Insurance Premium Rise – Medical insurance schemes have become necessary in this indefinite. Pendemia is rapidly in hospital, people are engaged in financial loss. In addition, according to the epidemic, there was an increase in demand for health insurance in 2020. What are the possible reasons for an increase in health insurance premium? Let’s check –

Medical insurance companies registered a high claim for epidemic. As of October 30, 2020, according to the Public Insurance Council (GIC), there are a cumulative case of Rs 7,700 crore in the Medical Insurance Policy. The epidemic increased the demand for health insurance policies by 15.8% on 15.8% October. (Source: India Express)

Insurance Premium Rise

According to the high claim, health insurance is forced to increase the reward rate to ensure profitability and payment.

Medical Rate Revision

Medical inflation continues to increase since the cost of therapy and increase in the price of therapy. As of 2019, the Economic Survey in 2017-18 was 2017-18, in 2017-18, 4.39% of health inflation reached 2018-19%. Compared to these two financial years, inflation was 9.4%in 2018-19 in 2018-19 2018-19.

In turn, these increasing inflation, which in turn, increased the prize rates.

IRDAI (India’s Insurance Regulatory and Development Organization) has abandoned mandates that will expand awareness for health insurance companies. Diseases and treatment such as mental disorders, modern treatment, cave treatment, etc. are a common coverage of health insurance schemes. As the amount of policies expanded, the insurers are expected to have more probability of high claims. Thus, the insurers visited the awards to compensate for more comprehensive coverage.

As people with diabetes, high blood pressure or other concentrations, insurers face high risk. Therefore, the increase in the premium increases, and more tilt for cooperation, a high health risk against the covie for more inclination or smokers.

Motor Insurance Premiums Likely To Continue To Rise As Claims And Costs Surge

Many insurance companies get equal prizes to individuals in a certain age group. This age bracket is 25–30 years old, 31–35 years old, usually for 5 years, etc., however, insurers may have to fix their awards based on the practice of claiming, and it is generally regulated when the wet brackets are generally replaced. Thus, when you pass the next age group, the prize change may be more to keep in mind the insurer’s required experience.

While covid health insurance companies affect premium rates, the above factors also affect the huge increase in reward rates. Thus, you will update the health insurance scheme next time and know the reasons for unusually high-level premium and the company asks for a high premium amount.

Watch the blog to read interesting articles related to health insurance, car insurance, bicycle insurance and life insurance. You can go to get insurance on the Internet.

Revolution of Health Insurance-Wherever you choose a health insurance scheme, they are offered to choose non-cash hospital treatment anywhere, often a non-wide network of treatment. For example, you have … Ankita Sejpal | 01 February, 2024

Cause Of Skyrocketing Insurance Premium Increases

In India, the best health insurance policy is a product of 2024, which is due to an increase in the number of health insurance, lifestyle and expensive treatment. But find the right health insurance … Ankita Sejpal | 29 December 2023

Can Santhent Citizens save taxes with a medical bill under 80D section? 80D discount for material section 80D exemption 29 December 2023

Significant difference between Network vs Non-Network Hospitals-Network and Network Hospital Network Hospital Non-Network Hospital Network Hospital vs. Network Hospital Hospital Hospital Hospital Hospital Hospital Hospital Hospital Hospital Hospital Hospital Hospital Hospital. December 21, 2023

The latest report covering pre-existing diseases (pads) since day 1 shows that more than 101 million people are suffering from diabetes and more than 45 years in India. There are some types of thyroids of about 42 million people. More than 25% people … Rapanjali Mitra Basu | 22, 2023

Term Insurance Plan & Its Types In India 2024

No claim bonus – various types of health insurance, discovery of large number of diseases, 14%of high -medical inflation, and health insurance, health insurance is something less than the fact that nothing less than the basic requirement. Will offer … Rupangy Mitra Basu | 22, 2023

Waiting Time – Health Insurance Types for Health Insurance are important for content welfare and peace. Health concerns, Pandem, Pandem, Weak Lifestyle Options and Risk increase in health schemes for health … Rapanjali Mitra Basu | 22, 2023

These children are probably the most important responsibility of your children by choosing the health of your children as the parents of your children, and by ensuring the future of your children. A good education and safe environment is very important when gives them a loving house …. Ankita Sejpal. November 11, 2022

Politics and award policy policy should be due to the terms and conditions of policy. Refunds are directly operated by the insurance company. You are asked to contact your insurance company to contact the paid number or apply on the appropriate part of your policy terms and conditions. You can also call us on our free numbers in 1800-266-0101 or support us in support @. We will be available to you for guidance / assistance. A different provider could choose an affordable plan compared to a separate provider, but he asked one that his wife had to enter the doctor.

Oregon Backs Hefty Rise In Health-insurance Premiums

“We are for both of them and are ill,” said the Bay area of Wartur, San Jose and Sunvel New York New York Pizza shops in the Gulf area. “It’s ridiculous.”

In the late 50s, the consuart is millions of California, which struggles to combat a faster health insurance premium than inflation.

The average monthly awards for families with health coverage in the private sector of California more than 1,000 in the last 15 years, $ 2,000 in 2023, showed federal data analysis. It is doubled at the rate of inflation. In addition, employees were forced to absorb a growing stake.

Spike is not limited to California. Medium prizes for families with health coverage provided by the employer have been grown in California from 2023 to 2023 to 2023. According to 2023, in 2024, in 2024, the awards continued to grow rapidly.

Disaster Risk And Rising Home Insurance Premiums

Small business groups have warned not to expand the developed federal subsidies that are more affordable in individual markets that do not cover more than 1.9 million California.

Since 2022, the awards on safe California have increased by about 25%, and inflation speed is increasing about twice. However, 90% of people who entered state and federal subsidy with many families, including exchange, helps reduce high costs.

The Rising Awards also killed government workers and taxpayers. More than 1.5 million California’s active and retired public activists and family members have increased a forecast since 2022. Public employers give share of premium expenditure as discussed with the acquisition of salary; Workers pay the rest.

“The insurance premium continues faster than the last 20 years,” he said. “Especially over the last few years, this premium growth has been very dramatic.”

Health Insurance Premiums To Increase Upto 25%

Ditz said that rising prices in the hospital are very accused. According to the Labor Department, the cost of consumption for hospitals and nursing homes was 88% from 2009 to 2024, the total inflation rate increased by about twice. According to him, the cost of management of mass medical care systems in the US has further increased high awards.

Insurance companies are very beneficial, but their overall edges – the amount of premium revenue was extremely durable over the last several years, KFF research shows. According to federal rules, insurers will have to spend minimum prize percentage for medical care.

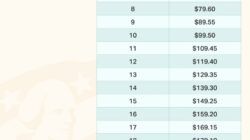

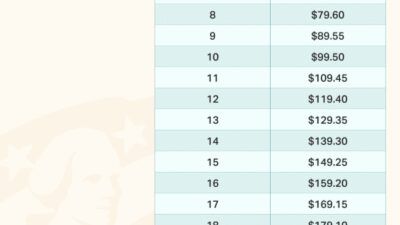

Average annual cost of family health insurance