Insurance Premium Under Section 37(1) – During the past few years, especially since 2020, employer worker employer employer has taken traction. Pandemic Covid-19 effect creates a fulfillment of growing strips of India’s health protection. To ease this gap, the Indian government is forced businesses with more than 20 employees to provide health insurance through job owners. This initiative exacerbates a culture that works well at work, while also secure a strong work worker.

To encourage businesses following the group’s health insurance command, the government also provides taxes under Section 37 in the Accox Act. This provision allows businesses to claim tax deductions for business-related costs, including e-e insurance costs. It does not only provide businesses to opportunities to save taxes, but it is also encouraged to participate in their employees.

Insurance Premium Under Section 37(1)

Now we know how the tax filing process, especially for small business owners. This blog is aim to decode Section 37 to the AccociX Act also includes tax taxes for different business expenses including Group Health Insurance. Learn all about key provisions, reducing, and practical suggestions to use reductions available under this tax break.

Section 37 Of Income Tax Act For Employer-employee Insurance

For those who do not intervene, employer-employer insurance or health insurance or group

Health Health Insurance pays the costs associated with the hospital, before post-hospital, maternity care, critical illness, and more. The owner bought this kind of policy and employees used and sometimes members of their family. There is no time to wait for Heart Health Insurance, which means that policy benefits and supers can be used from one day.

As well as giving attention to employees’ health, employee insurance also provides different benefits to your business. From improvement of employee’s participation to improve job productivity, a holistic group’s health policy has a major role in improving business results.

Under the total provision of Section 37, cost costs can be obtained for professional or trade purposes for deductions. It lowers the business tax burglary by reducing the total income income.

Level Or Stepped Life Insurance?

Decreases for different operating costs can only be claimed as long as these costs are considered “perfect and loneliness” related to business.

For example – salaries, legal fees, interests of loans, and perquisites as insurance premiums directly related to or importance to business operations and therefore attached under section 37.

To better expand how business expenses are considered for reductions under section 37 we will understand different conditions that businesses should follow in order to be eligible to file tax.

SECTION 37 AND SECTION 37 (1) Apply business – Change costs but different from scope and decrease. They are included but have a clear intention to lead the taxpayer in the types of business costs that are eligible for reductions.

The Premium Paid By The Employer Is Considered As Profits In The Hands Of The Employee, And Hence The Employee Can Claim Tax Rebate Under The Income Tax Act. The Premium Paid

Section 37 (1) an extension of section 37 above and businesses should also consider the instructions specified under Section 37 (1). It indicates the activities forbidden by law and considered crimes and some CSR costs not available for reductions under section 37. They are as follows:

The main difference between Section 37 and Section 37

Although Section 37 contains a wider cost of business expenses, Section 37 (1) positioned some categories forbidden from deductions.

The advertising cost or any other media services provided for business and professional use, excluding spending advertisements released by a political party.

Who Is Winning The Cloud Ai Race? Microsoft Vs. Aws Vs. Google

Payment fees to lawyers, insurers and lawyers due to a legal business related or profession. There is no expendit of law to be allowed according to the provisions under Section 37 (1).

Wages paid to employees other than recognition paid by another business owner. The payments worker paid permitted to conclude it from office or end of work. The salaries paid by company companion allowed by the company but limited to certain conditions.

Payment paid as sentences or for fee allowed. The penalty paid for violation of the law is not allowed. Payment has changed by nature and from the responsibility of contractual can be allowed.

Costs made for charging for business or profession are allowed. Costs such as brokerage, also allowed charges and registrations.

Porsche Insurance Launches In Canada

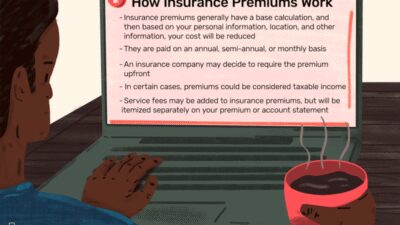

Section 37 allows businesses to require decreases for the costs associated with e-e insurance. As health insurance premiums are paid for employer, they are regarded as part of the operation costs of the company and treated as expenses.

This means businesses can reduce their tax responsibility by drawing the cost of premiums from their total tax. By offering employees’ insurance benefits, businesses not only fulfill their legal obligations but also increases tax opportunities.

We list 5 simple steps that businesses can easily request tax deductions under Section 37.

To gain a decrease, first you need to know all the costs, including group insurance group, allowed under section 37

41 Essential Business Expense Categories For Businesses

Press full records of all relevant costs with invoices, receipts and policy documents for tax-filing insurance for free. So make sure all your documents are in order.

If you are a business owner or professional, use ITR-3 to report your income and decrease; If you file for a company or cap, use ittr-5; And if you file for a company, use ittr-6.

You can file your own tax return or get professional help. However, it is important to be with the costs of the relevant department of the return to ensure they are obtained from your total tax.

If you file a tax for your company then you need to consider consulting a tax professional to ensure that you have correct accounting and your reductions are attached for maximum results.

₹ 1,27,000. ] Him :- Life Insurance Premium Is Treated As Drawings. Q. 1..

Partner with the correct insurance provider and make sure you choose a health insurance policy directly related to employees’ welfare, these policies can – medical insurance.

If the costs pay for your business (including insurance premiums) do not meet tax regulations then your business can receive serious sanctions.

A tax counselor helps ensure that your deductions are properly counted and you take advantage of your storage under section 37.

Tax filing will be heavier, especially if you are a small business owner and / or you file yourself. This is where partnership with the right insurance provider comes. With, you can handle claims and payrolls without. In addition, health and good benefits are adaptable and cheap for businesses in all sizes.

Flood Insurance Is A Driver Of Population Growth In European Floodplains

We can find out what health care plans can add value to your business and how they can affect your tax deductions under Section 37. There is a monthly subscription to cost you Rs. 145 the employee,

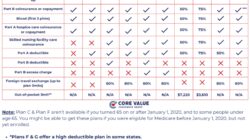

* Tax percentage can vary based on company turnover and the composition of the design. We advise you to consult an ITR file tax professional to maximize tax relief and earnings.

If you want to understand how health benefits do and do well to make value for your business, please contact our team today. Ensure quickly quotes and protect your team with the most comprehensive member of health.

Section 37 reduces the weight of the business tax by reducing their total income tax. Various expenses, including health health insurance premiums, can be obtained for business purposes or trade to be left under section 37.

End The Tax Exclusion For Employer-sponsored Health Insurance

Business expenses for – advertising, legal fees, interests of loans, payments paid by employees, penalties and costs of setting business operations to be gained under Section 37.

Yes, wages and wages paid by workers and professional business expenses and therefore received under Section 37. However, a fee made by another business cannot be gained under Section 37.

Under section 37, no financial limit. However, there are different restraints of costs not allowed under section 37.

CSR activities are often regarded as voluntary actions through businesses committed for social benefits and no direct impact on business operations and therefore not allowed under section 37.

Voice Of The Consumer Survey 2024: Asia Pacific

Some of the documents you need to find useful to claim reductions under section 37: invoices and receipts; Proof of business purposes; Insurance documents documents for e-e insurance; Bank statements; third party contracts; Payments and salary records; Tax invoices and GST documents.

Employees must maintain accurate documentation, avoid double decreases, and ensure that costs are entirely and perfect for business purposes to ensure compliance with section 37 provisions.

Section 37, tomica premium 37, nfpa 37 section 4.1 4, section 37 order, section 37 cafcass, scheduled c section at 37 weeks, pegasus 37 premium, premium fans section, 37 week c section, c section with twins at 37 weeks, premium only section 125 plan, erisa section 3 37