Insurance Underwriting Process – Financial risk is the risk that a company could not generate enough cash flow or revenue to fulfill its financial obligations.

The risk associated with a loan is whether it will be repaid and that the borrower could not have a history of loan defaults.

Insurance Underwriting Process

The underwrators look at everything relating to an application, including financial situation and overall health. They typically work for companies offering mortgages, loans, insurance and investments.

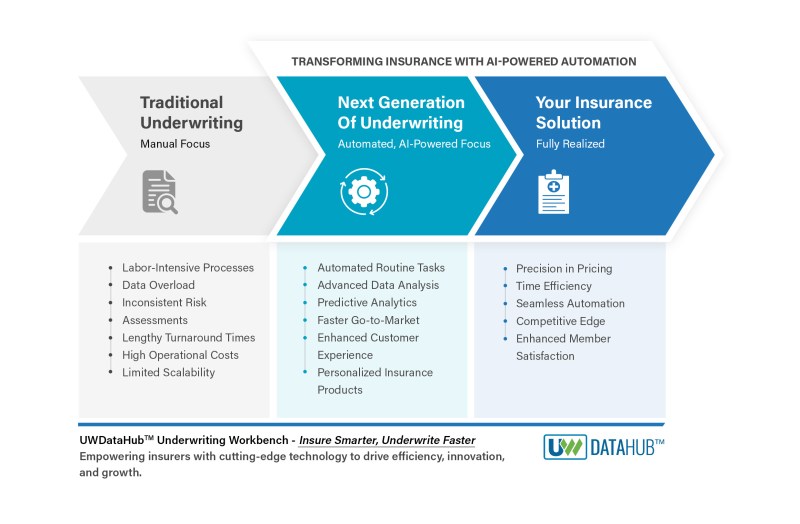

Top 7 Technologies That Improve Insurance Underwriting

They assist the companies to decide whether to accept a contract of an applicant based on their findings and the associated level of risk. In the financial industry, underwriting is essential since it enables investors to choose profitable investments.

Lone underwriting involves evaluating the financial background of borrower, income and credit standing. Lenders assess the financial risk that a borrower has before lending them money.

An insurance that the investment can be paid and that the borrower does not often leave up lower default is necessary.

Loans that are secured are mortgages. If they default on a secured loan, the borrower politeral to the lender.

Three Stages Insurance Process For Underwriting Life Insurance Diagrams Pdf

In this approach, you can talk with an underwriter about the circumstances rather than allow the computer system banner one as an unsuitable borrower.

When assessing risk, age, gender, and medical history are only a few of the rate factors underwrot. For example, smokers and alcoholics rates will probably be more significant than those who are not.

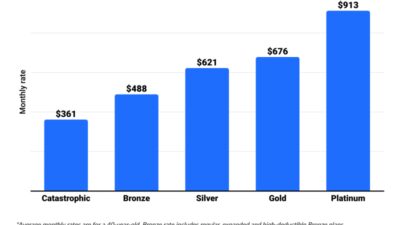

The affordable care act (aka) was enacted more than ten years ago. The aka abolished patient costs-sharing for high-value preventive care and formalized safeguards for those with prior diseases.

Securities underwriting assesses risk and sets prices for separate securities, most often related to an initial public offer (IPO).

Ai In Insurance Underwriting: Streamlining The Process

Underwriting assesses the viability and potential of the company for success before you go publicly to ensure that investors, usually an investment bank, have the information needed to make an informed decision.

Based on the findings of the underwriting process, the investment bank would buy the securities issued and subsequently sell those in the market.

If more than one underwriter is involved in purchasing the securities, it is referred to as an underritter syndicate.

A underwriter syndicates is used when a problem is too large for one company to deal with an aggregate of several companies.

Underwriting Income: What It Is, How It Works

The underwriting process starts after the applicant submissions The documentary requirements. It can take different methods for each type.

For loan underwriting, the credit history, financial records, and the value of the loan collateral were assessed.

Underwirers review the company’s financial records, cash flow statements and liabilities. After fully understanding the reasons, a proper prooping solution is proposed.

Underwriters use different techniques in evaluating risks. With the available information, companies can generate a report that covers the financial, physical and ethical aspects allowing the risk factors.

How Insurance Underwriting Works: A Guide

The underwriter comes up with a professional and unbiased valuation of a property or security and medical risks in the case of insurance underwriting.

In the case of life insurance, a medical exam is required to assess the medical risks of the applicant.

After the assessment and review process, a decision to approve, dismissed or company the application as pending must be made.

Approved: a low-risk application usually get approval. Loan rates and terms, premium amounts, or what cost to pay for securities are stipulated.

Transform Insurance Underwriting With Agentic Ai

Pending: If an underwriter decides to keep the application, they need more information or the correct information to decide.

During the underwriting process, details on the following are required: (1) income, (2) employment status, (3) assets and liabilities, (4) credit history and credit rating, and (5) medical history.

The standard documents required to confirm income are wages and tax statements, pay stubs and last bank statements.

Some of the required documents for self-employed people with more than 25% ownership are the partner’s share of current income, deduction credits; Balance sheets; Personal and business tax returns.

Underwriting Process [classic]

Signed consent is required for them to have access to information about their current position, salary and labor history.

For loan underwriting, some metrics are used to determine the likelihood of a borrower repaying a loan. A change in employment status can significantly impact the outcome of an application.

The underwriting process includes ordering an estimate for the home intended for purchase, which is always required for purchases for purchases and may be required when refinancing.

The purpose of the estimate is to protect both buyers from overpaying and lenders of loans more than what the house is worth it.

The Underwriting Process In Insurance Infographic Template

The house serves as collateral for the loan, which means that the investor can recover invested capital if the borrower defaults on the loan.

They also need to review documents that outline current debt obligations in the form of machine payments, student loans, credit card debt, or other liabilities.

Even if monthly payments are made on time, a high debt-to-income ratio (DTI) is a warning sign of impending financial difficulty.

Insurance companies use medical underwriting to assess a person’s risk before they provide with health coverage. They do this by looking at medical history, lifestyle and demographics.

Straightforward Life Insurance Application Process

Based on this information, they can appreciate how likely the man will need medical care in the future and set premiums accordingly.

The medical records are checked to see if there are pre-existing medical conditions at the time of application. If so, there is a higher risk of covering the applicant.

Personal and car loans have equal underwriting processes. Most often the types of loans are below the computers using modeling algorithms. However, it is still human interaction in the process.

On the other hand, the underwriting process for home loans can be long, and take up to 45 days from start to finish. The underwriter must confirm the creditworthiness of the borrower and require appraisals for the property and confirmation of home ownership.

Underwriting Process And Procedures

The process of obtaining life insurance usually spans two to eight weeks. If the company has questions or wait for information from a doctor, it can take even more.

A full medical underwriting (FMU) may be required in some cases. It is an in-depth estimation of the applicant’s medical records. The potential policyholder must disclose their entire medical history, which may include the value of information from age.

Investment banks take six to nine months to underrotee securities, which are the most complex products to assess. They do this by examining the accounts of a company, assets, cash flows and liabilities for discrepancies.

When a bank uses the process, it depends on multiple underwritors that can help evaluate risk, design, design and perform the agreement to underright an IPO and sell securities.

Life Insurance Underwriting Explained — Skye Wealth

Prepare bank statements: Be sure at least 60 days of bank statements ready for underwrators when at the beginning of the loan application process. If the money is to be used for the applicant’s bank account, depositing it a few months before applying the loan is recommended.

Pay taxes: Although right taxes do not need an unacious for a loan, it can make obstacles that slow the process. Underwriters usually request tax return transcripts of the IRS to check if a client owes money and if there is a payment plan.

If one is already repaying the balance, giving the underwriter at least three months’ value value of repayment receipts.

Address possible red flags: if something in the financial history may be a red flag, address it forward with the underwriter. Being open about the current situation can help create a positive experience overall.

What Does The Group Life Underwriting Risk Selection Process Help Protect Insurance Companies From?

Risk and value are fundamental to underwriting. The function of the underwriter is critical in reducing or eliminating financial risks re-reports to debts, insurance and securities.

For loans, the borrower could not repay the loan or remain caught up on the interest payments. For insurance, premiums must be accounted for the potential of numerous Palace policeholds filing claims simultaneously.

When securities are involved, underwrators must be concerned about whether the investment will make a profit. It is equal to have some form of compensation for the risks taken.

:max_bytes(150000):strip_icc()/UnderwritingIncome3-2-99c6961c6f5145d680cb8b20a21f53da.jpg?strip=all)

Without a risk assessment, all financial transactions are educated said. Underwriting is based on a process that benefits both the lender or insurer and the borrower or insured.

The Impact Of Ai In Insurance

The amount of time required for underwriting varies depending on the investment product. Personal, mortgage and insurance loans take up to 45 days to accomplish. Due to the complexity of the securities underwriting process, it takes six to nine months to complete.

Underwriting is the evaluation process that people or organizations below before taking on financial risk in exchange for a charge. This typically involves lowing money, investing, or ensuring against loss.

These types of underwriting are loans for the release of loan and mortgage applications, insurance for the issuance of policies and securities for valuing companies went publicly.

The underwriter will look in credit history, financial records, and the value of the radeaual loan. Before you publish a insurance policy, insurance underwriting verifies eligibility for coverage by investigating medical risks. A medical exam and the results of laboratory tests may be required. The financial risks of a firm fork, the public was instead of analyzed in case of securities.

Underwriting In Insurance: Types & Duration Of Life Insurance Underwriting

Underwriting may fail for various factors, such as red flags on credit report, high outstanding debts, not enough money for a downpayment or damage to the property. If one of these are detected by underwriters, they will

Insurance underwriting process steps, underwriting insurance process, life insurance underwriting process, auto insurance underwriting process, process of underwriting in insurance, car insurance underwriting process, insurance underwriting process flow chart, property and casualty insurance underwriting process, insurance underwriting process pdf, commercial insurance underwriting process, what is insurance underwriting process, underwriting process