Insurance Rates Keep Going Up – Why do my car insurance prices continue to live my car aging? Most of our customers ask this question so I would like to arrange it on a few angles.

First things first, though called Car / Auto Insurance, include more than your car. It should be called car word insurance, in the same way that home insurance is actually called “homeowners’ insurance.

Insurance Rates Keep Going Up

It is important to understand that there are many things that are variable in insurance premiums, and car insurance, no different.

Homeowner’s Insurance Rates Are Just Going To Keep Going Up. And Your Biggest Opportunity To Win With Clients? Well, Help Them Save Money. And Perhaps One Of The Best Ways To Do That? Introduce Them

The insurance company is very frustrating with you a collision and causing (or yourself) to damage the body, or death, rather talking to your car. The car is a visible material that can be changed.

If you look at it you will see that there are so many different in your car policy.

These are all the things covered in your car policy. How many of them should do with your car?

It is also important to understand that it is not your only insurance company. It is one fish in the sea of certain fish, sharks and sea creatures, all having different characteristics and risk profiles.

Auto Insurance In Austin, Tx

Insurance speaks by broadcasting costs above a large number (in the incident pond), anyone paying for a fee. That lake of accidents is constantly changing, and is affected by different objects, including the general economic state.

This means sharing the cost of millions of other people, most of whom may have poor loss and / or debt.

Next time your car insurance prices go up, see the big picture. Be sure to look at everything to cover, and compatible prices.

I hope this is helpful! If you would like to know more about car insurance be sure to visit our dedicated page.

Ever Had To Pay Insurance Excess And Wondered… “why Me?” 😅, We Get It, It Can Feel Unfair, Especially When The Accident Wasn’t Your Fault. But Excess Exists To Keep Insurance Fair And Affordable For

Delivery: Statements of information on receiving insurance for normal purposes. These statements are not abundant, transform or add any insurance policy. Read your policy or contact your agent for details. Your eligibility for specific products and services depends on the final writing and approval of an insurance company that provides these products or services.

This website does not make any presentation covered or not any claim or loss or form of claim or loss, under any policy. Make sure you are learning a policy, including all to enable, or propectus, if applicable.

We use cookies to provide you with better browsing experiences, analyze site traffic and customize content. Learn about our cookie policy. OK3 mins can save you great. Enter your postcode below and join thousands of Canadians except on vehicle insurance.

It works as a private sector between you, financial institutions and licensed professionals without additional charity for our users. By helping, disclosing that we work with other providers writing about them – we also record a lot of financial services without financial gain. It does not apply to a financial institution or diagram and ensures accuracy, our content is reviewed by licensed experts. Our unique position means that we do not have a multiplied position in your policy, which confirms our submission to help Canadians make financial decisions or better bias.

Insurance Rates Seem To Keep Increasing At Every Renewal But With Erie’s Rate Lock® Feature You Can Lock In Your Auto Premium Today And It Remains The Same Year After Year—even If

Cancer insurance premiums increase by 6% between December 2022 and December 2023, which indicates that the world continues to deal with industrial challenges. But if you are a good driver with a clean record, does your insurance prices go up for no reason? We give the answers.

Risks are the best cause of car insurance premiums, with marks 2022 counting the second death (1, 931 deaths) since 2013. So, what if you don’t have an accident on the road? Unfortunately, your insurance prices are still able to wake up for other reasons, including the following.

While accidents affect insurance premiums, faster tickets and other violations of your vehicle report, such as disappointments, they may increase your standards. Why? The wrong record tells insurance that you are a high risk driver.

Where you live the most car insurance earns the car insurance, so personal change is such that it moves to a new city can raise the cost. For example, if you were in the rural area and I went to the city with integrated roads, you could expect your premiums to go up.

The Struggle Of Medicare: How Insurance Payments Fail To Keep Pace With Inflation

Some human changes, such as marriage, may affect your insurance prices. Married couples generally pay a little in car insurance.

Yes, climate change can influence your insurance values! Places in natural resources such as storms and wildlife often force insurance companies to cover disaster risk claims and extreme weather events.

In 2022, more than 105,000 vehicles were stolen in Canada, in the number of Interpol as one of the worst stolen countries. This strong loss almost always drives claims and causes insurance prices.

If inflation can affect other industries, you can be sure of your car insurance. Insurance values will increase if the vehicle is very expensive to repair and change. Features such as costs of restoration parts and lack of staff can also affect these amounts.

Rates Went Up, Thinking Of Switching From State Farm

It’s like a romantic property, renewing your car insurance policy increases prices. How many changes depends on your measurement issues, such as you have just migrated or add a new driver to your policy.

While many features that cause traffic insurance are often without your control, there are things you can do to work your premium costs.

An accidental and proven solution that a safe driver can speak volumes with your credibility in an insurance agency. To prove that you have taken a safe driving course to give your insurance provider the peace of mind. Also, there is no damage to your driving skills.

Drivers who have good credit often have lower premiums. While your credit points may have a small insurance policy, having good interaction issues that you are a trusted customer.

How To Profit From Increased Insurance Rates

The cost of removing one vehicle will be different from the other. Consider electric cars-taking advantage of the environment, can be difficult for your bag, as the restoration and repair components are expensive.

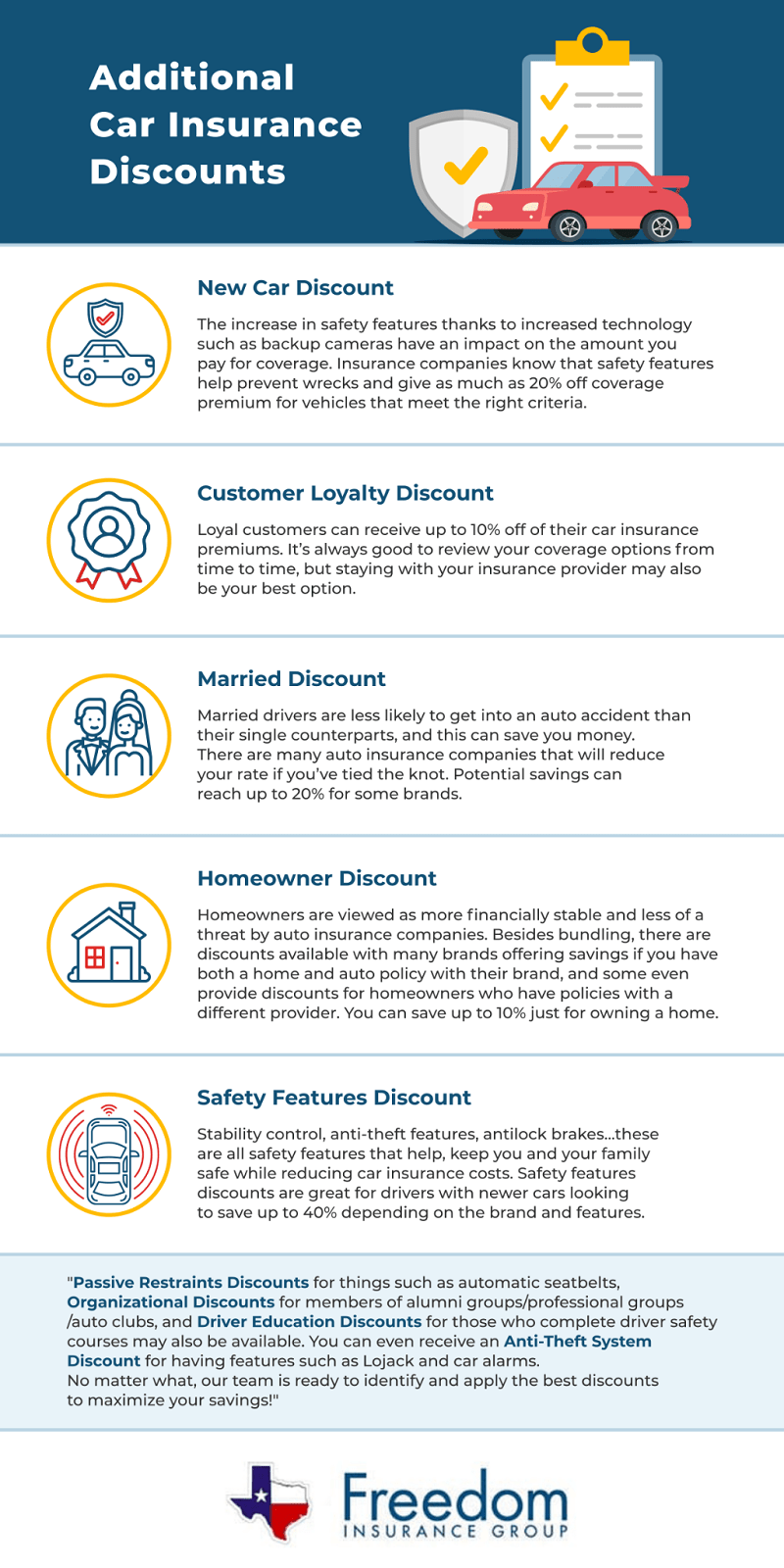

Bunding Auto and Home Insurance can save money, as many insurance companies offer discounts. You can also look at a lot of car insurance, facilitate the payment process of premiums and make it easy to manage.

If you have a saving budget, the payment of all your policy thermet can save between 6% and 14% in your premiums.

If you do not yet have a car insurance policy, turn around. Don’t jump on the first policy you see-you may not have the best deal. Remember, each insurance has variable values based on how to check as a driver. For example, some insurance company can look at your age and type of car more than the other.

How To Keep Fleet Insurance Costs Down

Depending on the type of driver of your driver, consider some companies. Let’s say it’s not always on the road and drive less than 11,000 miles a year. You can get better catching up with the limited insurance company.

Choosing your policy can determine how high your prices are. Insurance policies have the lowest prices but do not provide sufficient protection. On the other hand, perfect crashes or coverage provide many risk benefits but can be very expensive over time.

The closure of vehicles will not be allowed to protect you when you enter a defect shower or involved in the hit-and-run. Click to learn more.

The new Fraudulent Fasra reporting law can be divided under Atario’s insurance. Learn how this renewal can reduce your premiums, though not all night.

Car Insurance: 8 Quick Tips To Reduce The Cost

Did you know that you still need insurance while driving someone else’s car to Canada? Learn to be insurance as a cream of KRED.Greensboro, N.C. -Not only you and not your thinking, everyone around you thinks the same thing.

People around the country feel the hearing of the car insurance. According to the bank premiums up to about $ 243 to $ 2,000 a year.

“I pay $ 351 a month, rather than paying for my month every month,” said one driver in Florida.

Cheap insurance values are usually found by calling. Sometimes a car along with home insurance can lead to a better estimate. People who work from home can qualify for the lower mileage discount. Car owners can consider the portions of their policy.

Car Insurance Savings Referral Available

“To make an example, that the cost of employment of vehicles covered? You must have drainage insurance,” said Mark Hamric, Bankrate the big economy.

Completed. This includes theft, damage to your car allocation, breaking, falling tree and snow. This is not necessary.

A complete mix is one of those areas you can and can save in your monthly premium. But, if your car is stolen, the tree falls and beats it, you will pay it in your pocket.

Insurance rates going up, why do my car insurance rates keep going up, why does insurance keep going up, geico rates going up, are insurance rates going up, home insurance rates going up, car insurance rates going up, geico insurance rates going up, public storage rates keep going up, house insurance rates going up, usaa insurance rates going up, spectrum rates going up