Insurance Premium Monthly – An insurance premium is the amount of money an individual or business pays for an insurance policy. Insurance premiums are paid for policies that cover a variety of personal and commercial risks. If the owner does not pay the premium, the insurance company can cancel the policy.

If you sign up for an insurance policy, the insurer will charge you a premium. This is the amount you pay to maintain the current policy. Policyers can make the options that their insurance premiums can pay. Some insurers allow the policyholder to pay the insurance premium in quotas, such as monthly or annually, while others require an initial payment for every full year before any coverage begins.

Insurance Premium Monthly

There may be additional expenses to pay the insurer above the premium, including tax or service tariffs.

Commercial Auto Insurance Cost: Fast & Free Quotes

Insurance companies make money by raising premiums and investing this income on safe financial instruments, such as bonds. Once the insurance company wins the premium by providing protection, it becomes the carrier. Not -experienced premiums also represent a responsibility, as the insurer must cover the policy claims.

Insurance companies are considering a variety of factors to decide which premium will be charged by a specific owner for a certain cover. Although some of these factors are common in most types of insurance (such as the age of the insured), others vary depending on the type of coverage,

The most important factors for determining car insurance premiums include your driving record, your geographical location, how often do you use your car, insured cars, sex, your credit record and your age. Another consideration is the type of insurance cover you buy, it contains the boundaries of the cover amounts and the deductible amounts.

For example, the likelihood of a claim against a teenager living in an urban area may be greater than a teenager in a suburban area. Similarly, younger and younger drivers are more at risk of being involved in an accident than larger and more experienced drivers. Generally, the greater the associated risk, the more the insurance premiums are facing.

What Is Insurance Monthly Premium?

In the case of a life insurance policy, the most important factors the company has in price coverage are the risk of safe deaths, the interest hoping to win by investing your premium and the expenses it will mean. The age at which the coverage begins will determine your premium amount with other risk factors (such as your current health). The younger you are, the lower the premiums in general. The older you have, the more you pay for your premiums for insurance companies. High -value policy will also have a higher consent.

Since life insurance covers a period of many years, there may be more flexibility in the way you pay for your premiums. A few insurers can offer Premium Box payment plans. These plans enable the lawyer to pay the premium in small intervals. Some advance publishers may also use premium financing to pay premiums, but the risk exists that this process will do so.

The 2010 Affordable Care Act (ACA) has indicated several rules that regulate the way the insurance company the premiums they charge. For businesses that cover the ACA Health Insurance Market, there are five most important factors that can be used to determine rates: age, insurance plan category, geographical location, tobacco consumption and if the registration covers a person or a family. Market plans should also charge men and women the same rates and not take into account your health history.

Insurance companies occupy the type of risk level and the prices of the premium forums given insurance policies and for police groups. While the incidence of sophisticated algorithms and artificial intelligence changes the price and sale of insurance, human actors remain the key to the process. Actors use math, statistics and financial theory to analyze the economic costs of possible risks in a policy or group policy. It is based on computer models to analyze past experiences and provide future results, so they can establish premiums that enable the insurance company to obtain benefits while raising competitive prices.

5 Ways To Lower Your Auto Insurance Costs

Once the premiums are determined, insurers use this income from their clients to cover the obligations associated with the policy they sign up. They can also invest premiums to deliver higher returns. This may compensate some costs associated with providing insurance coverage and the insurer helps maintain their competitive prices in the market.

While life insurance premiums are generally established for the life of the insured, health actors and car insurers adjust the premiums regularly. Insurance premiums may increase as soon as the police period is completed. The insurer can increase the premium for the claims made during the previous period if the risk associated with the supply of a specific type of insurance increases or as the coverage costs increase.

Although insurance companies can invest in assets with different liquidity levels and returns, they must maintain a certain liquidity level at all times. State Insurance Regulators determine the number of liquid assets required for security insurance claims.

Most consumers find that purchases are the best way to find the lowest insurance premiums. You can choose to buy on your own with individual insurance companies or through combination websites that offer prices from different insurers. It is fairly easy to get online quotes.

Could You Explain More About How The Updated Insurance Rates Will Work If The Ta Is Ratified?

For example, ACA has allowed unspoken consumers to buy health insurance policies in their market. When sign -in, the site requires basic information, such as your name, date of birth, address and income, along with the personal information of someone else in your home. You can choose from different options available, depending on your origin, with different premiums, deductible and copies, changes in policy coverage based on the amount you pay. Suppliers will base the premiums in the state of the Enroeie, the history of the individual and other factors.

The other option is to go through an insurance agent or agent. They usually work with various businesses and can try to make the best contribution. Many runners can connect -you are alive, car, home, health, the responsibility and other insurance policies. However, it is important to remember that some of these runners can be largely motivated by the sales commissions they win.

The insurers use the premiums paid by their clients and pre -concerns to cover the obligations related to the policies they sign up. Most insurers also invest premiums to deliver higher returns. In this way, companies can compensate for some costs to provide insurance coverage and to maintain their competitive prices.

Insurance premiums depend on several factors, including the type of cover obtained by the lawyer, the age of the police color, where the preacher and the history of the company’s claim. Insurance premiums may increase as soon as the policy period is completed, or as the risk associated with the supply of a specific type of insurance increases. The insurer can also change if the amount of cover changes.

How Life Insurance Premium Is Calculated Formulas Explained

An actari evaluates and manages the risks of financial investments, insurance policies and other potentially risky enterprises. Actions evaluate the financial risks of certain situations, mainly using probability, economic theory and computer science. Most actuaries work in insurance companies, where their risk management capabilities apply especially to determining risk levels and premium prices for a certain insurance policy.

This requires writers to use primary sources to support their work. This includes white roles, government data, original reports and interviews with industry experts. We also refer to the original investigation of other good reputation -publishers, if applicable. You can find out more about the standards we continue to deliver accurate and impartial content in our editorial policy. My health insurance premiums increase more than 56%next year. This is the biggest annual increase in the monthly premiums I’ve ever had.

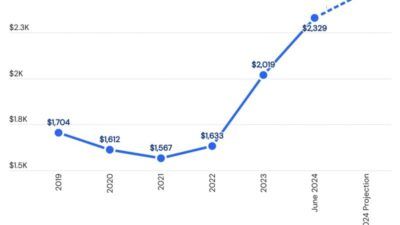

A few weeks ago, I accepted how Obamacare could have been a fundamental factor in the US election. The Affordable Care Act (ACA) has increased the cost of health care and has made health care for most citizens in the United States much less affordable. He certainly has not benefited me in the past year. Look at the graph of my insurance premiums from 2005 to 2017 below.

Dalt chart speaks on its own. As the details of the Affordable Care Act have been implemented over the past year, I have seen my health insurance premiums shoot. In addition, my insurance company – Medica – has reduced my coverage, reduces the amount they will pay for recipe medicine and increasing my deductible amount.

Massachusetts Has Some Of The Highest Health Insurance Premiums In The Country, With The Average Annual Contribution By A Private-sector Employee Clocking In At $2,018 In 2023, According To The Agency For

In 2017, I pay 455% or 5.5x more for my health insurance premium each month than I paid in 2005. I realize that I have aged and understand that higher age means higher premiums. But a 455% increase is absurd.

So what causes these increased price increases? There are dozens of factors, but two emphasize: 1) demand and supply and 2) inefficiency.

I think the people who created and supported the Affordable Care Act had good intentions, but unfortunately they were not economically cunning. The ACA added different costs to the healthcare system without taking into account the supply and demand. There is a relatively fixed