Insurance Premium Of Pmsby Scheme – Pradhan Mantri Suraksha Bima Yojana-the government has created many plans to benefit different parts of society. Insurance is not a new subject in India. However, accessing is limited to some people.

Although there are many insurance companies that operate in India but there are still many people, especially in rural areas that are not guaranteed.

Insurance Premium Of Pmsby Scheme

Therefore, our government introduced “Pradhan Mantri Surakha Bima Yojana” after Jan Dhan Yojana’s successful performance, considering the poor.

5.91cr People Enrolled Under Pmjjby, 15.47cr Under Pmsby

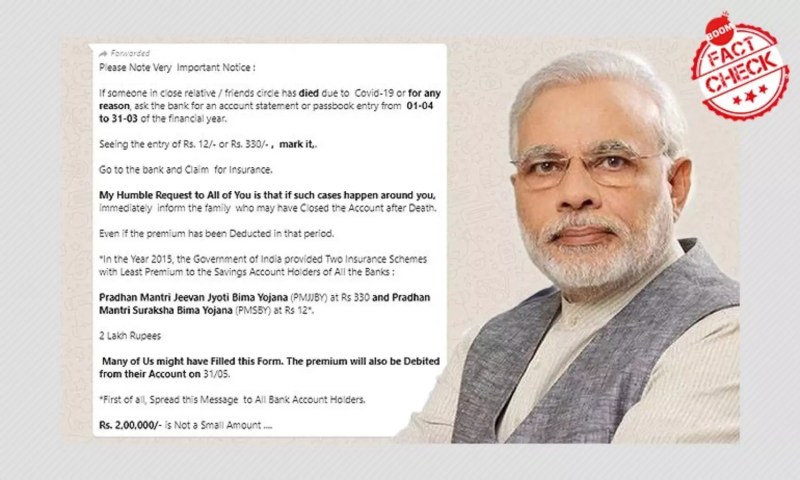

Pradhan Mantri Surakha Bima Yojana (PMSBY) is an accident insurance project supported by the government in India. Launched by Prime Minister Narendra Modi, our respectable May 9, 2015 in Calcutta.

The project has been launched with the intent to increase insurance coverage to any people aged 18 and 70 years. Bank Account can open Pradhan Mantri Suraksha Bima Yojana Account.

The range of RS 2, 00, 000 will be received in the event of a disability or death of an accident and Rs 1, 00, 000 in the event of a disability.

The premium deviates directly from members’ accounts and this is the only mode that exists.

Policyexplainer: Pradhan Mantri Suraksha Bima Yojana At Just Rs. 12

The account owned between 18 and 70 years, approved to participate in the PMBSY project or enable automatic debit ownership, may register this project.

People need to renew this project every year. Additionally, he chooses a long -term option that his account will be deducted from the bank each year.

The income received under this project will be expected from U/S 10 (10D), but in the event that the money from the policy is greater than Rs 1, 00, 000, the TDS will be used @ 2% of the general income, Ifno Form 15G or 15h form will be sent to the insurance company.

The main tourist of this project is the low premium of Rs 20 P.A., making it possible for the poor to use the project from the project.

Alert! Premium For Government Insurance Schemes Revised From June 1, 2022

You need to connect your Aadhar card to your bank account. Then fill out the application form and send to your bank.

However, the person will send an application each year to cover under this project. Whenever you fill the form, you should talk about the names of the nominated relationship.

Important exceptions, including suicide or suicide, under the influence of drugs or alcohol, accidental injuries or loss caused by actions due to violations of laws that have or without criminal goals.

The person is not eligible to receive any benefits and the scope of the accident will be canceled in case of any of the following events-

Punjab National Bank

2. The account is closed due to insufficient funds to the account to allow insurance.

3. When a person is covered by more than one account Insurance is limited to only one account and insurance premiums on other accounts will be confiscated.

4. When the insurance coverage is stopped for any technical factors, such as insufficient funds on due date or any management problem can be restored when receiving the entire annual premium. (Under conditions that can be placed)

The incidence of risk will be suspended at this time and the risk of risk will be at the discretion of the insurance company only.

Pmsby Doesn’t Cover Covid-19 Related Deaths, While Pmjjby Covers Covid-19 Deaths With Certain Conditions

Pradhan Mantri Suraksha Bima Yojana is one of the most important social security programs that our government has started to help the poor and incredible and cover up with the key benefits to social security. In January 2018, more than 13.28 million Rupees were registered under this project.

Policy that is benefiting from poor and low -inkome social groups. The policy with a minimum of 20 insurance premiums per year, instead of Rs 12 per year, Pardhan Mantri Saraksha Bima Yojana provides Rs 1 hundred thousand life insurance for permanent disability and Rs 200,000 for incompatibility and disability.

Pradhan Mantri Suraksha Bima Yojana requires a premium payment of ₹ 12 from applicants for benefits. Nominers will receive insurance currency if the insured dies. In addition, insurance money will be received in case there is no permanent ability.

Vineet is a co -Founder. Elearnmarkets he considers the role of the CEO and his job is to help the team work successfully. Vineet pushes the growth and operation strategy through product marketing, product marketing and bonding. He is committed to creating a highly effective and active participating team in solving problems for Vineet’s business growth. IIM Indore is also his licensed accountant and interest, including digital marketing, math management for recreation, travel and teaching desire. When not working, he wants to spend time with his lovely two sons. Arham & Vihaan and Preti.Pradhan Mantri Sneh Bandhan Scheme, a set insurance dedicated, will be launched from 1 August 2015.

Pmsby Consent Cum Declaration Form

Please find a form called Pradhan Mantri Sneh Sneh Bandhan received from the Department of Financial Service to be released from 1 August 2015. This gift product is designed to see the Raksha Bandhan Festival. Usually, Gifter bought a gift tool. (Generally, this is a check card or a gift card card) and given to your sister or relative -child as a gift at a specified opportunity. The gifts present at the bank to deposit its existing accounts or new accounts to open. The bank may open the BSBDA account as zero as needed. Three forms of gift tools under:

1. Tools for Rs 201. This will facilitate the premium payment for Pradhan Mantri Surksha Bima Yoj Ana for years.

2. Tools for Rs.351 This will facilitate a year’s premium payment for Pradhan Mantri Saraksha Bima Yoj Ana and Pradhan Mantri J Eevan Jyoti Bima Yoj Ana.

3. Tools for Rs.5001 This will facilitate premium payment for both PMJ J by and PMSBY for years.

Rajesh Mishra On X: “the Govt. Has Launched Two Renowned Insurance Schemes Which Offer Insurance Coverage At Low Premium Rates- Pmsby & Pmjjby. The Eligible Beneficiaries Desirous Of Joining These Schemes Shall

This is a picture about product 1 and 3 above. The interest in the regular deposit created is in accordance with the premium payment of insurance products. In the drawings given to the project, it is expected that the insurance premiums for the first 2 years will be kept in a savings account and the cost of the remaining deposits within 5 to 10 years. However, the bank may evaluate other methods to increase the efficiency of the process and to provide the readiness of premium accounts for premium payment each year. May 31, 2016 That day after the required amount for the premium payment on 1 June 2016, the remaining amount was in the remaining period.

The bank may ensure that the gift should be registered with the -The insurance plans and the required registration form is fulfilled. In the event that the gift for the current year is protected under such insurance plan, the amount can be used for premium payment in the following years. This is your information and required operation.

I ordered that the Prime Minister released only three plans on Social Security, Pardhan Mantri Surakha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bimayojana and Atal Pension Yojana.

2. Bank groups consisting of Indian Bank (SBL), Punjab National Bank (PNB), Bob’s Bank (BOB), etc., have a meeting to discuss and set some standard products to cover the premium of these plans.

Tnpsc Current Affairs

3. The group passed the project draft, which passed the LBA to rotate to the member banks to ensure that these products were available from August 13, 2015 before the Raksha Bandhan Festival.

In the past, the Prime Minister Hon announced two Indian government plans. I.E Pradhan Mantri Surakha Bima Yojana (PMSBY) and Pradhan Mantri Jeewan Jyoti Bima Yojana (PMJBY).

On the occasion of Raksha Bandhan, the three gift products were specially designed by Prime Minister Hon’ble, who would be purchased from the bank to pay for the specified amount for change as well as the details below. However, the project is available at all times.

The person can provide Rs 351/- to Raksha Bandhan at the first insurance funding for PMSBY and PMJBY (Rs. 12/- + Rs. 330/- I.e Rs. 342/-) with a balance of Rs 9/- will receive credit account credit account of the insurance insurance. Insurance must be deposited by the insurance company to resume insurance.

Pmsby Scheme Get 2 Lakhs Insurance In Just Rs 20

People can invest in Rs 201/- all the time within the year for gifts from:-

(B) Rs.12/- will be parked separately on the sb account of