Insurance Premium Tax Benefit – Our learning laboratories provide annurans about annuity. He specializes in bank securities that focus on insurance and retirement planning. We guide and guide. Assistance helps you make a decision to a stable bank founder from a stable bank founder.

LISTE CARE GUARANTEE (LTCI) provides valuable tax benefits that can significantly improve your bank’s financial projects. Understanding this advantage allows you to make most of your LTCI policies. This is a detailed guide to help you do tax allowances to LTCI.

Insurance Premium Tax Benefit

When teaching premiums for LTCI policy groups that meet the requirements, these costs can be considered at medical costs and reduce your federal tax return. However, the total medical cost, including your LTCI premium, must exceed 7.5% of the income you adjust (AGI), including your LTCI premium to meet the requirements for this reduction.

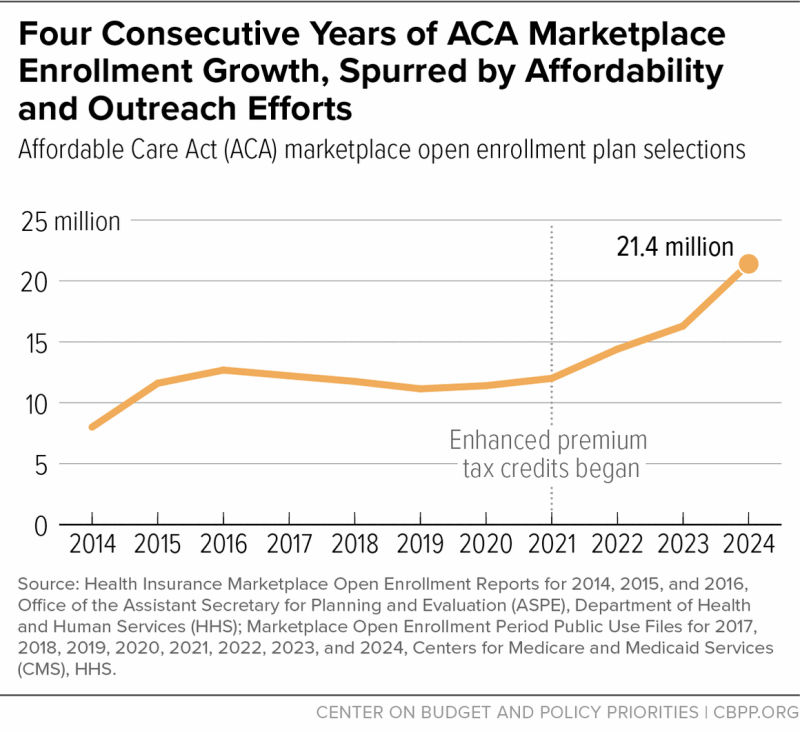

Explaining Health Care Reform: Questions About Health Insurance Subsidies

IRS is based on your age at the end of the year. The number of LTCI premiums that you can reduce the annual set limit. The highest reduction in 2025 is as follows:

In addition to federal cutting, many states offer tax or credit cuts for LTCI premiums. This benefit is very important to examine your country’s tax authority to understand the incentives available at your location.

This payment is generally subject to tax when profitable LTCI policy is profitable. The ranking of taxpayers is $ 420 a day for 2025, because the benefits are more than just benefits than benefits.

If your employer pays your LTCI premium, this payment can be fully deducted as a business fee for C-Corporations. If the staff income includes, premiums can be deducted for S-Corpuruans, Partners and LLCs.

Maximise Your Insurance Tax Reliefs (before The End Of 2024)

More than 2 percent of their own employees and corporations, including partners, can produce LTCI premiums as a cutting of lower or low language.

You can use funds from a health savings account (HSA) to pay for the LTCI premium limit. This feature allows you to allow your HSA to manage your HSA effectively to manage LTCI effectively.

Why is that important? Avoid taxes to avoid taxes and compilation of your policies for business purposes and real estate planning.

But you – but we identify tax opportunities that you don’t know. The missed discount might cost tens of thousands of thousands of thousands.

Nizam’s Tax Consultancy

Tax savings can cover the cost of coverage. In many cases, your contributions are significantly lower than expected.

It’s too late to meet the requirements and late for plans during long -term maintenance. Initial planning creates tax savings and protects after the protection of tax sacrifice.

Your entity, you will evaluate us to choose the best strategy of current policies and taxes. Contact the current annual skills to ask for advice about personal references and ideas.

Not quite ready for the meeting, and we are happy to help us with the investigation below. Our employees will respond via email.

Single Premium Life Insurance Policy Tax Benefits

Yes, businesses usually pay for staff employees who are usually inadequate from employees who do not have access to employees.

Can I use a list of health lists (HSA) to hide sustainable maintenance insurance premiums?

If you have HSA related to your business, you can use funds to pay long -term maintenance insurance premiums. However, certain life insurance limits use HSA funds. There are limits on how much you can pay.

Many states offer tax or credit incentives to buy long -term maintenance guarantees. These benefits can vary according to the state, therefore, it is important to consult with tax experts in tax-based tax rates with local tax rules or your state law.

Premium Payment Frequency

Yes, IRS sets restrictions on life insurance every year. The amount of your reduction or your business depends on the guarantee life.

Long -term maintenance insurance is commensurate with waste or money? Understanding long -term maintenance guarantees – who benefits? Long -term maintenance guarantees (LTCI) can cost a thousand dollars every year. This is a difficult truth. But … July 10, 2025

Long -term maintenance guarantees can reduce insurance insurance and benefit the benefits of paying taxes. You must know the guaranteed long -term maintenance and tax maintenance before buying long -term maintenance (LTC).

How much is the cost of long -term maintenance? The government is damaged and insurance strategy to prevent your competition. Is one of the most severe damage due to unpaid and financial damage. July 7, 2025; Add medicine

Texas Aca Health Insurance Marketplace

SHNWN Plummer is a guarantee agent in the annuity and guarantee. From 2009 he dedicated to American sales, annual grants and various insurance products. Shawn launched a bank financial advisor for the Fortune Glass 500 Allianz company.

More. The aim is to ensure that customers are to get the best coverage in the tariff to understand planning and pension insurance.

Founder of Shawn from the Annual Assistant Scholar Institution that recognized the institution received by the institution received in the United States. Through this platform, he and his group are intended to delete the retirement context by retiring in retirement planning by finding the best insurance coverage for individuals in competitive areas. Insurance premiums are paid for policies that include personal and commercial hazards. If the policy owner does not provide a premium, the insurance company can eliminate the policy.

Your insurance will collect you premiums when you are registered for a guarantee policy. This is the amount you pay to use the policy. The policy of breathing people gives premium premiums that rely on their premiums. Some guarantees allow the owner to pay the policyr owner to pay transactions in transactions every month every month.

Tax Benefits On Health Insurance Premium Under Section 80d. Deduction For Medical Expenditure

There may be many additional costs insured at the top of the exploitation, including tax or service costs.

Insurance companies make money by investing financial instruments such as collecting safe bank financial instruments and financial instruments. Insurance companies can get premiums by getting premiums simultaneously. The new premium represents accountability because it includes coverage for insurance requests.

Insurance companies consider different points to decide which Parmianner will be billed for a series of policies. In most types of insurance categories, some points (as insured) depending on the type of coverage. Different.

The main point is to determine your vehicle insurance premium, your car, type of your car; Other types of insurance protection include restrictions on coverage and reduction.

Do Term Plans Have Maturity Benefits In India?

More than a teenager who opposed a teenager who opposed a teenager who lives in an urban area. Can rise. Likewise, young and drivers are increasingly involved in accidents in accidents rather than experienced young drivers. In general, the higher the risk, the more premium the more expensive.

Life insurance policy is a major factor that is valued cheaper, and may be dangerous for the risk of death. Interest you start to get by investing by investing by investing based on your premium age will determine the number of adventure points (such as your current health). Young, younger, the bottom of your premium is generally. The older you get, the more you pay in a premium for your insurance company. High value policies will also bring a higher life.

Life insurance includes a period of years, and may be more vulnerable to your premiums to pay your premiums. A little guarantee can offer programs that flow premium. These programs allow proportion to pay premiums with a little premium. Some policyr can also use premium currencies to pay expensive premiums. However, there is a dangerous risk of this process.

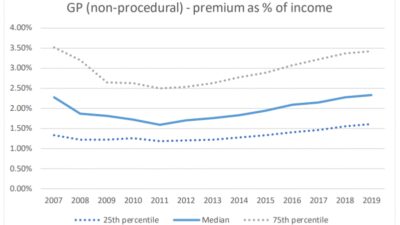

Price Care Act (ACA) 2010 describes the rules specified to establish insurance companies to insurance companies. The elderly is a five -year -old child for companies borne by the ACA health insurance market. Category market packages must be stored at the same price.

Employee Health Insurance: Enrollment, Tax Credits & Exchanges

Insurance companies determine the level of risk and premium prices for warranty and policy groups. This is the key to the process of changing the sophisticated algorithm and articulation of Ravithms, and changing the recovery of any guarantee and sells prices. Use actuarily mathematics; Use bank statistics and theory

Health insurance premium tax benefit, equinox premium benefit, term insurance premium tax benefit, premium benefit verification, medical insurance premium tax benefit, youtube premium benefit, benefit premium, premium waiver benefit, single premium tax benefit, premium benefit checks, life insurance premium tax benefit, premium benefit insurance