Insurance Premium Uk – The UK insurance sector is eligible for $ 1.8 of $ 5, something important to the property insurance. This aims to provide funds for the protection when the building and external home is damaged (such as a roof, and floor).

Without its importance, there is still a woman in property insurance. Many cities do not understand that it is really different from home insurance, and how much it costs as part of your home safety.

Insurance Premium Uk

That is why we are here, we decided to hang up and combined types of types of definitions. We cover that Propert Insurance Branch Group grew over time. We will reflect the different factors that can affect the main costs of property, and the number of claims made.

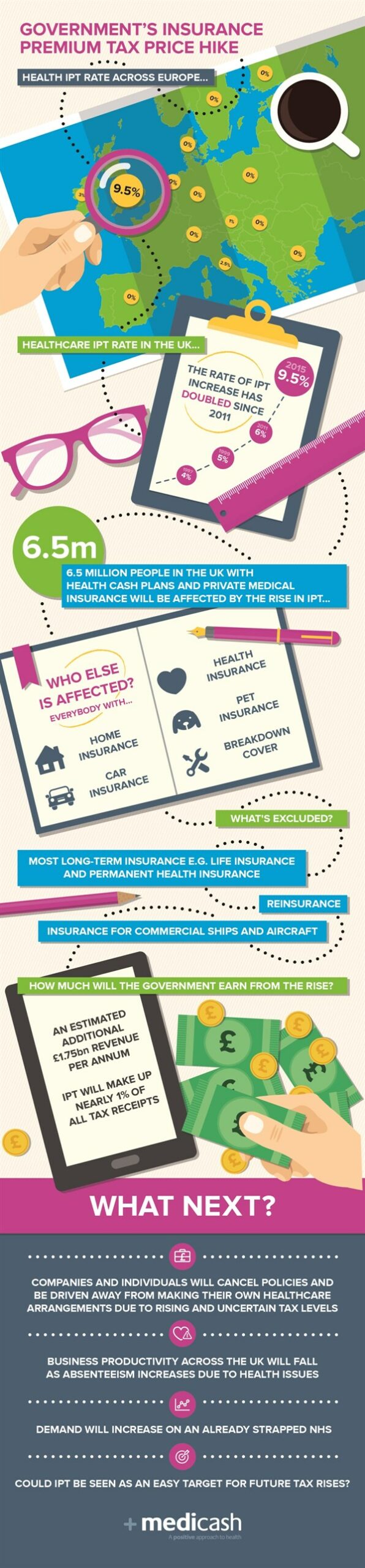

Insurance Premium Tax

Based on the quarters from consumers, general costs of property insurance costs since 2021, and 84.7% between 2021-24.

In 2021, normal costs stand £ 101.40, which almost 11,5% later was 2022.

From 2023, consumer costs generally received £ 147.86 – increase approximately 3.8%) within 12 months. In 2024, the number was extended and more than half of the above term (26.7%) at normal costs of £ 187.29 per year.

This section leaves the deep in each of the issues each of these issues testing the interior of the medium.

Coronavirus: Travel Insurance Premium Rockets By 550% As Providers Brace For Huge Payouts

From 2024, those who live in a flat may expect to pay more than their insurers compared to another section.

The flat insurance is available as a special home insurance mode. This is especially helpful if you have a frame owner (or share the frwand and others).

About 9 (88.93%) is found between 2023-24 of all houses. This causes the most important kind of property to the UK to find the buildings of the buildings and produce a common level of £ 164.64.

The unusual household insurance is also in the buildings listed in the list and / or the roof that includes grass, the phrears, and wood. Because these symptoms are often seen in normal houses and it can be difficult to fix that damaged. This means that the insurance options, can be regarded as a great risk and not be covered by normal insurance policy.

Insurers Must Cut Claim Costs As High Motoring Costs Push Consumers Away From Driving

The average property insurance value can vary according to the kind of house you live. In addition to the third (35.96%) for the quotations found between April 2023 and March 2024 were not bloods, cost and £ 153.40.

In contrast, above the quarter (26.86) for quotations made of the average valuation of £ 194.78. This applies to almost quarter (or £ 40 per year) is very expensive for comparison.

Often by means of saying, as the value of the building is increasing, and between the cost of buildings. Based on Chapete data, UK-UK – UK is $ 1 million would expect the normal cost of £ 361.29.

Remember, domestic insurance should be subject to your property property. Not to show its market value or what you paid for your purchase. For more information, see how to obtain your revised renewal costs.

Increase In Insurance Premium Tax From June 2017

In contrast, scarce buildings between £ 150k and 200k often produces a very low price for £ 134.40. This is about three times a third, on average, compared to it is very important for 1 million and more.

If you make your property at any time, you may want to think of insurance. Many local insurance policies cover the DIY and RedMedment, then be compliance with the work that your existing policy is available. It is worth looking at first before doing any job, to ensure that it is enough.

According to the medium data, the average cost of 6 or more of 2024 was $ 405.47. On the other hand, 2 sleeping buildings often have low cost of $ 129.92. This is about 3 times under 6 or more rooms.

Almost half (49.41%) for a quotation between April 2023 and on March 2024 was not 3 of 324 was not a bedroom, to produce costs between £ 151.20.

How Is My Car Insurance Premium Calculated?

Based on district data, general costs of property insurance costs may vary which section of the UK.

Those who live in Northern Ireland were always released their insurance. At the main cost of £ 286.85, around $ 100 a year above the national average.

It is about 1 COMPETTES This item points out the amount of values over £ 220 – about quarter (26%) compared to Ireland.

Our data also advises the northern and lower case at the cost of the medium property. The northern and east east of the northern are quoted between £ 126 and £ 143 in their insurance order between Eastern and £ 171 at the same time.

Uk: Average Insurance Premium Drops To Six-year Low In Spring 2021

This means that those living in the north of England can pay about £ 50 a year in the year under their policy than southern people.

In contrast, the general cost of Scotland were above Wales (£ 158.26 vs £ 151.10, successively). However, both were more than £ 30 a year below to the average of £ 187.29.

Based on customer ratio, general costs in the UK build are usually increasing. Those between 46-50 are usually paid (£ 178.42) by their insurance, followed closely with customers 41-45 (£ 176.54).

Those who are 21 to 15 and 76-80 often has very low premiums, at regular insurance costs in $ 138- £ 140 per year. This means that those who are 41 are often taking about a quarter (24.95% above their policies compared to those ages 21-250.

Age And Travel Insurance

If you are over 50, you may want to view a home insurance policy over 50s to help you save money from your insurance costs.

Usually, pensioners pay a little about their insurance against those who work. The main value of their buildings still work for £ 144.35, from 2024.

On the other hand, those who are considered teaching as taught as well as the learned centuries can expect to pay a large property insurance. Average estate around £ 203.07 per year represents the third party (33.8%) above, or additional annually, compared to the retirement.

White workers of collar made a large percentage of quotations between 2023-24, approximately 1 (29.62%). The value of the public policy on this community was £ 171.56 – about 10% under the weather the UK.

How Much Is Insurance Premium Tax?

Unfortunately, those who appear in the middle work can expect to pay about five (21.8%) above their local insurance in comparison with the working task. This is equal to £ 35 over a year.

The average property value is different according to the type of work you do. The measuring data between April 2023 and March 2024 indicates that those who are employed that vehicles are usually worth £ 140 per year. However, those who work in money and insurance may expect to be a normal average £ 220.64 – about 44.7% on comparison.

My family and pensioners make the most via quotation percentage between 2023-24, approximately 1 (24.4%). This was followed by approximately 1 of 5 (20.61%) in that work. However, the difference between its middle estimate could have been almost a quarter (24.98%) of an expert, resembling the amount of £ 40 per year.

Generally, policies with a large number of endless discounts (NCD) can expect the minimum payment of property.

Fca Launches Review Into Uk Premium Finance Market

About (42.17%) between 2023-24 quotations were 9 years old or older in the NCD. This is revealed policy costs between £ 157.

In contrast, approximately 1 (19.06% is one of the NCD years, equal to 12% of 9 or more than 20% above, on average).

From 2024 General cost of property insurance costs on the US UK was £ 161.58.

Often, about 4 in 5 (81.88%) customers want a year’s policy for property insurance. This can keep it around £ 15 per year, by a rate, compared to those who choose to pay every month.

The Insiders Guide To Motor Fleet Insurance & How To Secure The Best Deal For Your Business

Speaking, insurance policies with valuable valuable values always produce low costs. Based on the taxo data, the best of $ 02.53, compared to £ 160.05 for $ 400. This is equal to 13% below.

That means, if customers pass on £ 150, the general cost of insurance refuse. About 3 on 5 (57.77%) for quotations found between April 2023 and

Capital premium insurance, insurance return premium, premium tours uk, total insurance premium, insurance premium estimate, spotify uk premium, insurance premium, automobile insurance premium, premium bond uk, e premium insurance, premium insurance calculator, chesapeake insurance premium