Insurance Rate Comparison By Zip Code – Compare Washington, D.C. [2025] car insurance rates compare Washington, D.C. car insurance rates for the lowest price. Monthly rates have an average of $ 111, but mutual pharmacists and Geico offer affordable car insurance fees as low as $ 25/month. Washington, D.C. Automobile laws require a minimum of 25/50/10 for bodily injuries, property damage, and non -insured driver cover.

Daniel Walker graduated with a BS in administrative administration in 2005 and runs his family’s insurance agency, the FCI agency for over 15 years (BBB A+). He is licensed as an insurance agent to write property and accident insurance, including fire insurance at home, life, car, guard and housing. He was also presented on sites such as reviews.com and Safeco. To ensure that our content is accurate …

Insurance Rate Comparison By Zip Code

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a master’s degree in philosophy, Justin began his career as a teacher, teaching philosophy and ethics. Justin later obtained his property license and victims and his license of life and health and began working for State Farm and Allstate. In 2020, Justin started working like me …

Mississippi Auto Insurance [rates + Cheap Coverage Guide]

Advertiser’s Disclosure: We strive to help you make confident car insurance decisions. Comparison purchases must be easy. We are not affiliated with any car insurance company and we cannot guarantee quotes from a single company.

Our partnerships do not influence our content. Our opinions are ours. To compare quotations from major car companies, type your postcode above to use the free quote tool. The more quotes you compare, the more likely to save.

Editorial Guidelines: We are a free on -line feature for anyone interested in learning more about automobile insurance. Our goal is to be an objective and third party resource for everything related to automobile insurance. We update our site regularly and all content is revised by car insurance specialists.

Mutual and Geico pharmacists have cheaper car insurance in Washington, D.C. You can pay less than $ 40 monthly for liability coverage with any company.

Best Arkansas Car Insurance Rates In 2025 (top 10 Companies)

Continue reading to compare Washington car insurance rates, D.C. of the cheapest and most expensive companies in the district. We divide the non -fault car insurance policy options, we explain why specific types of coverage are essential and compare the rates of the best insurance companies in Washington, D.C.

There are other coverage options you can add to your minimum cost insurance package that can make a huge difference when it comes to protecting your investments (and saving money) in the unfortunate event of an accident.

Annual car insurance in Columbia district costs about $ 1, 324, which represents more than two percent of average personal income.

The above data were collected from NAIC (National Association of Insurance Commissioners) December 2017 Auto Insurance Report. Disposable Personal Income (DPI) is the total amount of money you left to spend (or save) after paying your taxes.

Michigan Car Insurance 2025 (coverage, Companies, & More)

Click here for the driving record and the personal profile used to get the quotes above. A handful of states took action to legally prevent men and women from paying different fees for car insurance, however, this is not the case in Washington, D.C.

Men pay more than women, especially in younger demography. Check out this chart showing the AD Automobile insurance rates by age and gender:

The more? Our researchers recovered specific rate quotations for D.C drivers, which were $ 240 a year more than those data for men who were the same age and had identical profiles and driving records.

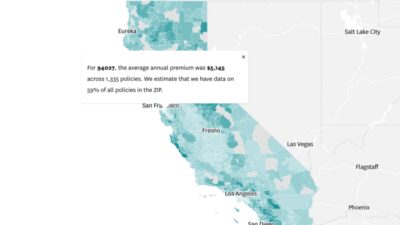

In most states, their zip code has a tremendous impact on their rates, simply due to different direction conditions and risk factors. In the district, this is not the case, and most postal codes pays a very similar rate on average.

California Car Insurance (the Only Guide You’ll Ever Need)

Now that you know the district insurance requirements and fees, let’s find out which providers in D.C. have the best (and worse!) Ratings and revisions.

You can start by conducting a comparison of better car companies with our free tools. Keep reading to get internal information about who the best suppliers are (and why) throughout the district of Columbia.

Here are the ten car insurance companies in Washington, D.C., who had more complaints. These data proves that a company may have a high volume of complaints, but still offers exceptional customer service. This is what the company does with the complaints that really matter.

In addition, what says more about a company is not the number of complaints it receives (larger companies usually receive more complaints), but the company’s complaint rate. Defined: In this case, the complaint rate is the number of complaints that the car insurance company received for every 1,000 accident claims it has submitted. Liberty Mutual, J. Whited and Metropolitan have more work to reduce customer complaints.

Cut Costs, Not Coverage. Save On Conroe Car Insurance With Tgs Insurance Agency

Now that you know the minimum coverage required by law to have in D.C., you can buy the price to compare what major providers have to offer.

There are many names for this new way of determining car insurance fees: payment insurance like you-directed, based on use (UBI), telematics, driver monitoring, etc., but all mean the same thing.

You will install a device on your vehicle that will report to your insurer how many miles you drove and with the safety of each of these miles on the roads.

What makes car insurance more expensive in D.C.? Here are some examples of why D.C drivers would be required to obtain this high -risk coverage:

Toronto Postal Codes With The Least And Most Expensive Auto Insurance Rates

In D.C., a high-risk driver must file SR-22 car insurance. Your insurance provider will register your SR-22 on the DMV for all vehicles registered on your behalf or driven by you. If your current company cannot register SR-22 insurance, you will need to move to an insurer that can, which can increase your fees. (For more information, read our “What are Dui’s insurance laws in Washington?”)

Like much of the US, Columbia district uses a car insurance system for moving violations and other illegal drivers. Here is what you will receive in D.C. for the most common violations:

When D.C. drivers receive 10 to 11 points, their license is suspended and they lose their direction privileges for 90 days. If they receive 12 or more points, your license will be revoked and will lose your management privileges for at least six months.

California, Hawaii and Nova Jersey are currently the only three states that offer government-funded car insurance programs for low-income and car insurance for welfare beneficiaries. However, D.C. has its own car insurance line that has existed since 1982 to ensure that every driver is properly safe.

How Does Your Zip Code Affect Your Car Insurance?

The Columbia District Auto Insurance Plan (D.C. AIP) is available for drivers who are refused from other suppliers due to a bad driving record or high risk personal factors.

Allstate, Geico and Liberty Mutual offer car insurance in D.C. drivers who use their vehicles for travel margin services, delivery and life imprisonment.

WASHINGTON, D.C. It is a “failed” district. No matter who guilty of a car accident in AD D.C., those injured can use their personal injury protection insurance (PIP) or “without fault” to get compensation for medical accounts and lost salaries of your insurance company.

However, PIP insurance or without fault is not the best option for innocent victims in an accident or when there is great damage. In D.C., it is better for the wounded (and innocent) parties to send a complaint against the guilt driver.

Best Los Angeles, California Auto Insurance In 2025

Usually, you cannot file a complaint against the guilt driver and receive benefits without guilt, but in D.C. You can if the following two criteria are met:

If the monetary and injury requirements listed above are not met, the charges against the driver will be withdrawn.

You and your vehicle need not be properly insured, you need to prove it all the time while operating a vehicle on public roads.

Even if you are following the law, if you are closed and cannot prove that you and your vehicle are insured, you will face all the same penalties.

Best Car Insurance In Arizona For 2025 [your Guide To The Top 10 Companies]

Regarding a DUI, Columbia district is one of the least forgotten areas in the US with this 15 -year -old period.

The fines and penalties above apply, even if the vehicle never moves a inch. According to the law of D.C., being behind the wheel with the keys in the ignition while harmed is sufficient to gain a DUI.

D.C. It was not only to completely ban text messages while driving, but is also known for giving the largest number of text messages with almost 90,000 written in AD alone in a decade!

Surprisingly, Columbia district has no laws on vehicle repairs or replacements. But just because D.C. has not established laws on cracks in the stop -to -browse does not mean that you cannot be stopped and fined for one.

Car Insurance Rate Increases

Drivers in AD. are not allowed to operate a vehicle that has something that causes an obstructed view of the road. There are many companies out there eager to repair their broken windows. Do not wait until it is a danger to yourself or others. D.C. drivers have the option of adding a zero deductible glass replacement