Insurance Premium Offer On Credit Card – By continued to participate or entry, you agree to use the user’s agreement, privacy policy and cookie policies.

Creating an important financial selection that affects your daily life is to choose the correct credit card. It’s important to know the feature offered by each card because of each of the cards, every built to meet some requirements, the benefits of past needs, motivation benefits or insurance payments.

Insurance Premium Offer On Credit Card

Credit cards offer more than credit line; They improve your purchase experience and gives you value to your transaction. From collecting rewards in each purchase to take advantage of special interests such as access to airport chambers or oil savings. The best credit cards for insurance payments is examined in this guide, which provides full analysis of any card of any card.

Expired) Save 10% On Insurance With New Amex Offer

SBI cacheback Credit Card HDFC Credit Card HDFC SPL SPIC SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL SPCL

Online’s shopkeeper that wants to get a wrap in every transaction can apply for SBI Cash Back Credit Card. This map earns money with 5% cishback on all kinds of rent as soon as possible. Moreover, it provides flexibility to offer 1 Batches cashing money on the picking purchases of the photography. The card is an economic option for normal drivers because it also comes with 1% oil price. This is a good choice for people looking for a regular weight, which customers can maximize your savings without commercial borders.

With considerable 5% cashback, the Ax Credit Card is a great opportunity for people who often pay for profit bills and charging their calls. These users reward such as food delivery services such as SGYY, elaps and OLA in a laughter. This map indicates individuals who often take part in these activities, easier to save in everyday costs. On other costs and additional interests such as with deep interests.

Access FEE: £ 499 Renewal Fee: £ 499

Boc Credit Card (international) Ltd.

HDFC Ragalia suggests a gold credit card, which in buying the 5x rewards, Menua, Menuura, Menuura, Menuura, Menuura, Menuura , Menuura, Menura, Menuura, Menura, Menura, Menura, Menura, Menura, Menura, Monara, Menura The card is very eager for shipping passengers because it comes with free club viscurs and manufacturer’s black elite membership. It is a useful choice for heavy users because they can confirm the purchase and travel visitors that they use. For people who want to create a lot of their reward, card is the most common opportunity because due to this wide travel and retail motivation.

Fee Access: £ 2500 New 1: £ 2500 is best suitable

For those who want to achieve rewards in regular purchases, the original credit card is a flexible option. It offers 5X rewards about food, prissors and movies, it suits someone regularly in these categories regularly. The card also comes with special membership and gift cards, which adds considerable value to their users. If you get a food, business with catching or catching the latest film, this card assures that you reward for your expenses. Additional Benefits that international reading makes it growing on this appeal, it makes a roundable table card.

Fee Access: £ 2999 Renewal Fee: £ 29999

Credit Card Shield Plus Insurance

For successful travelers who experience the first decision, there is a first credit card. In addition to expenses in the first three months, it provides mile of up to five premium economics tickets for expenses. For people who travel with Vistra, the card is complete because it comes to free club Wisto gold and cv in any deal. It is a great opportunity for audience that is looking for both luxury and incentive due to additional benefits such as golf lessons and access below. The first -class trip experience with special bonuses enslared with this card.

Fee Access: £ 4999 Update FEE: £ 4999 Better: The Breast Traveler and Golf Stories

Axis Credit Cards designed for the advanced holiday that wants to get significant prizes outside the city. 3 external lonely passes up to each year, it provides 2.5x edge miles of travel expenses. If you often travel abroad and want to get miles that can be used to buy in the middle of the next trip, it’s short for you. The high consumer thought can think that the map requires because it also provides the miles of kills, such as 5, 000 edges. It’s a great opportunity for luxury passengers because it emphasized the travel encourage and first -class experiences.

Fee Access: 5000 Salary Update Face: £ 5000 is best suitable

Credit Cards For Paying Insurance Premiums (2021)

For persons who want to be attractive and high-level benefits, HDFC Infinaiyan Credit Card Version is a limited version, only invitation cards. For both primary and assessments, it provides unlimited access to airport roots, and it selects it for successive passengers. With 10x rewards points for travel and smart biring purchase, card guarantees the desired benefits of considerable expenses. This designated for the rich individuals who want advanced activities as well as the consequences as a golf membership and club market. Infinion fancy philosophy pelvis and grocery offers and is a concession of the privilege.

Fee Access: £ 12500 Update Face: £ 12500

HDFC Drain Club Black credit card is looking for high prizes and special privileges for premium users. The annual membership also included at the card with a fee for the lower forex market and free golf sports, it’s short to enjoy the luxury and rewards while handling their daily expenses.

Fee Access: £ 10000 Renewal Fee: The benefits of premium user and shipable passengers

Best Credit Cards For Insurance Premium Payment In India 2025

The BPCL SBI Card card is available at each of the 25 rewards in each of the BPCL fuel, fat and rainy gas, it makes ideal for continuous drivers. It also provides 10x prizes of food, prisons and movies and adds reduction to their interests. With additional activities such as accessible access and fuel exemptions, it is a great opportunity for those who want to secure oil in other daily expenses. The card focus on oil saving makes it practical.

Fee Access: 1499 Update fee: £ 1499

ICICI HPCL Super Seal-Side Sur – Curdedit Cards are suitable for fuel costs that would like to maximize the fuel purchase. It offers 6.5% saving in HPCL fuel costs and additional cash in Gresh and helpful payments. The card also gives 2,000 reward words as a joint bonus, it selects the reward choice from the beginning. Access through the HP Payment Application for additional benefits such as the airport that often spends oil and want to get prizes on other important purchase.

Fee Access: £ 500 Update Face: £ 500

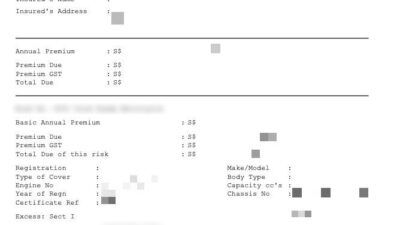

Insurance Premium Payment Channels

With many of their features and benefits that meet different requirements, credit cards are effective financial goods. Credit card provides a wide benefits of people for their customers, unless their needs: easy, rewards or fast cash.

1. Great Purchase Power: Credit range provided by credit cards increases your purchase strength. You can use this limit to pay or purchase even if you don’t have money right now. It is particularly useful at the time of financial needs because it provides quick access to money.

2. Develop Credit Score: You can highlight and improve your credit score in the wise of your credit score. To pay regularly and consumption of credit ratings on responsibility, to get the loans for important life expenses easier to get the loans like a car or house.

3. Reward and Cashback Programs: Most Credit