Insurance Premium Payment Through Credit Card – Many people choose different types of insurance – life insurance, home insurance, vehicle insurance, etc. Although most credit cards do not pay for insurance, some still give good rewards for them. Here, we will read about this national card.

Paying insurance using credit card will bring your reward points and this will help you handle your money better. The table below contains a few list of top credit cards for providing 2025 insurance to India.

Insurance Premium Payment Through Credit Card

This card does not give the membership award point for insurance. However, it credits 5 MR points and provides Rs 1.5 lakh, Tk 2,5. 10, 000, and 25, 000 MR points for Taj. 4 lakhs in a year.

How To Pay For Your General Insurance Premiums

Newquins for insurance expenditure will be capded on 2, 000 Newcone daily. 2 -day credit will be credited after transaction settlement.

Get a luxurious and enjoyable travel experience with this card. Apply for this and earn air miles, discounts, cashbacks and rewards when you shop, food or travel.

Earn maximum from your savings with this co-branded credit card. Enjoy 10% savings on e-commerce, bill payment, insurance, UPI transactions and lounge access.

Apply for this credit card and enjoy great welcome benefits, prizes in purchase, admire lounge access, vouchers and more. Enjoy your life with all this on one card.

Best Credit Card For Lic Premium/ Insurance Payment 2021

This card provides extraordinary prize for Non-EMI for Tata brand partners and spends EMI on Tata brands.

This card offers various benefits for business travel, compliment club membership and hotel to stay and savings in income tax or GST bill.

This card provides exemplary benefits for business expenditure. To the right from access to the admire lounge access to the Travel Voucher and Business Ad cost, enjoy the proposed parks of this card by applying for this card.

It provides facilities in multiple categories such as shopping, dining, golf, etc., one of India, but it is more concentrated on facilities across the travel department.

Pay Insurance Premium Later With Gcredit From Cimb

The YES Bank Market Credit Card brings interesting benefits such as international lounge access, low forex-up fees, complimentary guest inspection, etc. For those who often take international travel, it creates an interesting alternative.

Acrew Club Vistara points with every swipe on your club Vistara SBI card. This power -packed card has a fruitful and smooth travel experience.

It refers to a card for high expenditures providing premium lifestyle facilities in various categories of golf, travel, shopping, dining, etc.

This card gives you a reward by spending daily. ICICI Bank get Payback Points and Awards in Shopping with Coral Credit Card.

Chubb-credit Card Payment Form

Providing your insurance premium through your credit card can be a smart step that brings a number of benefits. Here are some reasons to consider the issue of providing your insurance premiums with the help of credit card:

Insurance is always essential for your life, home and other products are available for insurance available. In this way, we will be able to get a certain amount of cover for the financial crisis we face in emergency situations. Providing insurance is a repetition duty, but with a lot of money to keep track, it is difficult to keep a check on this payment. Thanks, credit card helps us do this. Messages are sent to remind us of the insurance providing. We can even automat our payment. Using the right credit card to provide insurance premiums we can earn cashback or reward points in paying us.

You can provide insurance premiums in person or by their distributors in branches of insurance companies through your credit card. You can pay online through digital device by adding a credit card to the final payment.

When you provide a premium through a credit card, it is subject to any convenience fees. This fee is fully carried by the LIC. However, it is provided by a debit card, netbanking or UPI, no charge. On the other hand, you can get rewards and cashback when you pay through credit card.

How To Pay Lic Premium Online Through Credit Card/ Debit Card/ Wallet

To maximize benefits from credit cards, select one that provides cashback or reward points in the case of insurance. Also, check if the card has travel or dining facilities to earn maximum from your expenses.

Some credit cards can collect processing fees for payment of insurance. Thus, check with your credit card Zarker for the applicable charge.

Good food is the best form of entertainment that gives people a lot of joy. However, whether it is eating … Read more

If you are a defense worker (active or retired) in India to choose a credit card that combines with your expenditure habits … Read more

Analysis Of Insurance Premium Volumetrics And Transactions

The physicians of India have a lot of claims, they run their own private practice or work at the hospital. They … Read more

Credit cards are becoming increasingly popular and more people are using it. By 2025, the number of Credit V … Read more

There are so many people who often travel abroad officially or even for holidays. International travels like we all know … Read more

Most people in India travel a lot. When they choose different ways of transportation such as flights, trains, cars, etc. … Read more

Premium Finance Loan

A credit card is a truly useful financial equipment that gives the purchase power if you don’t have … Read more

Students’ credit cards are designed to meet the needs of college students in India. They bring useful features for read more

ICAI is the top organization that recognizes a person as a chartered accountant when he qualifies for the exam. On … Read More Life Insurance Corporation of India, usually LIC, is one of the oldest and most respected insurance companies in the country. With millions of policies nationwide, the question often arises: “Can we pay LIC premium through credit card?” The emergence of the digital payment method has created a requirement to solve the simple premium. Providing LIC premium with credit card makes the whole situation easier and the excess financial parks bring about cashback, reward points and interest -free credit for a period.

Due to the tendency to pay cashless payments, there is also concern whether the LIC can pay through credit cards and they can pay through credit card. So, in this article, we will cover the way we can pay LIC premiums with credit cards, benefits and some important pointers. Continue reading to find out how to maximize your credit card when providing a premium to LIC.

Top Lic Premium Payment Services In Hyderabad Near Me

Before discussing how to do this, let’s look for the benefits of using credit cards to provide an LIC premium.

1: With credit card, you do not need to go to your branch offices to provide your LIC premium or use net banking, eliminating hassle.

1: Lots of credit card companies give you a reward for paying points, cashback or discounts in healthcare servicing.

2: If you charge your LIC premium on your credit card, you will enjoy the reward points, which can be released after shopping, travel or even statement credit.

Life Insurance Premium Payment| Online Premium Payment Options

2: It can make financial management easier and allow one to suspend the payment from their bank account at once.

3: If your premium is payable to your credit card’s statement cycle with the cycle of payable, you may enjoy extra time to pay.

1: Credit card payments associated with LIC reduce the issues that come with cash and check the check writing.

2: Numerous banks provide protection from fraud, so the request will be blocked if the transaction is considered unauthorized.

Best Credit Cards In India With No Annual Fee| Best Credit Card For Online Shopping

1: Numerous banks allow the LIC premium and other expenses to be settled at once and then pays several installments.

2: It lowers the strain to a lot as one does not have to worry about giving big money but instead operates small, manageable menstruation.

1: Credit card statements explain the expenses in detail, so it is not a problem to know where the money goes.

1: Credit card payments come with receipts, which offers important and skilled plans for taxes and other financial decisions.

Insurance Payment Of 1.08l

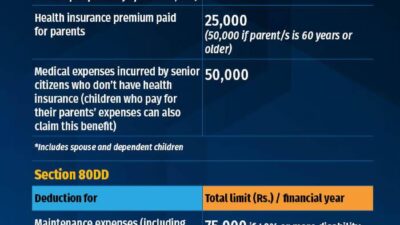

2: Some LIC principles actually come under the Taxable Limit and 3C section of the Income Tax Act, so they give some benefits.

The whole process of paying through credit card is easy for the LIC to pay. Here’s how you can do it:

The LIC allows for the payment of payment via credit card, but additional fees can be spent on the basis of credit card supplier and the payment gateway. Remember some points here:

1: Processors and banks of the specified payment depending on the quality of the transaction can add a ‘advantage’ charge between 1% to 2%.

How Does Debit Card Emi Work?

3: Although some credit cards can provide cashback or reward points to defray this charge, as a general rule, most of them test the first terms before moving forward.

1: If you want to provide your LIC premiums in installment, additional charge with the payment of payment will be applied with additional charges.

2: The interest on EMI conversion depending on the credit card supplier is between 12% and 18% annually.

2: In other words, fail to pay the balance of your credit card