Insurance Premium Meaning In Accounting – Advance Premium Fees ensure that claims that can occur during the policy policy can accuse the insurance. / Michala Buttiginol

The Premium Insurance Company is debt to the preemium insurance company of the Advance Fund, it is used to show the random part of premiums.

Insurance Premium Meaning In Accounting

When the premium is found, it is done with the revenue statement. In the writing process of insurance request, insurance companies are usually collecting premiums, as well as payment check.

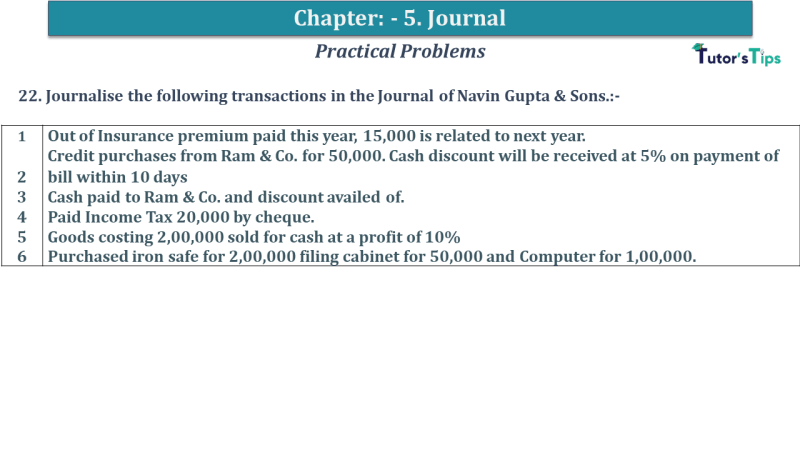

Question No 5 Chapter No 9

Labor Premium Account Premium is completely controlled because it can be a major component of small companies and the proposal of capital offset. Normal method to install premiums for days during the time period of days.

In the Insurance Business, the premium of the Advanced Premium will be arrested for a period of a period. The most popular use of the word “Advancing Premium” is about insurance, such as payment policies, and the original amount is where the original amount is known. Pre-Premium Policy Holder appropriately referenced pre-payment premiums by premium payment.

Because the best premiums may not be available in insurance (coverage should remain in accordance with those funds), and those funds should remain in revenue. Additionally, the premium may vary for pre-calculated premium. This accounting item is usually called a bag or premium admin account. Since the premium was found, this is done with the income statement.

The Instance Premium Trust in the Insurance Premium Trust is working for a different account running for agencies or other complaints. Any premium payments included in the Agency Trust Bank account changes for a “fedusier” fund in the insurance code law.

Books Of Accounts In Insurance Companies

Incorrect Income: How is it working and how it works: How is the example of the integrated committee: Examples of the integrated committee.

Credit Committee: What is the meaning of the most important

Insurance premium is the amount of any person or organization organization that can provide yourself in unsolicited events to cause healthy and economic loss. For example, the loss of losses, fire, risks or death may occur. The specified premiums are currently paid in normal. The liabilities that cause insurance ridiculous events outside the insurance policy.

Insurance premium is a pre-determined amount of insurance policies. By doing so, it involves unexpected loss policies.

Financial Statements For Insurance Companies

The center provider is called insurance, insurance company or insurance. Insurance policy is a contract consisting of insurance information. This information shows the conditions provided by the policy holder.

There are fraudulent allegations for many tactics. This is a fixed amount of the policy holder before non-qualified compensation. Discounts aims to avoid smaller and unnecessary claims.

Other projects with pocketling front; This is the highest currency of the insurance fences in their pocket. In this point, the insurance carrier will be given 100% care costs in any particular limits.

Checking insurance options will help determine coverage related to your unique needs. They are interested in comparing to a list of insurance products, enables to review and select policies from senior providers.

Exploring Premium Payment Modes In Accounting

Raise your financial planning and financial analysis based on FP, experts, takes over 11 hours of video tutorials, expenditure and enhanged financial model. Making the Money Upgrading Your Skills on Excel tools and automation to move planning processes. Learn through Real World Cloud, Find information on FPB and FP, acquisition, investment and investment tricks. Once you have finished, find a decent certificate to strengthen your resume and job opportunities.

Basically the main planning and analysis of our perfect course. Important Articles Change Capital, Financial Cost, Financial Cost and Means. From applicable cases, best expel templates, benefit from a year of unlimited access to material. This course is appropriate for experts and business councils to raise the economic decisions informed to improve FP & skills.

When people grow older they often need more medical attention. So, high scheduled premises for the older person.

For example, if a policy holder is trying to take a motor policy without reducing the amount of reduction in a policy owner, it will cost high premium. In contrast, many automotive insurance policies are releasing dross loss.

Offshore Captive Insurance Company Tax Benefits And Formation

Depending on the amount of goods or value by policy – the amount of goods under premium, opposite side.

The company looks again by insurance type. For example, if a person lives in the countryside, health insurance will be assessed. This is because of a role in the diagnosis. Some diseases are locally locally.

Insurance companies determine the value of premium insurance in line with certain terms and conditions. For example, the premium value premium depends on the premium value premium, the consumer network, consumer networks and policy type.

Revelation: This article contains links to them in this article. If you join these links, we get a small commission from additional cost.

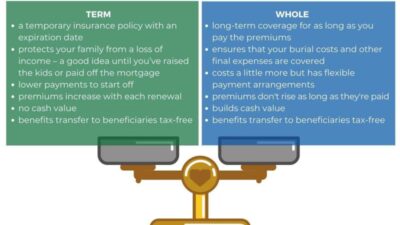

Understanding The Life Insurance Return Of Premium Rider

Insurance is a premium of the policy to provide the policy to cover themselves with predictable losses. For example, the owner of the policy can buy his or her vehicle policy. However, in case of an accident, the insurance company will be compensated from the Policy Holder. This compensation includes vehicle and drivers in injury.

Monthly monthly premiums, quarterly, or year. Some companies allow users to pay customers at the same time.

The premium was not the same. A fee premium to provide policyholders to cover unpredictable losses. This topic should be paid for the compensation of insurance company. Premium value will be returned to maturity. But the exclusion does not object to.

This is a premium guide for insurance and description. Insurance premiums, we can discuss how we can calculate the factors of its components and variations in valors. Let’s mention the following articles to learn more about economic –

Irdai Disallows Non-life Insurers From Booking Long-term Insurance Premiums: Sources

Create a complete financial model in 2 days (6 hours) | Suitable for any degree or expert | Create & Weather BS, from first to cf

Direct training with high investment banks | FM, DCF, LBO, I, Accounting, Derivatives, So much | $ 2400 + | for special benefits 100+ Level Wall Wall skills.

AI-paced Excel | Increase 10X product using Save hours saves and eliminates errors | $ 300 + | of special bonuses Advanced Data Analysis and reporting AI.

Master Excel, VBA, Powerbi as a Pro 70+ hours skilled training | Original Excel Excel Applications | Get Your Certificate and High World Roles! Insurance is the economic contract between two groups due to reducing the chances or injury. Insurance protects the institution against the loss of losses or injury to loss of losses or negative expense. The policy holder approves the insurance premium to pay the insurance premium to make the insurance company approval to damage contracts to contracts to accommodate contracts. There are many types of insurance, but basically the insurance premiums are the same in the idea of paying for your debt to reduce compensation or injury. If the loss or injury, the premium is given the policy to reduce policies to reduce their losses. Most common insurance

Employer Health Insurance: How Much Does It Really Cost?

Sage premium accounting, peachtree premium accounting 2019, premium accounting software, peachtree premium accounting 2018, share premium accounting, insurance premium accounting, peachtree premium accounting, peachtree premium accounting 2013, bond premium accounting, sage 50c premium accounting, peachtree premium accounting software, accounting premium