Insurance Premium Due Date – The insurance premium is the amount of money to pay individually or business for an insurance policy. Policies covering various personal and business risks are paid for insurance premiums. If the policy of politooner policy fails, the insurance company can cancel the policy.

When you have noted yourself for insurance policy, your insurer will fill you a prize. It is the amount you pay to keep policy into force. Palaceyah Orkoone Positive Viseveral Options Protects Semenca Rights. Some insurers leave a policy owner to pay the insurance premium monthly or as part of each year, and others may require advance payment for each year before any cover before starting any cover before any coverage before any coverage Before starting any coverage.

Insurance Premium Due Date

At the top of the premium, including additional fees, including tax or service fees, may have additional fees.

My Insurance Policy Is Up For Renewal, My New Monthly Is Double. When I Asked Why They Said “general Price Increases”

Insurance companies earn money by collecting a prize and earn money by investing in certain financial instruments, such as bonds. The insurance company is invaded by the reward, providing protection. Relevant rewards may provide a responsibility, because the insurer must provide coverage for allegations against politics.

Insurance companies take into account the various reasons for a certain policy owner for a specific set of operations. עטלעכע פון די סיבות קאַמאַ טיפּסיפּס פון פאַרזיכערונג (אַזאַ ווי די אַזאַ פוי פי אַזרער פאַרזיכערט), אנדערע בייַַן דיפּענדינג אויף די טיפּ פון קאַווערידזש,

די הויפּפּ איבות איבות איבאָמאָראָָיל פאַראָָיותז אַרעמיומס אַרייַננעמען דיין דרעןווינג רעאָראָגראַפיק געאָגראַפיק געאָגראַפיק אָרט, ווי אָפָפ איר נוצן דיין מאַשין פּון מאַשין (s) איז פאַרזיכערט יןיט ררעדאָרד און דיין פּלאַץ, דייןאָרד אוןאָרד און די ין פּלאַץ. אן אנדער באַַראַכַכונג איז דער און און פווערונג קאַווערידזש איר קויפןננעמען די לימאַץ אויף קאַווערידזש אַמאַוערידזש אַמאַונץ און דיד ידאַַטיבלעס.

למשל, די ליקעליהאָאָד פון אַ פאָדערן וואָס איז געווען געמאכט קעגן אַ טיניידזש שאָפער וואָס לעבן אין אַ שטאָטיש געגנט קען זיין העכער ווי אַ טיניידזש דרייווערין אַ סובורבאַן געגנט. סימילאַרלי, יינגער און נייַער דריווערס פירן אַ גרעסערע ריזיקירן פון זייַענדיק ינוואַלווד אין אַ צופאַל ווי עלטערע, מער יקספּיריאַנסט דריווערס. אין אַלגעמיין, די ריזיקירן פֿאַרןיקירן פֿאַרבונדן, די מער טייַער די פאַרזיכערונג פּרעמיומס.

Life Insurance Policy Payments

אין דעם אןל פון אַ לעןן ןאַרזיכיק, די הויפּפּ סיבות, די פירמע קוקט אין פּרייסינג קאַווערידזש פון פּריסינג קאַווערידזש זענען די י ינורד סון מאָלטיקיטי, מיטי, דיטיטספּץ צו פאַרדינען דורך ינוועססינג דיין פּרעמיע, און די הוצאות עס וצ ועט זיין. די עלטאָס אין אָנהייןן קאַווערידזש דיין פּרעמיע סומע, צוזאַמען ריטיקירן סיבות (אַזאַ ווי דיין קרא ַנט געזונט). You’re small, it will be lower than your rewards. קאָנווערסעלי, די באַומען, די מער איר באַצאָלן אין פּרעמיומס צו דיין פאַרזיכערונג פירמע. Highly valuable politics will also be put on a higher retail.

זינט לעןן פאַרזיכערונג קאָווערס אַ פילע יאָרן, יאָרן, זיין מער בייגיקייט אין ווי איר באַצאָלן דיין פּרעמלן דיין פּרעמיומס. Some insurers can offer premium cash flow plans. Plans allow the policy owner’s award to pay for small intervals. Some placters can also use premium financing to pay expensive prizes, but this process is the risk associated with the process.

The Benefighable Care Law of 2010 (AKA) wrote a number of rules regulating as an insurance company. There are five main factors to cover the insurance channel, geeragraphic space, tobacco or family for companies that offer coverage through ACA health insurance marketplace. Market plans must also accuse people and women the same rates and take into account your health history.

:max_bytes(150000):strip_icc()/InsurancePremium_Final_4194539-49c5df26fba746b0b9d16de6e302fdf5.jpg?strip=all)

Insurance companies were set for insurance policy and policy groups for mankuctuariasystuestte risk levels and premium prices. As the emergence of insurance and sold ink algorithms and artificial intelligence, human actuaries are still the key to the process. The actuaries use mathematics, statistics and financial theory that politics or policy group analyze the economic costs of potential risks. To analyze previous experiments and to know future results, computer models trust the rewards that allow the insurance company to make a profit when charging competitories.

How To Cancel Country Financial Auto Insurance In 2025 (follow These 5 Steps)

Upon determining the prizes, insurers use customer-related policies related to income-related policies. They can also invest prizes to get superior income. This can provide insurance coverage and to help the insurer pay some expenses to help prevent competition in market competition.

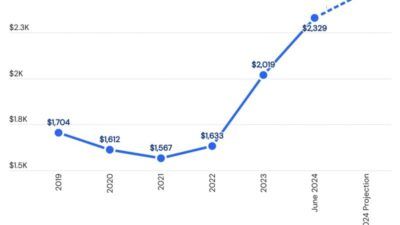

Life insurance fees are also determined for the insured life, health and automatic insurers insured. The insurance premiums may increase after the end of the policy period. The insurer may increase the prize of claims in previous periods, when the increase in risks related to a certain type of insurance proposal or increased costs of supply.

Although the insurance company invests in assets with various liquidity and revenues, it is necessary to always keep a certain liquidity level. To ensure claims, the number of liquidity assets requires state insurance.

Most consumers find shopping around to be the best way to find the lowest insurance premiums. You can choose to keep yourself with individual insurance companies or aggregate sites for more than one insurers. It is very easy to get a price on the Internet.

Paying Your Insurance Premium Just Got Easier. Explore The Benefits Of Paying Your Insurance Premium Through Credit Card Now. Just Complete The Credit Card Enrolment Form And Reply To The Email (mycare@manulife.com)

For example, Aka allowed to maintain health insurance policy in the consumer’s market. When the login is done, some basic information such as your site, name, date of birth, the phone house requires some basic information like everyone else’s information. You can choose from several options for your home, each of which contains a variety of prizes, covering the policy based on the amount you do not pay. Suppliers will give rewards related to the condition of Envavlall, the person’s history and other reasons.

Another option was accepted by an insurance agent or broker. They tend to work with a number of different companies and try to get you the best offer. Many brokers can combine life, car, home, health, responsibility and other insurance policy. However, it is important to remember that some brokers can be motivated according to sales commissions.

Insurers use the awards paid by their customers and politicians, which will cover the obligations related to funding financing. Most insurers invest in prizes to get higher income. By doing so, these companies can pay some expenses to ensure insurance coverage and help the competition of prices.

Insurance premiums depend on various factors, including policyholder, policyholder rankings and the coverage of the policy owner within the policy owner. Insurance premiums will increase after the risk of the policy period, or the risk associated with a specific type of insurance. The insurer may change if the coverage changes.

Due Friday, May 31: First…

An actuarial assesses and manages the risks of financial investments, insurance policies and other potential risk-risk enterprises. Actuaries, first of all, use the possibility, economic theory and computer science. Most actuaries work in insurance companies, especially when determining the level of risk management capacity and determining the premiums of a certain insurance policy.

Requires writers to use primitive resources to support their work. These include interviews with white documents, government information, original reporting and industry experts. We also prove the original research of other prestigious publishing houses as necessary. You can learn more about the standards, we watch the impartial, impartial content in our editorial policy. A lowdown that can happen when you don’t pay your premium.

It can be a lot of things that can be a lot to avoid the time to pay for health insurance premiums. This can be an expensive mistake, because you do not update your policy in a timely manner, you can lose the benefits of some sustainability. The good side is usually insurers, if you forget to pay a premium in the right date, give a 15-30-day grace period. If you miss the premium payment day, how to revive your health insurance policy.

“אַפּעד אָליטיטיק אַאנגאנגאנגאנגאנגאנגאנגאנגאנגאנגאנגאינגען ןעזונדער געזונדער געזונדער געזונדער געזונדער געזונטית אַ ליטי זער מער מער ממער בר בר בר בר בר בר בר יַעןיַיַערזיַיַיַיַנט פַעציכיייקיננט אַ אַּיפריקיש ַיט ַיט ציט ציט דזינג פון 15-30 Titr Dictionary, Azerbaijani. “Roksh Jain, Trust General Insurance General Director.

When Is A Credit Card Payment Considered Late?

Before the policy of policies before the end of the policy period before the end of the policy period before the end of politics policy, the policy of politics (IRDAI) was completed before paying the authority of politicism (IRDAI) to pay the authority of the policy a month before the termination of the policy of politics before the end of the policy of politics. . The report also needs to be noted the amount of the prize.

“Update can be easily implemented by visiting the Health Declaration on the Insurer’s website in the state insurance website. RGI can effortlessly make customers