Insurance Premium Renewal – Are you among these people for the most precious possession cars? However, annual insurance renewal has come morning with the thought of a bigger award to give you cold! Let’s find ways to fight the price of the car’s renovation.

Whether it’s BMW or ALT, who cares? Second hand car or brand new! We are somehow inclined to become possessive of them, though we should not be the most expensive possession we own. Now the days where everything is based on EMI, giving a car is not a big deal!

Insurance Premium Renewal

For a country like India where bad roads and traffic are still pain, we should rebuild car insurance to avoid huge costs in the event of an accident. If the thing was in our hands, I’m sure we wouldn’t decide to spend renovation in the car insurance policy, even if it didn’t affect our pockets much. However, one good thing forced to force is insurance, and we still do not have to. Because ..

Benefits Of Renewing Your Bike Insurance Online

The biggest reason why people are hesable to buy insurance is the growth of premiums. If the value of the car is depreciated each year, why is the premium for renewal of insurance is not lower with it? And that was not the case in the last few years. Because we have seen growing prices instead of decreasing.

At first, the Irdai (Indian Insurance and Development Administration) proposed up to 50% of the third -engine insurance increases, and later it was a demonication that remarked the path of GST. The increase in the award was also because Irdai wanted to help insurers establish a balance between the number of claims and a loss report in the carrier. However, there are ways that you may still be able to reduce your premium to a significant amount without a large compromise in your policy. Get how?

This is the simplest and most important of all. In case you miss the renovation of your policy before it fails, then you have to buy cool policies. This means that you will need to review the vehicle more to lose NCB (without a claim for a claim).

And no NCB means a discount on your policy. All of these factors are sufficient to increase the premium.

Keep Your Coverage After The Covid Emergency

We should get a maximum of 50% NCB in case we do not apply for one after another. The NCB allows your award to make the discs, a good amount.

For example: your car is damaged in the parking lot and has a small recreation. The cost of repairing ATA is smaller compared to the accumulated NCB. Would you still like to let go of the discount looking for a negligible amount?

And in the event that if you happen to apply, you may need to pay a large amount for next year because you have lost the accumulated bonus.

So it is wise to think twice before you ask for a small amount that is easy to grenade out of your pocket.

Life Insurance Premium Last Date: Irdai Allows Extra Time To Pay Life Insurance Renewal Premium Due To Covid 19

From the purchase of food, home decor to expensive electrical appliances, we buy them all online. We search, compare on different web pages to offer them better, why do we miss buying a network insurance policy?

The advantage of buying the insurance policy is that you can compare the premiums from different insurers and select them based on reviews, popularity, premiums, policy reports, etc.

Most importantly, the best thing about buying insurance online is that you get them all at high discount prices. I hope these reasons are more than enough to buy policy online.

Many of them are not aware that the NCB is associated with the carrier, not by car. Which means that the NCB has accumulated for years without asking, in favor of the insurance. And yes, it’s portable if you buy a new car after selling your old man!

6 Essential Tips To Negotiate A Lower Car Insurance Premium

However, still do not forget to get an NCB certificate for your car from an insurance company, which will help you get a discount when buying a new car policy. Also, even if you do not immediately buy a new car, transfer the NCB because the NCB certificate to hold is valid for 3 years.

IDV is the value of the carrier declared for your car and will maintain depreciation by 10% on each renovation. IDV in turn is the amount that the company will pay in case of theft or complete damage to your car.

However, most of us want a good IDV and do not consider it depreciation each year, affecting the premium of your car insurance policy. Keep in mind to mention the correct IDV of your car that could help you optimize your premium.

Also mentioning the correct data is vital at lower premiums. Details such as the year in your car production, the CI region, mention the previous claim if it greatly affects the premium of the car insurance.

Advice When Renewing Your Health Insurance

With these tips, I am sure that the renewal of your car insurance policy will no longer be a job. And you will always have insurance coverage. So think wisely, act wisely! When it comes to restoring your insurance policy, it is easy to neglect the importance of understanding the process. Knowing what goes to the renewal of your policy can help you make informed decisions about your protection and awards. From the insurance provider, the renovation is an important part of business models. The reconstruction allows providers to continue to offer protection while adjusting premiums based on any changes in risk. From the customer perspective, renewal can be an opportunity to re -evaluate their insurance needs and make any necessary changes in their policies.

To better understand the renovation process of the insurance policy, here are some key points to keep in mind:

1. The date of renovation is the date of reset for your policy. The date when your policy is renewed and any changes in protection or premiums take effect.

2. The renovation is usually automatic. If you do not ask otherwise, your policies will automatically renew your insurance provider.

Insurance Renewal Hi-res Stock Photography And Images

3. Your premium may change when renovation. Insurance providers based your premium on different factors, including the history of your quest, changes in your risk profile and all the changes in the shelf itself. For example, if you’ve got a lot of claims in the last year, your premium may be increased in renovation.

4. You can present your policies to renovate. Restoration is the right time to review your cover and bring any changes. For example, if you bought a new car or added a driver to your rule, you will have to update the protection accordingly.

5. It is important to review your policy on renovation. Even if you make no change, it is a good idea to review your policy to make sure you understand your protection and premiums.

Understanding the renovation procedure can help you make informed decisions about your insurance. Take the time to review your policies and make all the changes you need to make sure you have the necessary protection at the price you can afford.

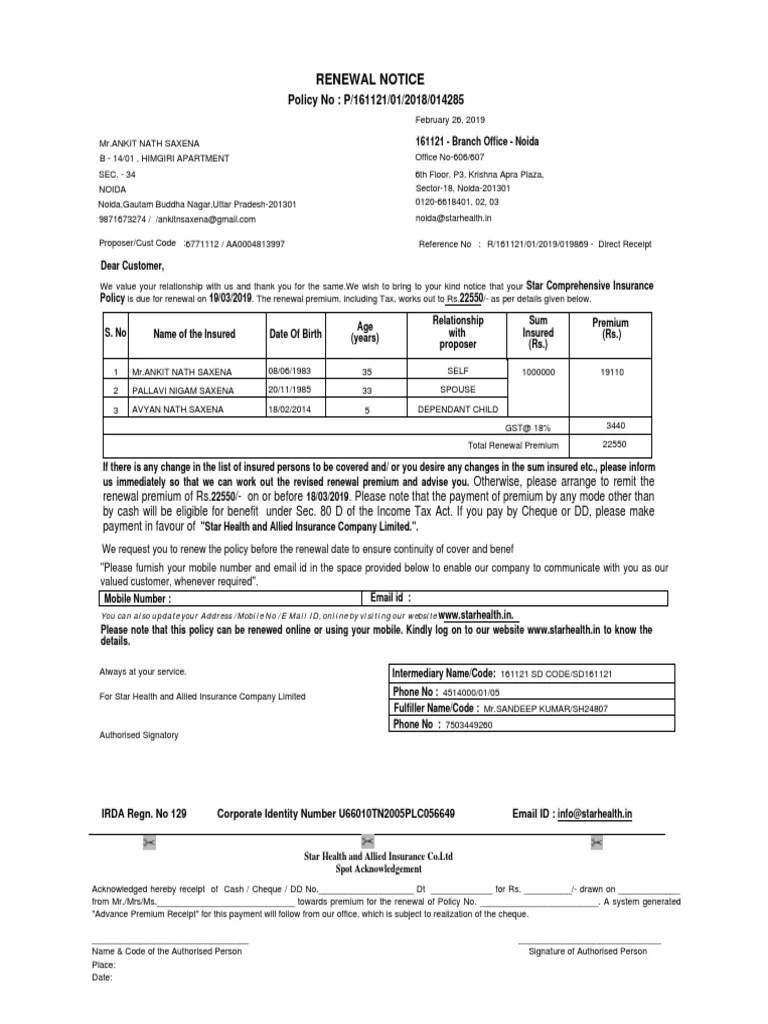

Understanding Your Invoices

Renovation of the insurance policy can be a scary process, especially for those who are not familiar with all the conditions and provisions involved. One of the most important factors affecting the calculation of the insurance premium is the date of the reset. The reset date is the date when the insurance policy starts a new term, with all the advantages and limitations of the renewed covers. This date plays a vital role in determining the amount the premium that the insurance will have to pay for a new appointment. The reset date may vary depending on the type of insurance policy and the carrier. For example, in health insurance policy, the date of reset is usually on the date of the anniversary of the policy, while in the car insurance, it is within the date of entry into force of the shelf.

In order to better understand the importance of renewing reset renewal of the renewal of the insurance policy, see the following insights:

1. Impact on premium – Re -can significantly affect the premium amount that the insurance must pay for a new appointment. When the policy is restored, the insurer reviews risk factors and insurance coverage needs. If the risk factors have increased or changed the need to cover, the premium amount may increase. On the other hand, if the risk factors have decreased, the premium may be reduced.

2. Mercy period – Date restore also determines the growth period for political renewal. The growth period is a time period after the expiration of a policy during which the insurance can renew policy without losing any benefit. The growth period may vary depending on the carrier and the type of shelf. For example, in health insurance shelves, the range with a range is usually 15 days, while the car insurance can be up to 30 days.

Renewing Your Insurance Policy Is More Than Just A Payment But A Vote Of Confidence In Our Protection. Registering For An E Mandate For Renewal Premium Auto Debit Is A One-time Setup That Will Ensure

3. Renewal Procedure – Reset date also indicates the beginning of the renovation process. The insurance owner should contact the insurer before the date of restore to begin the renovation process. The renewal procedure involves an overview of needs to cover policies and