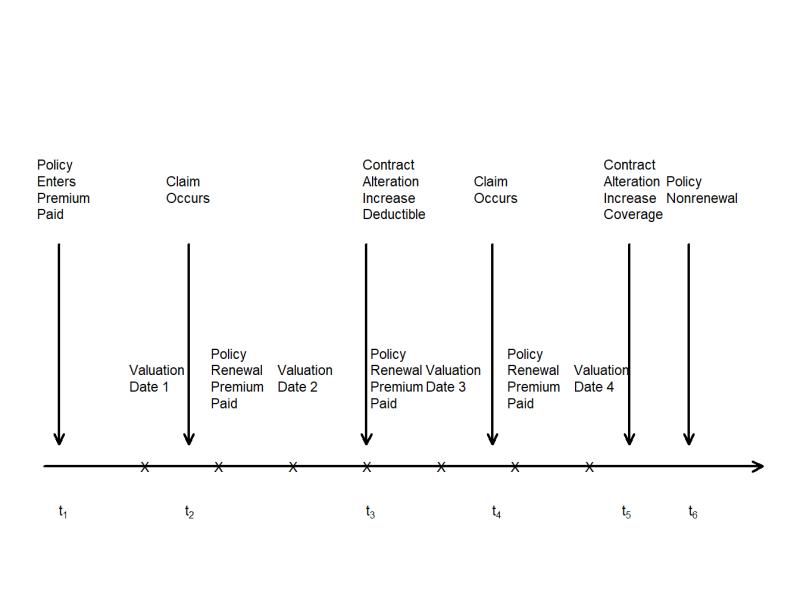

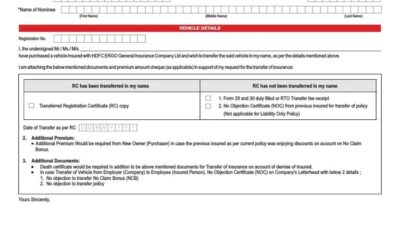

Insurance Premium Increase After Claim – Automobile insurance companies are portrayed as kind and forgiven on TV ads, but they are less kind than you may think. After submitting only a claim, car insurance premiums increase by an average of 41.81%, according to an annual SursuroTes and quadrant information services study. How many insurance rates increase depends on the state where you live. See how your source state is compared to others in the graph below.

To create our graph, each state has received their own line graph, with additional lines for D.C. and the national average. The first point represents the average annual premium for each state, the second point represents the average annual premium after a claim, and the gap between the two points shows the average increase after making a claim. We also encode the colors each line to show the importance of the increase in terms of drivers pay drivers in each state. The data we used came from insurancequotes and the National Association of Insurance Commissioners (NAIC). To generate their socks, Insurancequotes examined the impact of a new claim of $ 2, 000 or more on a married woman, 45 with work, excellent credit score, wireless in coverage and without previous car insurance claims.

Insurance Premium Increase After Claim

New Hampshire is in a league of its own. Although the $ 733 average annual premium is below the national average of $ 841, it is more than compensating for an increase in the rate of 65.9% after filing a claim, the largest percentage increase in the country. After the rate rise, the premiums in New Hampshire average $ 1, 216.

Report: Home Insurance Rates To Rise 8% In 2025, After A 20% Increase In The Last Two Years

However, for a higher cost of the premium, Rhode Island has a rhythm of New Hampshire. After only a claim, the smallest state in the United States has the seventh highest average premium in 1 dollar, 066 thanks to the third increase in the percentage rate of 61.7%. This means that drivers at Rhode Island will pay additional $ 657 per year in car insurance after a claim, the largest dollar increase by dollar.

When looking at our graph, an interesting pattern arises, all the greatest increases in premiums occur in the states that start with higher premiums, even without claims. In most states where premiums start below the national average, their average rate increases as well. Unfortunately for drivers of states like Texas (53% increase after a claim) and Connecticut (43.8%), their premiums start high and only worsen. However, other places begin so low that, although they have a big leap after a claim, their premium is not yet very bad compared to some of their neighbors. In Iowa, for example, our hypothetical driver begins with a premium of $ 572. After a claim, its rate increases by an outstanding 56.5%, but still only pays $ 895 each year.

The pattern seen with Iowa is especially exemplified by four other states. Even after making a claim, Happy Wyoming Residents ($ 826), South Dakota ($ 834), Indiana ($ 797) and Idaho ($ 734) continue to pay premiums below the National Pre-Re-Re-Re-Retriers.

Automobile insurance rates vary across the country, just as the insurance premium increases after a claim. But in some states, such as Iowa, presenting an automatic claim will not increase their insurance premiums too much because of the already low average insurance costs of the state. No one plans to enter an accident and file a claim, but when it is one of the most expensive states, make sure you drive more carefully.

Fire Insurance Claim Calculation Infographic

Classifying insurance companies for direct premiums written in 2020 Top 10 United States cities for the fastest growth and rental decline by viewing the best import partners for each US state state dependency and compensation compensation rates in 2021 mapped: The volume of loans and amounts of each state visualizing the main parts of each of the United States is approved. (Interactive Map) Visualization of world tax rates on companies worldwide COVID-19 Unemployment rates and advantages of assistance by mapped state: the proposal for tax increases on biden profit by Statethat is a good question to be asked because there are many unless drivers (or insured).

According to some estimates, about 10% of motorists who walk the roads every day here in California do not have any car insurance. So entering an accident with an insured motorist seems almost inevitable. Although it has no responsibility coverage is a direct violation of the California Act, almost 4.1 million drivers operate their vehicles daily without adequate insurance to protect innocent victims who can injure neglect, recklessness or simply ignore.

To add the danger, non -insured drivers are more likely to be involved in accidents (already cause them or not). In fact, statistics show that although non -insured drivers represent only 10% of all Californians, they are involved in 15% of all motor vehicle accidents in the state.

So, as you can see, it’s not a reasonable thing that you are asking if your insurance fees will rise after using unless biker insurance insured. But should the fear of increased rate increase a claim?

Does Homeowners Insurance Go Up After A Claim?

Most people ask us about the statements of the motorcyclist not secured or insured because they heard of relatives and friends who were in fault units and their premiums jumped up to 15% or more after reporting the accident. Indeed, these people who respect the law are being financially penalized for something they had little (or even not).

I would like to tell you that these things do not happen. The whole scenario seems unfair, punitive and oriented to put the consumer’s wounded, not to the insurer who is supposed to absorb the impact and protect the individual. But unfortunately, yes. In the vast majority of states, insurance providers can increase rates after unless or unprepared claims are filed. Not always and the policy of each company differs a lot, but the risk of increasing payments is real.

In fact, a national study found that, on average, insurance companies will increase premiums by 9.32% after an accident without fail, resulting in a non -assured motorist claim. The study went further to examine each of the most important insurers in the country and found that the progressive was the most aggressive drivers, indeed “punishing” with an average rate of the rate of 16.6% after they made a non -assured motorist claim. The State Farm was found as the most patient with a 0% increase for motorist claims not secured in its own insurance policy.

Why is insurance companies allowing rates to raise even if you are not to blame for an accident? If you live in California, they are not.

Compare Car Insurance

I come across California’s personal injury customers who often do not want to use their own non -ensured motorcycle insurance coverage because they are absolutely sure that they will increase their premiums. They heard horror stories about the doubles of defenses that resulted in hundreds of hundreds of dollars higher or even cancellation of the insurance policies. But as a California’s personal injury lawyer, I can assure you that your insurance company should not increase your fees to make an unforeseen or secured motorcycle claim about your policy. In fact, in most cases, doing so can violate the legal statutes of long -term California.

That’s right, California promulgated a proposal designed to protect innocent motorists from predatory tactics of insurance carriers. California proposal 103 contains clauses that prohibit insurance companies raising rates after an individual make an unforeseen motorist claim. This means that your fees cannot rise legally when you try to get the compensation you need and deserve after an automatic accident.

This causes California to be one of the two only states in the country that has legislation on books that prevent insurance companies from arbitrarily increasing rates after a consumer presents a non -ensured motorcyclist claim after a fault.

?strip=all)

There are exceptions to the Prop 103 (notably if you make several unqualified biker claims in the short term), but this binding legal precedent takes much of the concern about filing a non -assured motorist claim.

Can My Home Insurance Price Increase At Renewal?

It is important to keep in mind that only because you can file a claim with your insurance company after being involved in an accident caused by a non -assured driver, that doesn’t mean your insurance company has to pay. In fact, insurance companies are legally authorized to deny claims for any number of reasons. They could:

If you are lucky to receive a payment without additional problems, that payment is not as big as it could be. Simply submitting a claim does not mean that your insurance company has to give you the amount you have requested based on your needed need. In fact, the first offer is almost always lower than the one you initially requested. These low ball offers are designed to save money in the insurance company, but they may well leave the victims injured who struggle to juggle their expenses after an unless insured driver accident.

This is why I always recommend that any victim involved in a car accident always consults with an experienced car accident lawyer. Have a good personal injury lawyer by your side not just

Insurance increase after claim, home insurance premium increase after claim, insurance claim premium increase, car insurance premium increase after claim, premium increase after claim, car insurance increase after claim, insurance premium after claim, insurance premium increase after accident, does hail claim increase premium, homeowners insurance premium increase after claim, home insurance increase after claim, does insurance premium increase after claim