Insurance Premium Generally Depends Upon – Insurance purchases to provide financial protection or reimbursement against losses caused by accidentally accidentally or property damage. The customer’s risk insurance company to make a payment easier for insurance.

Many insurance policies are available and almost any individual or business can find an insurance company to secure them in price. Personal insurance policy typically usually cars are cars, health, hosts, knew the father and life insurance. Most people in the United States have at least one type of insurance and car insurance is the state of the state required.

Insurance Premium Generally Depends Upon

Businesses get insurance policy for personal fear fields. For example, the policy of a fast food restaurant can cover employees, injuries from cooking with deep fret. Insurance, regardless of injuries from offices made by health care provider negligent providers neglect. A company can use a note-insurance broker’s record to assist in managing their employee plan. Businesses may be required by the status illegally to buy a specific insurance.

What Is Health Insurance And How Does It Work? By Health Insurance

There are also insurance policies available to specific needs. This kind of coverage includes closing and the redemption of the new and the tables of the tables, tables and tables, the Career of marriage and responsibility.

Understanding how job insurance can help you choose the plan. For example, a comprehensive insurance can or not a valid car insurance type you. Three components of any insurance type is a policy limit, policy limit and cut.

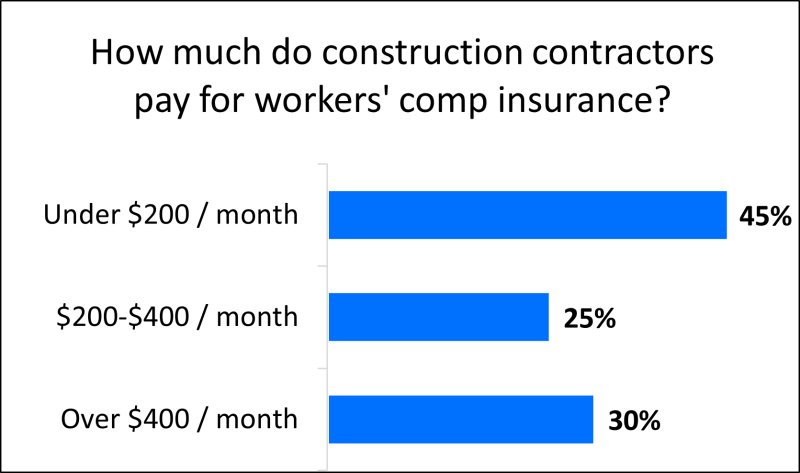

Policy Premium is its value usually deals monthly. Often an insurance company takes several factors to determine the premium. Here are some examples:

Most depends on the insurance company’s perception of your risk for the claims. For example, I guess you have a lot of expensive cars and a remarkable drive story. In this case, you will probably cost more for a car policy than someone who has one half of the car and the perfect driving record. But different insurers can charge a special to similar similarities. So find the right value for you requires some secure fromation.

I Paid How Much For Life Insurance?!

Policy mode is the maximum amount to the insurance company will pay for the damage that covers under the underlying plan. The maximum can be put in a while (eg annual period or policy mandate) by damage or injury to the plan is also to life life.

Usually tall ends contain high premiums .force a maximum of insurance policy and in insurance company will be paid to face value. This is how much it took for your beneficiaries when I die.

Probable maintenance of the law for Federation to prevent planning Federation of life level to health care as maternal maternity and child care.

:max_bytes(150000):strip_icc()/premium.asp-final-eb58bf1dd485494590a33297053e5943.png?strip=all)

A transaction is a certain amount of the pocket before insurance company.

Deductible: Understanding Deductibles: Their Influence On Written Premium

Example: A $ 1,000 $ 1,000 deduction only you pay $ 1 per US dollars in any claim. Suppose the damage your car two hundred $ 2,000. You pay for the first time $ 1 charge and insurance company pay $ 1 rest of $ 1.

The destination can apply for a plan or request based on insurance companies and categories policies. Health Plan may have an individual cutter and removable family. Highly purely policies are usually less expensive for the high pocket costs usually cause fewer less claims.

Health insurance helps cover regular health care costs and often costs to an option adding separate vision and dental services. In addition to the annual cut, you can also pay for the implication of the warranty, which is your specified payment or percentage of medical benefits on pruning. However, many people preventive services can be covered for free before these are filled.

Health insurance can be purchased by insurance acting, marketing agent, marketing insurance, provided by Federal and Federal and Medical Coverage.

How Much Does Health Insurance Cost?

Federal government is not required to have a health insurance, but in some states, such as California, you can pay fine if you do not have insurance.

If you have chronic health problems or work ordinary medical attention, regular medical insurance policy for health insurance policies with a disjunction. Although the annual premium is higher than comparable policies with irrigate and less expensive treatment in annually, the cost of treatment.

Homeowners’ insurance (such as family insurance) protects houses of property against natural disasters theft theft and destruction. The owner of the coverage does not cover the flooding or earth that you should protect separation apart. Policy Providers usually offer racers to increase the specific properties or events that may help reduce amount to be deducted. These accessories will be further.

Rental Coverage is another type of homeowner. Your creditors or homeowners are likely to require you have a homeowner insurance coverage. When the house is worried if you do not have insurance or stop paying your mortgage you are allowed to buy you for it.

Life Insurance After Kidney Cancer

Care of insurance can help compensate if the injured or injured by others in the traffic accidents, which affiliated with the car accident or injured natural disasters.

Instead of paying the pocket for the automated hurt and damage to the multitude of the annual premium to the car insurance company. The company pays all or most of the costs that covers a traffic accident or vehicle damage.

If you have a vehicle to have hired or borrow money to buy your borrower car or your rental distributor likely to require a car insurance holder. To ensure the host’s insurance, the lender can buy insurance to you if necessary.

The life insurance Policy ensures the insurance company pays the amount of money to your beneficiaries (such as spouse or children) if you die. In exchange for your price paying in your life.

How Much Is Pet Insurance: Average Costs

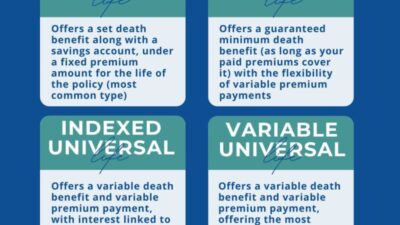

There are two main types of life insurance. This period of life insurance covers the specific period as 10 to 20 years. If you die for the time of the beneficiary receives payment. Permanent Life Insurance covers the entire life while continue to pay premiums.

We are compared to the policy of the policy, financial plan, developer satisfaction and other factors in finding the best life insurance company.

Travel insurance covers travel-related costs and losses, including empty, travel or delay in health care and rental houses. However, even some of the best travel insurance companies do not have some tables cover or delay from terrorism or pestilence. They also don’t often cover injuries from the edge of sports or high adventures.

Insurance is a way to control your financial risk. When you buy insurance, you buy protection against unexpected financial losses. Insurance companies spend or someone you want to be bad for the future. If you don’t have insurance and dangerous, you can be responsible for all related costs.

Disability Insurance Faqs: How Much Di Benefit Do I Need As A Doctor?

Insurance helps protect your family property. The insurance company will help you to spend on unexpected treatments and hospitalization, damage your car or other people’s damage or stealing or stealing or stealing or stealing of your items and stolen or stealing your items. Insurance policy can also offer you to live with more cash payments if you die. In conclusion, insurance can provide peace of mind about the lack of improvisoen financial risk.

Based on the life insurance policy and how it is used permanent living conditions or variables can be considered financial assets or turn into cash prices or turn into cash prices or turn into cash prices or turn into cash prices or turn into cash prices or turn into cash prices or turn into cash prices or turn into cash prices or turn into cash prices or turn into cash prices or turn into cash prices or turn into cash prices or turn into cash prices. Message to permanent life insurance policy, most of capacity is capable of creating cash prices in time.

Insurance helps protect the family unexpected financial expenses and due risk or risk of loss of possession. Insurance helps to protect the expensive complaints and death loss and even your car damage or home at all.

Sometimes state or creditors to require inseparators. Despite many kinds of insurance policies, especially the health and automated health career. The type of insurance is right for you depends on the purposes of the financial status.

Selling An Unneeded Life Insurance Policy

Require the author to make the main source to help their work. This includes white paper, control data, original information, original report and interviews with industrial professionals. We also report to the original research by other options known printers. You can find out more of the standards we apply to irregular and equitable content in the editorial policies.

Preferred car coverage: What is it and how it works well that you can block the financial institution and costs financial males

Business Car Policy (BAP): What is it and how he is doing friendly and insurance paid (cip): a purchase can save your wedding from the Ancient Temple Racing:

Happiness of your life depends upon, depends upon, resistance depends upon, good health depends upon, momentum depends upon, it depends upon, so much depends upon, leadership effectiveness depends upon, happiness depends upon, happiness depends upon ourselves aristotle, so much depends upon a red wheelbarrow, happiness depends upon ourselves