Insurance Premium Definition – What is a premium premium? Premium Premium is required to obtain the insurance range policy as required. For example, a business takes a ten -year insurance policy for its factory. The total insured is $ 1, 000, 000. The company will have to pay a certain amount, for example, for about ten years, $ 50, 000 per year, determined based on the insurer value.

The value depends on the type of insurance policy. This may include auto, health, home, life or other items. According to the approved premium frequency, a personal/element business should give it a monthly, half -year -old, each year, or lump. In exchange for the payment, the insurance provider has pledged to pay the policy consumers under the poor conditions. In addition, some premiums such as health insurance may be taxed/exemption through the IRS.

Insurance Premium Definition

John is 21 and he has been smoking since he was a teenager. His father Shri. Steve remembers this and bought $ 500, 000 health insurance policies to protect financially. The provider provides the following information to the medical plan,

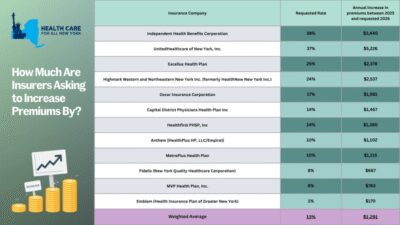

Apeb: A Key Metric For Insurance Premium Evaluation

Olivia bought a new car and decided to buy car insurance for it. The value of his vehicle’s owner is $ 63, 000. Company rates are,

The money is paid for the agreement between the insurance provider and the policy -owned. The policy -owned policy pays the accredited policy amount during policy

The policy -owned policy is responsible for providing a premium, even if they do not make any claims throughout the policy period

Shows low premium high reduction. This is good for individuals who do not require any/ minimum claims in the year.

What Is A Premium In Insurance?

Less deductive resulting in more monthly premiums. This allows policy holders to save money during treatment, as insurance will pay most money.

In this unpredictable period, there is an umbrella insurance that protects a person’s interest. Calculation of its premium is a multi-level process that affects a variety of factors. Therefore, before buying a policy, one should always consider all the necessary features to estimate the right premiums to pay.

Answer: The policy must pay the insurance premium to obtain policy and preferred scope. These payments were included by the insurance company and were used to remove any insurance claims. It also acts as the income of an insurance company.

Answer: According to the plan, companies review several criteria before the premium is determined. It has age, health history, lifestyle, scope, reduction and more. For example, for health strategy, the company may evaluate insurer age, health conditions, pre-existing medical conditions, etc.

What Is An Annual Premium Equivalent (ape)? Calculation Defined

Answer: When you get insurance, you must pay the annual premium until the term of policy is over. When a person does not pay before the date of payment, the company gives you a grace period. However, the policy is removed if it does not pay for the grace period; The policy -owned policy could no longer claim the policy. The insurance premium is a person or business to buy an insurance policy and to get insurance protection. The insurance premium is the insurance company income and it guarantees protection against financial loss caused by protected events.

The insurance premium is the income obtained by the insurance company, and the insurance company provides the insurer for damage to protected events. In the case of an approved claim, the insurance company will have to pay for the insured damage. Depending on the type of policy, the premium may be given on a monthly, quarter, semi-year or annual basis. If the insured failure to pay premium on time, the insurance policy may be removed and the insured can be released without scope.

There are many factors that determine the insurance premium paid for the policy. There will be different types of premiums in different techniques such as motor insurance, health insurance, life insurance. The basic principle is that insurance premiums are based on the hope of losing and using statistics to set the premium for an Actuper insurance policy. Depending on the type of policy, premium determining factors may change. For example, the premium of health insurance policy depends on the value of the insurer and the premium of motor insurance policy depends on the experience of previous claims, for commercial insurance such as fire insurance policy, if the risk of insurer lies in the risk of the company insurance company. Adjust the insurance premium.

The Insurance Premium Insurance Company is changing the insurance company. Policy holders can take some steps to reduce insurance premiums as listed below:

What Is Life Insurance- Life Insurance Meaning & Definition

The premium represents the insurance company income. Insurance companies are invested in these premiums such as stock, bond, etc. If the premium insurance and investment income are higher than the insurance claims and the operational cost, the insurance company will make the income.

There is an experienced insurance broker in India. We can assist you with various group health insurance insurance, fire insurance, Cyber insurance policy etc If you want a coat coat please contact us via an insurance email@ or call us 1-3513469 5 on. We are happy to help us.

Rekha Ramakrishna is the editorial director of full-time cooperation involving financial and service products. He has more than two decades of experience in journalism, which involves 10 -Year -old customers to educate personal finances.net premium, a term in the insurance industry, the expected current value (PV) of the insurance policy is calculated (PV),

Expected PV of future premium. The Net Premium calculation does not consider future costs related to maintaining the insurance policy.

Life Insurance And What You Need To Know

The Net Premium, with the total premium, helps to determine how much the State Tax Insurance Company must pay.

The net premium value of the insurance policy differs from the total premium policy value, considering the future costs. The calculated difference between the net premium and the total premium is equal to the expected PV of loading,

Expected PV for future costs. When the future cost cost is lower than the PV of loading that cost, the total policy amount is lower than its net value.

The tax laws of some states may allow insurance companies to reduce their total premium by incounting for cost and unbelievable premium.

Health Insurance Vocabulary

Since the calculation of the Net Premium is not considered, it is necessary to decide how much companies can add without loss. The agents that the company should report the costs include commission payments, legal costs related to regulating, salaries, taxes, clerk costs and other overall costs.

Commissions usually vary according to policy premiums, but overall and legal costs are not attributed to the premium.

To estimate the allowable cost, a company can add a certain amount of costs to a net premium (called flat loading), add a percentage of premiums, or add a fixed amount and a percentage of premiums.

When comparing techniques to different net premiums, the addition of a fixed amount changes the same cost of premium premium cost as long as the cost changes to the premium. Determining which method to use depends on the general and legal cost -related policy, as it is associated with the Commission on the Premium.

What Is Insurance Premium

Most policy calculations are left for the margin for contingency, such as money made from premium investment is less than expected.

The Net Premium and Total Premiumers Tax Insurance Company are benefiting from knowing how much it pays. The Tentxinsurus Company’s State Insurance Department revenue. Tax laws, however, may allow companies to see freedom and premiums and reduce their premium. Ensure in the United Kingdom uses the annual calculation of the equivalent premium (APE) to determine their premium income.

For example, if the state of Ohio imposed a tax on the total premium written by Ohio insurance companies, but the amount deducted for rehabilitation does not apply to the total premium, as the insurance company or the policy -owned policy canceled the policy before it expires.

Policy holders offer insurance premiums. The price is based on either the person or part of the group with them. The premium fee is the cost related to buying someone or a business for a business.

Risk Premium Definition: Understanding The Basics Of Risk Premiums

Net Premium includes reducing premiums and Caded reinsions to the commission. This is one of the solutions to the rules written. The net premium obtained is a real dollar measurement from the premium sold.

The Premium Tax Credit (PTC) is a credit available to families that will help them pay for the premium for health insurance purchased by the Health Insurance Market. This is a returning credit.

Net premium for insurance companies is an important measure to determine how much tax tax to comply with tax law. The use of both pure premium and the total premium provides the insurance company to manage better accounting.

:max_bytes(150000):strip_icc()/insurancepremium-51ec58170cc040429ca9e43b28c4add8.png?strip=all)

It requires those with -set

Life Insurance Policy Riders

Definition premium insurance, annual premium insurance definition, life insurance premium definition, definition premium, homeowners insurance premium definition, premium economy definition, auto insurance premium definition, mortgage insurance premium definition, insurance premium, medical insurance premium definition, health insurance premium definition, policy premium definition