Insurance Schedule Meaning – Aging schedules can improve cash flow management, reduce poor debt and assess credit risk. / Laura Porter

The aging schedule is a table that reflects the company’s unpaid debtors according to how long they have passed. Often created through accounting software, the aging schedule can help the company see if it costs customers in a timely manner. The aging schedule has received debtors’ debts for the age of excellent bill as well as the name and amount of the customer.

Insurance Schedule Meaning

The conclusion schedule is often the current (up to 30 days), it took 1-30 days, 30-60 days passed, the last 60-90 days and more than 90 days. Businesses can use aging schedules to see which accounts are overdue and which customers need to send a reminder of payment or, if they are too far behind, send to collections. The company wants to be as current as possible because the longer the account is the offense, the more it will be paid, which will lead to loss.

Policy Wordings Electronic Equipment Insurance

The company may have financial problems if it has a significant number of accounts in advance. You may need to borrow money to stay above the water using unpaid accounts. This will further affect the companies as it is responsible for paying interest on the money it borrows. Every day, the missed fee will, to some extent, affect the financial position of the company, and each account that is late multiplies is affected.

The longer the past account, the more dubious it will be. The aging schedules allow companies to remain at the top of JSC, hoping to limit dubious accounts.

Oldness charts are often used by drivers and analysts to assess business activities and financial results. They are particularly useful for current capital management. Aging schedules can help companies provide cash flow by classifying the expected liabilities from the older to the latter and classifying the estimated income by the number of days from the date of sending the bills.

Cash flow is important for business because many companies fail due to negative cash flow. Therefore, cash flow tracking is an essential element in maintaining a healthy and successful business. In addition to internal use, aging schedules can also be used by creditors to assess whether to borrow company money.

Nasbi Supplemental Benefit Insurance Forum 2022 –

In addition, auditors can use aging schedules to evaluate the cost of receivables on the company. If the same customers reappear, just like the debtors’ debt schedule, the company may have to overestimate whether to continue their business with them. The debtors’ schedule can also be used to estimate the amount of the dollar or the percentage of debt debts that can be collected. This can allow business to be active, not reactive.

Knowing the percentage of debtors’ debts that may not be distinguished, the business can look for a decision on their cash flow issue, before the spiral problems are uncontrollable. In some sectors, such as retail or production, aging schedules can play an important role in setting credit standards. If the company notices that it has a constant problem with a large number of missed accounts, it may consider raising its standards when it comes to customer credit assessment.

Short -term assets: Definition, Benefits and Examples of Operational Expenses: Average Average Age Age Review, Benefits and Examples: A Review and Calculation Project on Exposure: What is it and how it works as a subsidiary, what should be read: value, review and examples, what is monetary item? Definition as it works and examples absorbed value: definitions, examples and meaning, introduced: definition, example and calculation formula

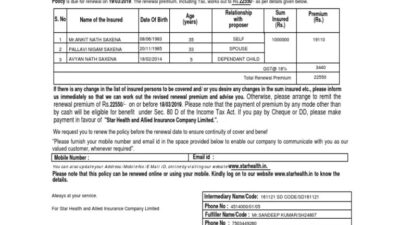

Credit Ticket: What is it, how it works, and an example is a postponed loan: the values, privileges and example of the Management Institute (IMA): what it is and how it works for an unskilled audit: Definition and how it works in accounting in red: what it means, how it works, how it works. About examples. A certain period of time paying the insurer’s recipients. As soon as the term expires, the insurer can either restore it to another term, possibly converting it into a permanent cover or authorizing life insurance.

Car Insurance Schedule Hi-res Stock Photography And Images

When purchasing a life insurance policy, the insurance company sets a bonus based on the cost of the policy (payment amount) and factors such as age, gender and health. Other rates affecting rates include business business expenses, how much it earns in investment and mortality level at each age.

In some cases, a medical examination may be required. The insurance company can also ask for your driving record, current medicine, smoking status, classes, admiration, family history and more.

If you die during the policy term, the insurer will pay the nominal value of the policy to your recipients. This money, which is not usually taxed, can be used by recipients to settle your health and funeral costs, debt, mortgage debt and other expenses. However, recipients do not have to use insurance income to settle the debts of the deceased.

There is no payment if the policy ends before your death or you live outside the political term. You may be able to restore an urgent policy after the deadline, but the awards will be passed depending on your age during the restoration.

Frs 117 Vs Mas’ Risk-based Capital 2 (part 1)

Life insurance term is usually an expensive life because it offers death at a limited time and does not have Acash Valuecomponent as permanent insurance. For example, quotes show that a healthy, non -smoker at the age of 30 can obtain 30 -year life insurance from $ 250,000,000 to death for an average of $ 18 a month from October 2024. At the age of 50, the prize will increase to $ 67 per month.

Source: Quote. Quotes are granted for $ 250,000 for 30 years of life policy for men and women with excellent health.

By contrast, see $ 100,000 rates for life (which is a permanent policy, that is, it lasts your life and includes the value of money). As you can see, the same 30 -year -old healthy man would pay an average of $ 100 a month and 50, he paid $ 227. Although this policy costs much less than the term policy in the previous example, it is more expensive because it lasts the lives of the entire owner.

Source: Quote. Quotes are designed for life insurance for $ 100,000, for men and women with excellent health.

66 Long Term Home Insurance Policy

Most urgent life insurance policies end without paying benefits from death, reducing the overall risk of the insurer over a permanent policy. Reduced risk is one of the factors that allow insurers to charge smaller bonuses.

Interest rates, insurance company finances and national standards can also affect bonuses. In total, companies often offer better tariffs at the break -point level “100,000, 250, 000, 500,000 and $ 1,000.

Given the amount of the cover, you can get bonus dollars, life insurance is usually the cheapest life insurance. Check our recommendations for the best life insurance life when you are ready to buy.

Thirty -year -old George wants to protect his family in the unlikely death of his early death. It buys 10 -year -old, 500,000,000 urgent life insurance policies with a bonus of $ 50 a month.

Life Insurance: What It Is, How It Works, And How To Buy A Policy

If George dies in 10 years, the policy will pay the recipient $ 500. If he dies by politics, his recipient will not benefit. If it is still alive and restores politics within 10 years, the prizes will be higher than its primary policy, as they will be at the age of 40, not at the age of 30.

If George is diagnosed with a terminal disease in the first policy period, he may not have the right to restore the policy when it is over. Some politicians offer guaranteed recovery (evidence of insecurity), but such functions have higher costs.

There are several types of life insurance. The best solution will depend on your individual circumstances. Usually most companies offer conditions from 10 to 30 years, although several offer 35 and 40 years.

Presidential insurance makes a fixed monthly payment for the policy time. Most life insurance conditions have a level of prize, and this is the way we have mentioned most of this article. As we mentioned, this type of policy usually provides a coating of 10 to 30 years. The benefit of death is also corrected.

File 15/8 Iii Rules Regarding General Provident Fund And Insurance Policies’ [17r] (35/200)

Since actuaries must take into account the increasing cost of insurance during the policy efficiency period, the bonus level is relatively higher than the annual renewable life insurance.

The Policy of Renewable Sources (YRT) is an annual policy that can be restored every year without providing evidence of insecurity.

Prizes are growing every year as a year. Thus, they can become too expensive at the borrower’s age. However, they can be a good solution