Insurance Premium Tds – According to the 194A section of the 1961 IT law, insurance companies in India were able to allocate taxes to their source if they pay life insurance at the time of maturity. Its payment equipment to insurance holders is taxed by the company at the time of payment. TDS is also deducted to pay bonus.

Note: Any amount received against life insurance is covered by this law. Even the loan against the life insurance will be covered.

Insurance Premium Tds

“Anyone who lies in the life insurance policy, including the amount allocated by the reward in such a policy, apart from the total income not inserted in accordance with paragraph 10, to pay it, paying it, paying for income tax, at 5 % income rates.”

Tds On Insurance Commission Payment

As I mentioned in the text, if the life insurance policy is covered by paragraph (10D) of the 10th Law “1961, it will not be deducted in this section. Falling policies in this section are:

The first paid per year should not be more than 20 % of the amount insured for the policies purchased between April 1, 2003 and April 30, 2012

If this policy is purchased after April 30, 2012, the value of the premium should not exceed 10 % of the insured amount

Payable premiums should not exceed 15 % of the insured for the policy purchased on or after April 1, 2013.

Budget 2024 Proposes Lower Tds For Insurance Commission, Bonus Payment

The TDS deduction in the 194A section is done only if the payment is more than 1 rupee in a financial year. TDS is not applied for each payer.

The government in the 194DA section has made changes to the tax deduction (TDS) on the life insurance tax revenue. Due to this change, the deficit is now obliged to deduct TDS at a rate of more than 5 % instead of the previous rate of 1 %. This applies to the amount received through the life insurance policy not subject to the exemption provided by Section 10 (10D). Important point:

According to the IT 1961 law, TDS does not apply to two scenarios in case of insurance:

1. The amount of such a payment or as a case, the total value of these payments to the beneficiary during the fiscal year is less than 1 rupees. (Proviso in the 194DA section)

Examples Of Inadmissible Expenses And Admissible Expenses

2. Any amount received in the death of a person. {Provide Section 10 (10D) In these cases, there is no need to infer TDS about maturity. Practical items:

Insured amount: 10lakhpolicy term: 9 years of monthly premium: 9, 980 annual insurance premium: 9980 *12 = 1, 19, 760/-20 % of insured capital value: 2, 00, 000/-Materity value: 14, 68, 000/–

While the first annual payable is less than 20 % of the insured amount of capital. The exemption according to paragraph (10D) section 10 is applicable and does not deduce the TD.

While the first annual payable is more than 20 % of the amount of insured capital. Execution is not applied to paragraph (100) Section 10.

Latest Tds Rate Chart For Fy 2024-25 (ay 2025-26)

While the first payable annual more than 10 % of the amount of insured capital. Exemption is not in accordance with clause (10D) section 10. When a health insurance payment is credited to your account and noticed it as TDS, it can be unexpected and confusing. Many wages and insured face this situation, especially when the payment is directed by an employer or processed as a refund. Understanding the process

It is important to know that when using such a deduction, they can be recovered and how you can recover your money.

Under normal circumstances, TDS (tax -deducted tax) is not applied to the repayment of health insurance for the insured. However, when insurance payments are carried out on behalf of an employee or insurer in the hospital, the nature of the transaction can create TD in accordance with the 194J or 194R Income Tax Act.

Yes, if TDS is deducted wrongly or unnecessary from your insurance payment, you may be eligible for a refund. However, to do this, you need to make sure:

Complete Tds Rate And Threshold Limit Changes Proposed In Union Budget 2025

Although this policy can only be repaid unless it is canceled, the inference TDS in health payments can be repaid by sending correctly.

According to LiveMint.com, a taxpayer was able to successfully show the TDS repayment request, and shows the amount as exemption in the ITR and joining the CA certificate.

In some cases, TDS is inferred due to technical or incorrect classification. The deduction (eg the employer or insurer) is allowed to provide correction, but if not, Onus claims to you. Here they are looking for a lot of users

Recent updates to the ITR forms for Ay 2025-26 now provide a better classification of exemption, which makes it easier to reflect. As India emphasized today, the new income tax factor is aimed at simplifying the disclosure of employees and eliminating ambiguity in such repayments.

How To Calculate Tds On Salary As Per Section 192?

If you have ever asked about the TDS inferenced in the health insurance program and how to recover it, the key to timely submission, understanding the exemption revenue, and the correct classification of insurance payments. By improving financial deposit systems and clearer reports, trends

The financial assets mentioned are subject to market risks. Please read all your assets carefully or optionally, before investing. Insurance agents earn a commission for the first time by the insured, which is calculated as the first percentage. However, it is necessary to understand the consequences of TDS in the Insurance Commission, which represents the tax deducted in the source.

TDS is for the Tax Insurance Commission, which is deducted by the insurer and only applies if the commission paid more than the rupee. 15000 in a financial year. The insurer must deduct the TDS at a rate of 5 % and send it to the government within a specified period of time. Also, it is issued to the TDS Certificate of Form 16a.

Reduction Commission: TDS in the case of Insurance Commission reduces the value of the commission received by the insurer.

Unlock Premium Rewards And Travel In Style With The Hdfc Biz Black Credit Card! ✈️✨ Maximise Every Point On Your Tax Payment This Season On Gst

Credit claim: Agents must make sure that the insurer has reduced the TDS and issued the 16A form. They must apply for TDS credit when submitting a tax return. Failure to comply with this can lead to higher financial commitment.

Bronze’s requirement: If the representative commission exceeds Rs. 50 stains in a fiscal year must obtain a tax deduction and a collection account (TAN) and deduct TDS for payments for subsidiaries or employees.

Keeping Records: In order to accurately calculate their financial obligations, officials must maintain sufficient records of their income and expenses, including the tax deducted by the insurers.

TDS is an important financial point for the insurance commission and failure to comply with it can lead to penalties. Officers must be aware of their TDS obligations and respect them to ensure the accurate calculation of financial obligation and preventing punishments.

Requesting Sop For Deduction Of 5% Tds On Payment Of Maturity Of Pli/rpli Policies

The TDS file quickly returns the TDS TDS file. This provides a complete credit for the deduction. Prices start with Inr 999/-. Now the case

This is a concept that appears with the progressive and intellectual mentality of people with similar thoughts. This is aimed at providing legal advice, adaptation, advice and management of corporate legal services to customers in India and abroad in any way possible.

For more information on our services and for free consultation, contact our team with@ information or call 9643203209.

This is a leader’s online platform that offers final business adaptation solutions for startups, small and medium -sized companies and global companies. The company specializes in Indian and international markets, including the United States, the United Kingdom and Singapore, at the/LLP Constancy, ITR and GST record, legal advice and training of subsidiaries. With the support of experienced experts, including CAS, CSS and legal experts, they provide precise services in accordance with thousands of business adjustments. The platform is aimed at simplifying complex processes of technology, personal support, and deep understanding of Indian and global supervisory frames.

Premium Paid Certificate

LLP Form 23 against the Top 27 Classes in LLP forms Tangible in India Do you also know their goals of 8 interesting facts about the Indian branch business? When you pay the insurance rate, tax problems are probably one of the last things in your thoughts. However, how knowledge (taxable tax) for coverage policies can clarify your tax obligations and prevent possible confusion, especially for specific types of payments. In this post, do we apply TDS on the premium?

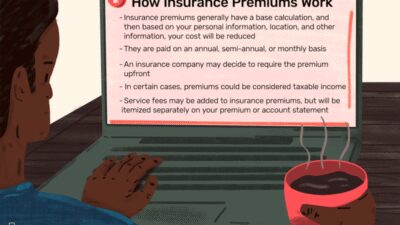

TDS, or tax -deducted in the source, is a type of tax in which the tax is deducted by the payer (with a company or a financial institution) with a variety of accurate income earlier than the charge is charged. The idea is to ensure that the government is already collecting taxes in advance, unlike people counting and paying later. TDS is usually applied to numerous profits such as income, interest, employment and price.

If you are a health or life coverage premium, TDS does not apply to higher levels. Thus, if you buy personal cover,

Insurance renewal premium, lower insurance premium, total insurance premium, insurance premium rates, tds on insurance premium, insurance premium estimate, tds insurance, automobile insurance premium, insurance monthly premium, allstate insurance premium, insurance premium audit, insurance premium