Insurance Premium In Balance Sheet – The gross is obtained premium a term used in the insurance industry. It obtained the amount of insurance premiums obtained by insurance author at a specified period. This is a revenue obtained in the insurance product sale.

The gross is obtained premium is described as a gross phone before insurance efcts. Reinsource means the insurance company again with some insurance contracts with another insurance company. Insurance companies earn income from other sources such as investment income and income income, which is not covered by a gross-adarned premium. Therefore, it is important to use different metrics when inspecting the insurance company’s income.

Insurance Premium In Balance Sheet

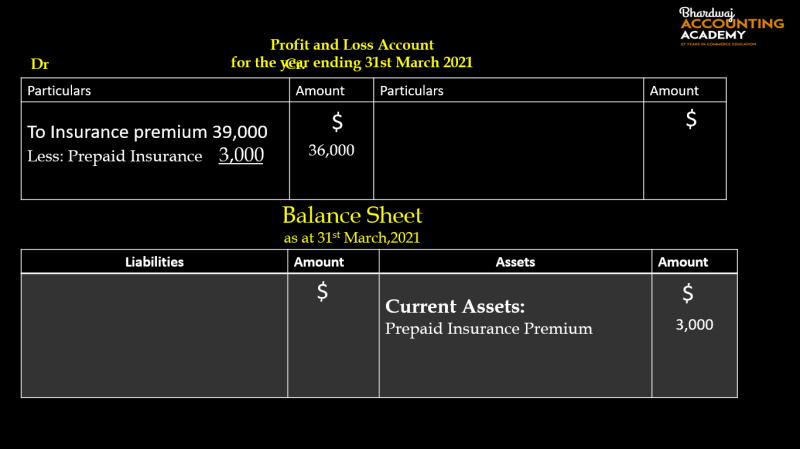

The gross actually obtained premium departments from all premiums (‘gross-written premiums’), which is due to insurance premiums at the beginning of the insurance period by the time of the agreed time by the time of the insurance period by the time of the insurance. According to the principle of accrublubles, the ratio of insurance covers given at that time should be found than the amounts received.

8 From The Following Balances Prepare

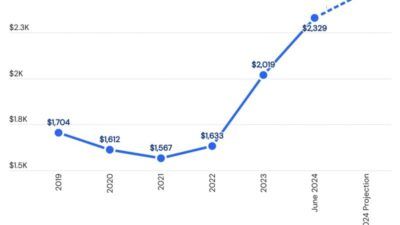

The gross obtained premium is closely monitored in the income metro because it appears to an increase or decrease in new insurance business.

Insurance companies reveal gross premiums in their quarterly and annual income ads. This is the top of the income statement because it is an income item marked from insurance premiums.

DLG’s gross shemium in 2020 is 189.3 m, lost 0.4% of a gross premium in 2019. Or competitive pressures reducing new business prices.

The ratio of the insurance cover provided by premium year is calculated by multiplying the gross written premium in the insurance cover ratio.

X, Y And Z Are Partners In A Firm With 3:2:1 Z Retires On The Above Date And The New Profit Sharing Ratio

Let’s make an instance of the insurance company written by 000 1, 000.0 insurance policy on June 30. The policy offers the cover next year, and the insurance company has the end of the fiscal year of 31.

Gross written premium for policy $ 1, 000.0. However the insurance company offers only 50.0% of insurance cover until December 31. Therefore, mostly obtained premium $ 500.0.

Based on the below information, we are asked to calculate the gross premium from the agreement with the fiscal year’s insurance.

Until December 31, 2020, the insurance cover ratio provided by insurance company can be calculated as follows:

From The Following Trial Balance Of Rajan, Prepare Trading And Profit

Therefore, even if the insurance company receives the insurance company from this Agreement .0 800.0 in the true 5 600.5. It shows the ratio of insurance covers given by the year and the remaining premiums to include in the income of next year. Insurance is an economic product that sells insurance companies, protecting people (and companies) from unexpected losses or losses. Insurance companies can provide this product by spreading personal hazards among many groups, so if a person does not occur in a person with a serious car accident, the insurance company can help to heal repairs or again. Instead of paying insurance premiums, people get more financial security, knowing that they will face only a significant financial burden.

The main financial reports for insurance companies are similar to many other organizations: (1) balance sheet, (2) income statement and (3) cash flow statements. Each financial report provides important financial information to internal and external shareholders to the insurance company.

Note that the balance sheet is the first financial statement on the list. This is how we handle financial reports. This is because, as a financial institution, activities and income insurance ads in insurance companies operate their balancing sheets, instead of regular institutions or services.

Balance sheet cannot be said to be just an important financial statement. As with all other companies, financial analyzes use three major financial reports to analyze the results and health of insurance companies.

Prepaid Expenses Journal Entry

It is important to understand the financial health of insurance companies, not only for companies, but also for investors, body regulations and a wide economy. It is also important for clients in insurance companies, which should ensure that the company can provide respect for responsibilities what accidents are.

The insurance company is important to understand and it is important to understand the insurance company’s business model.

Float refers to insurance companies The premiums pay for customers. These funds are not immediately paid as consecutive insurance. However, insurance companies use Float to invest in securities to earn investment income. Sometimes, unlike banks that pay interest in dependents, insurance companies usually do not pay interest in customers’ premiums to customers. As a result, premiums effectively provide premiums at source of low cost or free financial company insurance.

Insurance policies collect the insurance premium pool, forming a float. Float then invests to get more income, usually through bonds, stocks and other assets.

Solved: On 31st March, 2019, The Balance Sheet Of A, B And C Who Were Sharing Profits And Losses I [business]

If reporters file insurance insurance for events of accidents or property injury, the insurance company uses funds from Float to pay for these claims. And by spreading the risk of a large group and investment prizes, insurance companies prove that they have financial resources to meet their activities and increase their businesses.

Because the suits are difficult to do, insurance companies must maintain appropriate reserves to cover suits. This requires practical need and control. These reserves are in the form of equity or part, capital.

Equities act as a buffer against further damage than stated. The internal insurance company is determined with the available regulatory authorities applying the correct amount of equity buffer.

As discussed earlier, it is very difficult to make arguments. It takes some time to inform the insurance company even after the accident. In addition, the insurance company usually wants to investigate to make sure that any claims are correct, covered and unsuccessful. Due to these factors, it is difficult to evaluate the costs of any claims in any claims. However, the insurance company should be done to follow the appropriate accounting basis.

Schedule L (balance Sheets Per Books) For Form 1120-s

Therefore, insurance companies should evaluate claims and record it as an income cost. This examination is called but not reported (ibnr). Because it is an estimate, it will eventually change based on actual arguments that finally come.

If the suits are reported, they are part of the costs of claim. The union with IBNR will display the overall cost of claims within the accounting period.

The insurance industry is equally working in the plane industry we pay for future service. The principle of the overall accounting principle is not after spending premiums during policy and marketing policy.

As discussed earlier, insurance companies have received premiums before they are paid by claims. In the meantime, insurance companies float in different investments to make income or profits. The specific accounting patterns can change depending on investment, many investments are measured by an affordable amount. This means that if the value of these investments increases, the insurance company will make unrealistic gains in imposto notice. In fact, if investments invest, it can cause unrealistic damage.

Balance Sheet Total Rs 161600 10 The

Note that not all investments affect the income statement. Some earned extracts or losses are marked instead of other comprehensive income.

Insurance companies should be a solvent to fulfill any financial claims. As part of this, insurance companies must continue adequately equity reserves and usually invest in fixed investments in income.

The high levels of bond, especially Governments and corporate bonds, usually consistent and able. Strong cash flows from binds help ensure funds are available if they need to pay claims.

Insurance companies should be useful to increase business and make sure they can pay claims. Gains can come in the form of insurance policies as well as useful investments. Any way, profit increases capital to equity, and make sure that the insurance company can provide respect to financial responsibilities.

Financial Statements For Insurance Companies

Insurance is in danger, so it is important to properly handle risk for insurance companies. Danger management is important to ensure the loss and strength of finance, to determine the risk of different suits), controlling customer’s approval and reputation.

The insurance company can analyze based on a number of metrics we use to analyze regular and operating companies. For example, justification can be calculated similar to other companies.