetni proizvodi osiguranja i mogu završiti svaki rizik.

Prilikom registracije za sve politike osiguranja rizika postoji nekoliko dokumenata koji se moraju unijeti. Obavezno učitajte SIM i STNK, kao i fotografiju za auto ploče iz automobila koji želite osigurati.

Kupovina svih rizičnih osiguranja automobila je vrlo jednostavno kao što se radi na mreži. Kupci samo trebaju pristupiti! web stranica ili aplikacija. Popunite tražene podatke o vozilu, a zatim odaberite osnovni tip kroz sveobuhvatne ili sveobuhvatne premije. Takođe odredite dodatnu pokrivenost. I izvršiti plaćanja.

Steps On How To Reduce Your Car Insurance Premium

! Najbolje od svih proračuna premijskog premijskog osiguranja automobila odnosi se na stopu koji su postavili tijelo za finansijske usluge (OJK). To znači da se izračunavanje transakcija cijena vrši na transparentan i odgovoran način. Legalne reference kišobrana su OJK Round broj 6 / Seojk.05 / 2017.

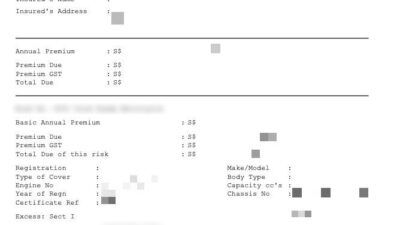

The cost of the premium is the result of a premium percentage according to the category listed in circularity at the cost of the car or in this case under the name provided.

Da bi se utvrdio sav procenat premije osiguranja rizika, zasnovan je na cenama automobila po regionu. The area consists of region 1 (Sumatra and surrounding areas), region 2 (Dki Jakarta, West Java and Banten), and Regions 3 (Areas outside of the area 1 and 2).

Proširiti sve osiguranje automobila nije komplikovano. Ono što je važno jeste da se napredni proces provodi dobro prije nego što je politika završena. Kupci samo trebaju posjetiti! web stranica ili aplikacija. Slijedite protok. Ako se proširenje provodi prije završetka politike, kupac ne treba ponavljati učitavanje dokumenta. However, if the policy is over, you must reload the document.

New Report From Insurify Reveals 12% Increase In Car Insurance Rates And Covid-19’s Impact On Car Insurance And Driving Behaviors

Just like registration, the process requires it! Very easy. Receivables can be submitted online or contact!. When applying, the basic documents required are KTP, SIM and STNA. Other necessary documents will be in accordance with the type of request submitted.

If all car insurance risk is provided to the documents end and load, the request procedure will begin. Takođe treba napomenuti da će kupac biti u riziku (ili) prilikom podnošenja a