Insurance Query Meaning – What is the meaning of life insurance and how many types of life insurance are? Please explain in detail.

What is the meaning of life insurance and how many types of life insurance are? Please explain in detail.

Insurance Query Meaning

Time management is very important in IIT jam. The addis test series for IIT jam mathsmatical statistics helped me a lot in this portion. I am very grateful for the test series I bought from EtinCl.

What Is Insurance Excess?

Edunferer served as my guide light. It has a responding solution team to solve and click good solutions to your questions within 24 hours. Markortrip Angunfle services guide you step by step on your syllabus, books to learn topic, vicant, important things, and so on.

The general part of Edunfer’s study materials are very good and helpful. Land science chapters are also very satisfactory.

The recovery study material helps me a lot. Smart camera questions and test series are useful. Help me delete my doubts. When I do not understand a topic, ability support is good too. Thanks Anyde.

I recommend that endersfert learning material and services are best to burst UGC-Net exam because the material has been developed by subject experts. Aptell material consists of not good. Of car series car series & royer test newspapers.

Insurance Underwriter: Definition, What Underwriters Do

I really staded with learning material from Edunclec.com for English Their four test card is really cold because it helped me to crack the Dilaes. Thanks an anyde team.

One of your mentor will return to its whitan 48 hours. You can currently enjoy the free learning material of a free learning material

Please give us 1 – 3 weeks to review your profile. In a kose of any questions, write to us from support@eduncle.comsurancule is purchased to provide financial supplies, injury, or program damage. An insurance company collects the risks of customers to make payments more accessible to the insured.

Many types of insurance policy are available, and almost any individual or business can find an insurance company ready to insure them, for a price. The common types of personal insurance policy are cars, sound, homeowners and life insurance. Most people in the United States have at least one of the types of insurance, and car insurance is required for state law.

How To Use Point In Time Tables In The Insurance Industry?

Businesses receive insurance policies for field-specific risks. For example, a food restaurant fan may cover the injuries of an intense Cook employee. Medical malpractice insurance covers death-related injury or liability resulting from the healthcare provider’s negotence. A company can use a record insurance broker to help her manage its employee policies. Businesses may be required by state law to buy specific insurance coverage.

There are also insurance policies available for their specific needs. אַזאַ קאַוערידזש כולל געשעפט קלאָוזשערז צ צו סיויל אויטאָריטעט, קידנאַפּ, ויסליזגעלט, און יקסטאָרשאַן (ק & ר פאַרזיכערונג, אידענט in פאַרזיכערכער.

Understanding how insurance work can help you choose a bill. For example, comprehensive coverage may or may not be the right type of car insurance for you. Three components of any type of insurance are premium, policy limit and deductible.

The policy premium is the price, typically monthly costs. Often, an insurer considers several reasons to establish a premium. Here are a few examples:

Insurance Portals: Use Cases, Features, Development Costs 🌐

It depends largely on the perception of your risk insurer for a claim. For example, let’s say you have some expensive cars and you have a reckless driving history. In this case, it is likely to pay more for a car policy as someone with a single alternate trog and a perfect driving record. However, different insurers can charge different premiums for similar policies. So find the price that is right for you to need a little legmork.

The policy limit is the maximum amount the insurer pays for a loss covered under policy. The maximum can be set for each period (eg, an annual term or policy), for any loss or injury, or throughout the policy life, also known as the maximum life.

Typically, higher limits have a high premium. Likes a general life insurance policy, the maximum amount the insurer will pay is named for the nominal value. This is the amount paid to your beneficiary on your death.

The Federal Affordable Care Act (also known as) prevents compliant plans against basic health care services, maternity services and pediatric services and pediatric services and pediatric services and pediatric services and pediatric services and pediatric services and pediatric services and pediatric services and pediatric services and services. Pediatricty.

Checking A Claim Status: The Different Phases Of An Insurance Claim

The deductible is a specific amount you pay out of pocket before the insurer pays a claim. The service that may arise as determinations for large volumes of small and insignificant claims.

For example, a $ 1, 000 deductible device to pay the first $ 1,000 for any claim. Let’s say that your car damage total $ 2,000. Pay the first $ 1,000, and your insurer will pay the rest of $ 1,000.

Dieductables may apply to any policy or request, depending on the insurer and type of policy. Healthy plans may have a reduced and family-deductible individual. Policies with high dyducibles are typically less expensive because the high package cost generally results in less small claims.

Health insurance helps cover the costs of routine and emergency medical care, often with the option of increasing vision and dental services separately. In addition to the annual deductible, you can also pay Copdy and Coinsurance, which are your fixed payments or percentage of medical profit covered after satisfying the deductible. However, many preventive services can be covered for free before reaching these.

What Is User Intent (& How It Improves Conversion Rates)

Health insurance can be purchased by an insurance company, an insurance agent, the federal health insurance market, provided by the employer, or a federal Medicare and Medicaid cover.

The federal government no longer requires Americans to have health insurance, but in some states, such as California, you can pay tax penalties if you have no insurance.

If you have chronic health problems or need regular medical attention, look for a health insurance policy with less reduction. Although the annual premium is higher than a policy comparable to reduced medical care, less expensive, it may cost trandolof.

Homeowners insurance (also known as home insurance) protects your home, other property structures and personal possessions against natural disasters against natural disasters, unexpected damage, theft and vandalism. Home insurance does not cover floods or earthquakes, which you will have to protect against separately. Policy providers generally offer riders to increase coverage for specific properties or events and provisions that can help reduce deductible amounts. Addicts come to an additional premium amount.

What Is Insurance Underwriting?

Lessee insurance is another type of homeowner insurance. The lender or employer is likely to require the coverage of homeowners. Where homes are concerned, if you do not have coverage or stop paying your insurance bill, your mortgage lender will be allowed to buy homeowners’ insurance for you and blame for you.

אַוטאָ פאַרזיכערונג קענען העלפֿן קליימז אויב איר באַשעדיקן שעד שעדיקן עמעצער אַנדערש ס א vandalized, vandalized, vandalized, vandalized or connected or cast.

Instead of paying out of pocket for accidents and car damage, people pay annual premiums to a car insurance company. The company and pay all or many of the costs associated with a car accident or other vehicle damage.

If you have a rented vehicle or money borrowed to buy a car, your lender or rental allowance will likely need to wear car insurance. As with homeowners insurance, lender can buy insurance for it if necessary.

62 Insurance Q&as To Ace Your Next Interview In 2025

A life insurance policy guarantees that the insurer will pay an amount of money to your beneficiaries (such as spouses or children) if you die. In exchange, pay premiums throughout your life.

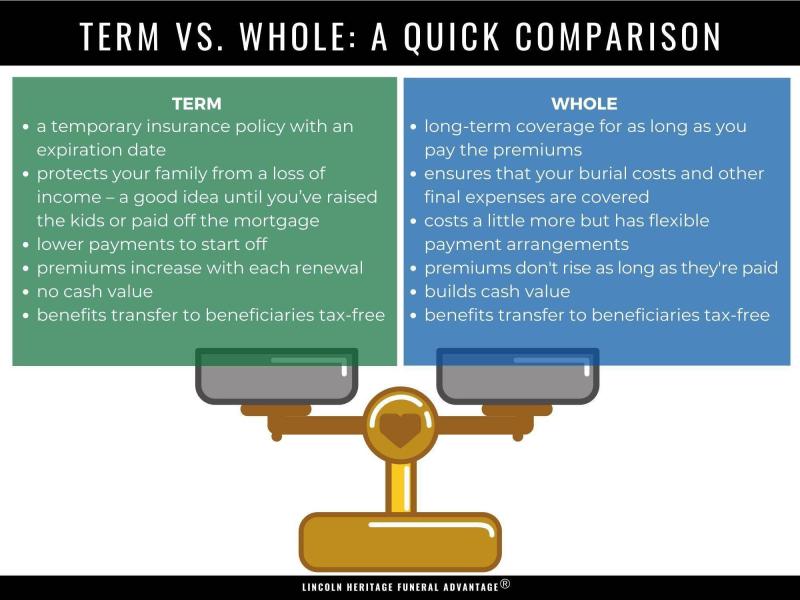

There are two main types of life insurance. Long-term life insurance covers for a specific time, such as 10-20 years. If you die in this period, your beneficiaries will get a fee. Life insurance always covers all your life until you continue to pay the premiums.

We compare the price, policy types, financial stability, customer satisfaction, and other reasons to find the best life insurance companies.

Travel insurance covers the costs and losses associated with trog cleaning, including bagfage, rental cars, and rental homes. However, even some of the best travel insurance companies do not cover cancellations or delays due to weather, terrorism, or pandemic. They also do not comfortably cover extreme sports injuries or high adventure activities.

What Is Investment Insurance?

Insurance is a way to manage your financial risks. When buying insurance, buy protection against unexpected financial losses. The insurance company pays you or someone to choose if something wrong does. If you have an insurance and an accident happens, you may be responsible for all related costs.

Insurance will help you, your family and your assets. An insurer helps you cover the costs of medical bills or unexpected and routine hospitals, accidental damage to your car or damage of your things, and the usual person of your things. An insurance policy can even provide your survivors with a cash payment piece if you die. In short, insurance can offer peace of mind