Insurance Repository Meaning – “Insurance repository” refers to a firm set up and registered under the Company Act, 1956, and issued a registration certificate from the Regulatory Authority and Insurance Development (IDDA) for the purpose of preserving insurance policies data in electronic form on behalf of insurers.

The RDA has given registration certificates to the following five entities to function as insurance repositories to implement the insurance repository system.

Insurance Repository Meaning

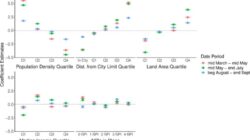

00064-5/asset/ee21b739-2f74-4575-a920-a7215e581ef3/main.assets/gr1_lrg.jpg?strip=all)

The policyholders can purchase and maintain all his or her policies using an electronic insurance account (EIA) with any insurance repository of his or her choice. Existing physical policies can also be dematerialized and stored in the EIA. All policies are then accessible with one click of a button. The insurance repository system not only allows policyholders to keep their insurance policies in electronic form, but also allows them to make quick and accurate adjustments, modifications and reviews for their policies. The repository also serves as a ‘one-stop shop’ for policy service.

Centrico Insurance Repository Limited

The purpose of establishing an insurance repository is to give policyholders the ability to store insurance policies in electronic form and make changes quickly and accurately.

In addition, the repository serves as a one-stop-shop for a variety of policy needs. The insurance repository system also makes the issue and maintenance of insurance policies more efficient and transparent. Insurance repositories give all their services for free.

Risk assumption and diversification are at the heart of the business models of insurance companies. The risk of individual payers is collected and redistributed in a wider portfolio under the basic concept of insurance. Most insurance firms make money in two ways: by charging premiums in exchange for insurance coverage and then reinvesting those premiums in other interest-bearing assets. Insurance firms, such as other private businesses, strive to successfully market while reducing administrative costs.

Health insurance firms, property insurance companies, and financial guarantors all have different entry models. However, each insurer’s first liability is to assess the risk and charge a premium to take it.

The 9 Best Ai Contract Review Software Tools For 2025

Assume that the insurance firm is selling a $ 100, 000 conditional payment coverage. It should determine how likely a prospective buyer is to trigger conditional payment and then multiply that risk by policy.

This is when it comes to the importance of the subscription of insurance. Without proper subscription, the insurance business charges some customers and charges others for taking a risk. This can cause the least risky consumers to be priced, causing premiums to rise even more. If a corporation properly marketing its risk, it should be able to generate more revenue from premiums than to spend on conditional payments.

In some ways, the real product of an insurer is insurance claims. When a consumer submits a request, the company must process it, check it twice, and send the payment. This adjustment process is necessary to remove fraudulent claims and reduce the risk of loss of the company.

![]()

Let’s say the insurance firm receives a million dollars in premiums for its policies. It can keep money in cash or put them in a savings account, but none of these options are very efficient: at least, their savings are vulnerable to inflation. Instead, the corporation can invest its capital in safe and short-term assets. While the Corporation expects possible payments, it produces additional interest income. Treasury bonds, high-grade corporate bonds, and interest-bearing cash equivalents are examples of this type of instrument.

Insurance Company Registration In India: Eligibility, Procedure & Renewal

Reinsurance is used by some businesses to alleviate risk. Insurance firms buy reinsurance to protect themselves from excessive losses caused by high exposure. Reinsurance is an important part of the efforts of insurance firms to remain solvent and prevent payment default, and is required by regulators for companies of a specific size and type.

For example, an insurance company can subscribe too much storm insurance based on models that predict a low hurricane likelihood of a specific place. If the worst happened and a hurricane hit that area, the insurance firm may face significant damages. Insurance firms can go into business if they do not have reinsurance to take some of the risks off the table when it affects a natural disaster.

Unless a policy is reinsulated, regulators require an insurance firm to offer a 10% hood policy. As a result, as reinsurance allows insurance companies to transfer risks, they may be more aggressive in gaining market share. In addition, reinsurance alleviates the natural volatility of insurance firms, which can result in considerable profits and losses.

It is similar to arbitration for many insurance companies. They charge a higher charge for individual insurance clients, then get lower rates when they reset these policies in mass.

E-insurance Simply Means Buying Insurance Policies In A Digital Format. , ✅ Your Electronic Insurance Policies Will Be Held In A Demat Account Termed E-insurance Account, Or Eia. , ✅ You Can Manage

Companies in the insurance industry, like any other non-financial business, are judged on their profitability, envisaged growth, payment and risk. However, there are several challenges that are unique to the industry. Because insurance businesses do not invest in fixed assets, there is little depreciation and relatively low capital costs. In addition, because there are no standard working capital accounts, the insurer’s working capital calculation is a difficult task. Analysts do not employ indicators of the value of the firm or enterprise; Instead, they use equity metrics such as price ratios (P / E) and price proportions for the book (p / b). Analysts use ratio analysis to evaluate firms by calculating insurance-specific proportions.

Insurance firms with high growth, high charge and minimum risk tend to have a higher P / E ratio. Similarly, high-risk, low-risk, high-risk, and high-income insurance businesses have a higher p / b. Return on equity has the greatest impact on the p / b ratio when all other factors are kept constant.

Analysts should support with additional considerations that complicate when comparing P / E and P / B proportions in the insurance industry. Insurance firms set aside money to cover the future costs of claims. P / E and P / B ratios may be too high or too low if the insurer estimates such provisions too conservatively or aggressively.

Comparability in the insurance industry is more hampered by the degree of diversification. Insurers are often involved in many insurance companies, such as life, property, and casualty insurance. Insurance firms face varied risks and returns depending on their level of diversification, resulting in a wide range of proportions P / E and P / B.

Einsurance Policies & E-insurance Account

Start your insurance company in India that complies with all mandatory standards and regulatory compliance framed by India’s regulatory insurance and playback. Enjoy simple processing, fast updates, and, better than everything, no hidden fees.

Digitailze your insurance policies and get verfications / real-time updating that is done in no time. One has to obtain a license repository for mantane insurance and update the insurance policy. Enjoy simple processing, fast updates, and, better than everything, no hidden fees.

Start your consultancy business legally with permits from the SEBI to act as a consultant for various investment strategies or products. We take care of all the other documentation, we follow both the Government, and the other legalities.

This site portion is for informative purposes only. Content is not legal advice. Statements and opinions are the expression of the author, not, and have not been evaluated with accuracy, completeness, or changes in the law.

Proof Of Insurance

Get help from an experienced legal consultant. Schedule your consultation at a time that works for you and is absolutely free.

An experienced digital trader with a history shown of work in the internet industry. He likes to write about the latest technology trends, skilled in digital trading. Search engine optimization, SMO …

Thank you very much for sharing your experience with us !! We hope to see you again soon. !! A depository is a facility or institution, such as a bank or credit union, accepting money deposits or securities for rescue retention and assisting in their trading.

The term depositary may refer to a facility in which something is deposited for storage or safeguard, or an institution that accepts currency deposits by customers, such as a bank or savings association. A depositary can also be an organization, a bank, or institution that holds securities and assists in securities trading. Deposits placed in a depositary must be returned in the same condition upon request.

Visa Kerja Australia: Panduan, Jenis, Syarat, Hingga Biaya

Depositaries provide security and liquidity in the market. They use the money deposited to maintain rescue to lend to others, invest in other securities, and provide a fund transfer system.

Depositaries are buildings, offices, and warehouses that allow consumers and businesses to deposit money, securities, and other valuable assets for safeguarding. Depositaries may include banks, safe, security rooms, financial institutions, and other organizations.

Depositaries serve multiple purposes for the general public. First, they eliminate the owner’s risk of holding physical assets by providing a safe place to store them. For example, banks and other financial institutions give consumers a place to deposit their money by offering a deposit of time and deposit bills.

A time deposit is an interest-bearing account with a specific maturity data, such as a CTD of deposit (CD). A demand deposit account has funds until they have to be withdrawn, such as an audit or saving account.

Insurance Industry: Trends & It Market Size Report

Deposits can also be titles, such as stocks or bonds. When these assets are deposited, the institution holds the securities, or in electronic form, also