Insurance Stocks – Aero-thin-down S P nd P5 500 6, 279.35 +0.8% +$ 51.93 aero-thin-down DJI 44, 828.53 +0.8% +$ 344.11 aer-honey-down nasadac 20, 601.10 +1.0% +$ 207.97 ARO-Down-Down 09. 213.57 +0.5% +$ 1.13 aer-thin-down AMZ $ 223.48 +1.6% +$ 3.56 aero-thin-down Goog $ 180.68 +0.5% +$ 0.92 aer-down-down Met $ 718.78 +0.7% NVDA $ 159.26 +1.0 TSLA $ 315.76 +0.0% +0.12

The main conclusions are supported by Chatgpt and are based only on the content of this article. These conclusions are reviewed by our editorial team. The author and editor of the editor assume the final responsibility of the content.

Insurance Stocks

Insurance stocks can add a lot to any investor’s stock portfolio. Insurance businesses can not only create long -term returns, but they can also work in good and bad times.

Solved: If The Number Of Chinese Insurance Stocks Represented 3.5% Of All * 1 Poi Insurance Securi [business]

With this in mind, here is the overview of three insurance shares that the insurance industry works, some important concepts and investors should maintain their radar by 2025 and beyond.

Met Life (MET 0.62%) is a good choice for investors who want some insurance exposure with low volatility. It is the largest Life insurance company in the United States and is also a big retirement business.

Metropolitan Life has a history of easy -to -understand models and a history of stock return. In the context, a total of 127% return for investors in the last five years (about 18% of the year) has been received. In addition, the company offers one of the highest dividend income of its Pear Group, which can greatly improve the total return.

Merkel (MKL 3.7575%) is a professional insured who chooses to ensure unusual risk, which is the required business in a strong economy and recession. Markle not only operates underwriting profits, but the company has a colorful strategy of investment.

European Insurance Stocks Gain 16% In H1 :: Insurance Day

Markle not only focuses on a safe investment such as a premium bond, but instead puts one -third of his investment property in publicly trading, while Markle also bought the entire business from his Markale Ventures section. As a result, Markel is often described as a small version of Berkshire Hassels (BRKA 1.9 %= BRK.B1 %.), Which is Markale’s largest stock investment.

This is a good insurance stock for investors who want to be more exciting than the Kinasel Capital Group (KNSL 3.7777%).

If you are not familiar with the company, Kinasel is the only pure game of commercial insurance (extra and surplus) in the market. This means that the company is an expert in risk and special conditions that are difficult to evaluate. For example, if you want to start a high-ranking company, such as a demolition company, you may need a professional insurance company like Kinsele.

Professional insurance is a difficult business, but if you are good in it you can make a lot of money – Kinasel is definitely. In the last three years, the average company of Kinasel’s Pear Group has created 8.3 percent of the underwriting margin, while Kinseel’s company is three times higher than the price.

Hdfc Life To Max Financial: Here’s How Life Insurance Stocks Are Delivering Smart Returns To Investors In 2025

The most important thing to do before buying any stock is how the company earns money. It may seem simple, but there is often misunderstanding in the insurance industry.

The obvious way that an insurance company can make money is to sell the insurance policy and give a premium loan rather than paying the claim. This is called underwriting profit.

Second and importantly, the way insurance companies have to make money is to invest in the money they have earned before claiming. This money is called float. Most insureds invest in safe places (such as high-quality bonds), but some choose to be more dangerous and buy other types of investments (such as Merkel DO).

Of course, this is a simplified explanation. Insurance companies have other ways to gain revenue, and the two companies discussed in this article also have uninterrupted operations. But the main idea is how this business works.

Insurance Stocks: Manulife, Sunlife, Intact And Gwl

To analyze the insurance list, most standard metrics work, such as return on equity (ROE) and net profit. However, before you start, you should know three insurance-specific profits:

Like many industries, insurance companies can be divided into sub -categories, so here’s the main type of insurance companies and what they do:

Best bank shares may seem complicated for banks in 2025, but the way to make money is simple.

7 Blockchen stocks invest in this type of laser technology behind the trend of cryptocurrency and other technology.

Why Are Insurance Stocks A Safe Bet Now Amid Market Volatility?

In July 925, these companies regularly handed over the shareholders to the stakeholders, which gave them a good source of income.

Insurance companies have an attractive economics. They will pay them until the claim is required to be paid and the insurance company can invest money for its own benefit during this period. That’s why Warren Buffett was so attractive for insurance and chosen as the particle of the Berkshire Hathaway Empire.

Insurance is a recession-resistant business. For example, during the difficult time, people need to maintain insurance for the car and homeowners. In short, insurance is a business that can make long -term profit without much instability.

Insurance companies make money by charging the premium and investing in the insurance premium to pay the premium. Sounds simple, right? Both are not. Each insurance company is for a large part of its revenue through underwriting, which is basically called a premium (premium). What does insurance companies use a large amount of cash through premium payment? Both companies stopped some stocks to ensure that there was enough time to pay for all the claims expected in the short term. But then they invested the rest of the money. Investment yields are often lower than underwriting income.

S&p 500 Gains And Losses Today: Centene Pulls Guidance, Health Insurance Stocks Fall

Top five health insurance shares that divide the market value (the size of the company is calculated by the multiplication stock by stocks):

Berkshire Hathave, Kinasel Capital Group and Matte Frankel are the positions at Markle Group. Motley is a place and Burkshire recommends Hathaway, Kinasel Capital Group and Markle Group. Motley is a manifestation policy.

More investments are made on motley. Get stock advice, portfolio guidance and more from Motley’s premium services. We want to clarify that there is currently no official line account on the international. We have not yet installed any official presence on the online messaging platform. Therefore, any account that claims to represent online internationally is unauthorized and should be considered fake. CFD is a complex tool. When trading CFD with this investment provider, 71% lost money in the retail customer account. With the benefit you can quickly lose money. Make sure you understand how the product works and whether you are capable of risking HH damage. CFD is a complex tool. When trading CFD with this investment provider, 71% lost money in the retail customer account. With the benefit you can quickly lose money. Make sure you understand how the product works and whether you are capable of risking HH damage.

Exploring insurance stocks can provide uncontrolled opportunities for. Thanks to Warren Buffett, we are well known as our highest choice for the best insurance shares.

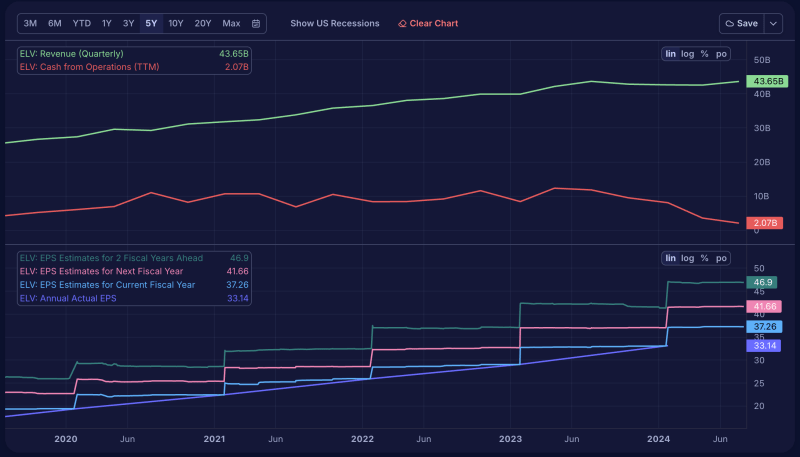

Analyzing Graphs And Charts

The insurance company first is a business, which means the same metrics that apply to any company such as profit and revenue. Regulatory violations or negative publicity when successful merchants carefully follow the results and news of the insurance company and follow the stumps.

Together with us, you can exchange insurance stocks with a growing or falling value. If you think that the value of the stock will increase or you think they will decrease, then you will be long (“buy”).

You can buy and hold the stocks you trade. This means that you have a stock in the hope of benefiting the long -term stock price appreciation. You will be eligible to pay any dividend (if the company provided) and you can get an RHT to vote.

You can take advantage of our best stock trading commission rates – start with a zero commission when you buy our stock or when you buy UK stock £ 3. Our best commission rates are for customers who have opened three or more positions on their stock trading account last month.

Financial Services Sector: Exploring Banking And Insurance Stocks

For an interesting year for insurance shares and many potential opportunities, our choice is the choice of good insurance shares we can trade on special orders:

*Please note: These reserves are not number in specific order and the list above does not represent the numerical ranking value.

In British books alone, Aviva has a Billion over $ 2 billion AUM. Aviva is also a good reputation to pay valid claims to bring about $ 300.6 billion to the policy holders in the Claim year in 2020.

Although its operating profit has dropped by about $ 20 million compared to 2019, the profit rate of Aviva is high in accordance with the International Financial Report Standard (IFRS profit).