Insurance Premium Doubled – During the past five years, host insurance premiums increased by 34% throughout the country according to S & P World Marketing. In 2023. Prices rose by 11.3%, while states (23.3%) and Arizona (21.8%) are the largest increase.

For some owners of the homes, these are high-feelide increases forcing difficult decisions, such as reducing costs, disclosure policies and even give up on domestic insurance coverage.

Insurance Premium Doubled

But how seriously do the homeowners do at home for insurance in the country? We study 1, 500 houseowners across the country to get an idea of a rise in domestic insurance.

Insurance Industry Market Growth In India

Answers to the premium bubble are almost as versatile as the American owners themselves, but some grouped behaviors are obvious. First, 61% of respondents pointed out their prize in the last 12 months, and almost a quarter of respondents (23%) adjusted their consumption habits in response.

Some decide to balance the costs in other ways. A total of ten increased by a deductible to reduce their insurance premiums, and another ten have achieved updates to updates their homes to reduce insurance premiums.

Then there are those who prefer to fully stronger their service provider. One of 500 surveys of 500 polls to change the bidders in the next 12 months, and in 1 of five showed that it will completely dissolve coverage if their mortgage loan is not required.

Among the owners of the houses of our investigations, more than half (61%) reported the homeowners in the last 12 months. Some stated significant growth – more than one in ten say their reward has doubled or more than doubled at the time.

Big Insurance 2023: Revenues Reached $1.39 Trillion Thanks To Taxpayer-funded Medicaid And Medicare Advantage Businesses

In response to these changes, almost one of the four respondents claim that they reduced daily costs, 90% in abandonment, 81% travel plans, 61% cut on the costs of food products and to reduce the impact on differentiation.

When purchased for home insurance, many consumers are disappointed: almost 3 of the four (73%) agree that affordable alternatives are too limited and more than a quarter (27%) say that currently attempting to find an affordable service provider.

Among those insured, only 16% say that in direct response, another bidder in direct response to their growing prize. Instead, balancing deductions, repair repair and insurance premiums is jongling law that are some ready to receive. One of the ten owners of the house says they have increased their deductible to reduce insurance premiums, and another in ten have achieved updates to their homes in Gambit to reduce insurance premiums.

If you can afford investment, if it is updated your home can reduce insurance premiums, according to Gerard Reccuk, insurance expert, with more than 40 years of experience as an intermediary and insurer.

Inflation Reduction Act Health Insurance Subsidies: What Is Their Impact And What Would Happen If They Expire?

“Roof updates to respond to new guidelines for coasts and other powers provide additional protection of homeowners and can reduce insurance costs, insurance companies and reduce insurance reductions and reduction of wind improvements.”

The natural response to increased costs is the search for other service providers, and almost one of three (31%) of our survey were performed in the last 12 months. In addition, one of five plans are said to change the service provider in the next 12 months, and some are even brave: 1 out of five they would live without insurance homeowners if their mortgage lecturer is not needed.

What is guilty of growing costs? In addition to suspecting the greed of the service provider (40% requested this), the second force can be for playing – climate change. The two trained spoken considered that the increase in serious damage and climatic threats caused an increase in insurance premiums, and one of the ten is considered to transition to a more favorable market with lower assurance premium.

Regardless of the reason, a strong majority (73%) agrees that the domestic insurance industry needs stronger regulations.

Premium Tax Credit Improvements Must Be Extended To Prevent Steep Rise In Health Care Costs

More than 6 out of ten (62%) says that there is a crisis in the home insurance industry, and many feel that the consequences of this crisis are still threatening. When asked to predict development in the next 12 months, 51% say they expect their insurance premium to be increased, and one of the ten is worried about their coverage.

It is simultaneously with the general distrust of the industry and its criteria. Most homeowners (86%) say that insurers use inflation as an excuse to collect premiums.

Did home insurance contributions reduce your need for your budget or prefer to improve monthly fees in your pocket as needed “goes a bar” or completely give up the homeowner.

No “Bare” is more popular than Mississippi, where 13.3% house owners failed. The state of magnolia is closely followed by the new Mexico (12.9% of the insured), West Virginia (12.3%) and Louisiana (12.0%), and are increasingly subject to environmental disaster, including property damage, including hurricanes, fire and floods.

What Is Health Insurance? Exploring Types, Benefits, And Coverage

Coastal countries and regions are usually the least ready to endanger the cooling coverage when Washington D.C. It requires the highest insurance rates – only 3.3% of the homeowner is not secured. Oregon (4.7% uninsured), California (4.9%), Massachusetts (5.4%) and New York (5.4%) are also needed for risks.

Almost all mortgage lenders require customers for homeholds to ensure domestic insurance. However, if your home is already paid, there is no need to cover. Life without home insurance includes consequences such as expensive costs if your home is a damaged time or other disaster type.

Living without domestic insurance is a dramatic measure, but there are safer ways to reduce insurance premiums. One of the easiest ways is to reduce deduction, which reduces your reward. Investing in home security and home infrastructure, such as wiring and HVAC, are additional methods that can help save money in the long run.

Subject to insurance requirement for homeowners can also increase your insurance premiums, so ensure that you use the calculated access before sending the request. If the cost of repair is approximately the same as a deductible, it is probably best to pay a pocket.

Average Health Insurance Cost In 2025

Householders should also spend time to check their insurance for each renewal at least, according to Reccuk.

“The insurance check is always careful,” said Ruckeck. “Understanding potential hazards and exposure to your area and your home allows you to intervene with all concerns. Reading floods, wind policies and earthquakes will take you to solve limits.

Climate change, increase construction and inflation costs have influenced the growing costs of domestic insurance. But additional time to explore alternatives and improving your home is a few ways to give yourself financial relief.

In May 2024. We performed a survey on national supervision of 1, 500 US house owners to obtain growth contributions for home insurance. Respondents included 40% of men, 59% of women and 1% when identified as non-binary / modest. The average age of the respondents was 46 years old. The answers on the survey rely on self-confidence, which can be exposed to bias or social desirability. A quantitative analysis was performed for the collected information for identification of trends, models and correlations related to domestic insurance costs.

The Perfect Storm In Home Insurance

Revenue: less than $ 25,000 (6%); 25,000 to $ 34, 999 (7%); $ 35,000-49 999 (9%); $ 50,000-74, 999 (21%); 75.000-99, 999 (19%); 100,000 to 149 dollars, $ 999 (23%), 150,000 USD or over (15%).

In order to determine the highest percentage of household owners without domestic insurance, we analyze the American Civil Community Survey (ACS) Rums 2022 Public use of microdata (ACS).

Sources: US Census Agency US community survey (ACS) Microdata General Act, S & P Global market insurance market plans are needed in these uncertain times. How the pandemic is increasingly causing hospitalization, people suffer from financial losses. In addition, since the end of the pandemic is not visible, for health insurance increased by 2020. years. Health insurance contributions have had a significant increase in 2020. year compared to 2019. year. Many policies stated that their insurance premiums rose to 30% to 40% and in some cases. What are the possible reasons for blaming health insurance contributions? Studio –

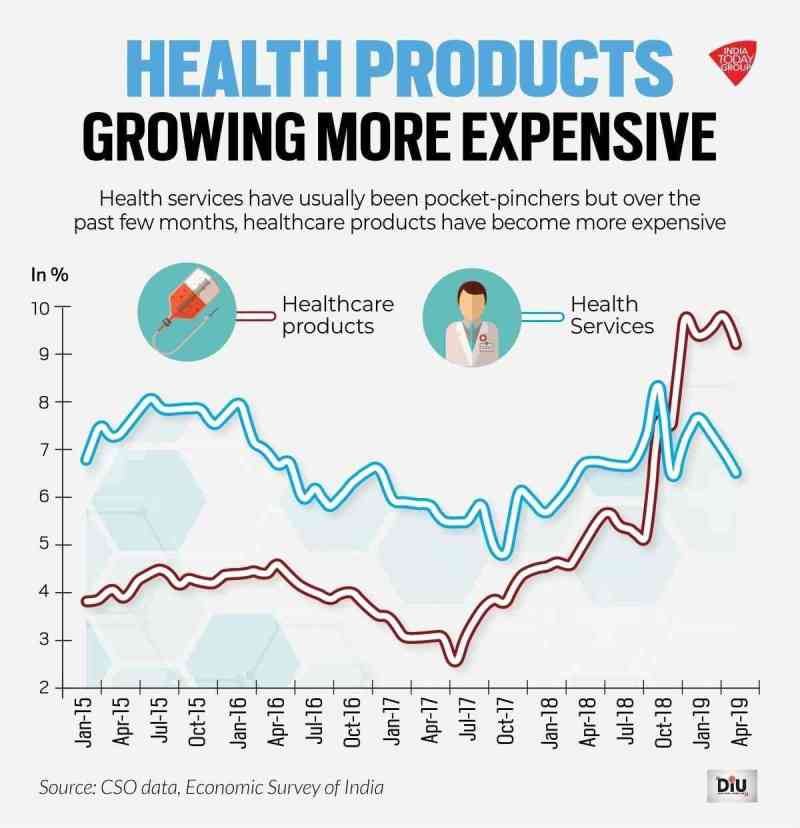

Health insurance companies have recorded major pandemic requirements. From 30. October 2020. years, insurance companies recorded a total requirement of 7,700 INR in accordance with their insurance of the confusion of the disease in accordance with the General Insurance Council (GIC). Pandemic also increased the demand for health insurance by 15.8% to 2020. October. (Source: Indian Express)

Average Car Insurance Cost In Uk Nears £1,000 After Prices Rise 58%

Due to the number of high demands, health insured are forced to increase the premiums to ensure profitability and solvency.

Medical inflation continues to grow from year to year, as the costs of medical and treatment increases. According to economic research 2019. year, in 2017. to 18. – 18, the inflation of health care was 4.39%, which in 2018. – 19 years rose to 7.14%. Comparison of these