Insurance Violation Meaning – The Federal False Claims Act Guidelines and the Federal False Claims Act are the main weapons of the U.S. government to combat fraud. It allows the whistleblower to prosecute the…

Why choose us, we are proud to be one of the leading whistleblower law firms in the United States. Each of us has a unwavering commitment…

Insurance Violation Meaning

In June 2020, the Justice Department fined, updating the 2020 False Claims Act fine to the range of $11, 665 to $331.

License Points And Suspensions

AKS – The Anti-Kickback Regulations explain that the Anti-Kickback Regulations prohibit the provision or acceptance of rebates designed to generate health care operations. Violating anti-kickback regulations…

The False Claims Act requires fines for every violation. The amount of FCA fines also increases with inflation. Currently, the False Claims Act fine range is as high as $28, and $619 per violation. However, due to fraudulent behavior involving thousands of individual violations, the total False Claims Act fine assessment could involve millions or tens of millions of dollars.

Unfortunately, whistleblowers and attorneys often fail to understand the significant fines for the FCA penalties for total false claims law awards. This led them to ignore the statutory penalty when evaluating the case. But understanding the nuances of false claims is that fines are key to correctly understanding their impact on the case.

American Code Volume 31. §§3729 provides that anyone who violates the law is responsible for civil penalties except for three times the damages. In addition, false claims law fines are sometimes referred to as statutory fines, civil penalties or fines. The original version of the False Claims Act also called the fine “forfeiture”, and some sources still use the term.

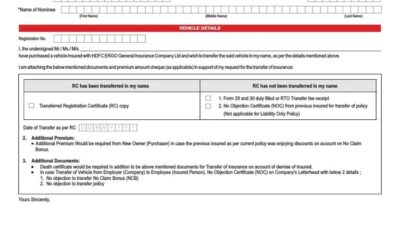

How Does The A-max Process Work?

The False Claims Act aims to achieve all fraudulent attempts to enable the government to pay money or deliver property or services. United States v. Neifert-White Co., 390 U.S. 228, 232 (1968). Therefore, the key to calculating FCA penalties is to calculate the number of legal violations.

Among these seven violation categories, there are many ways to comply with the False Claims Act. If you are still curious, check out the injunctions that violate the Error Claims Act and Interpretation.

Congress made it clear that the law imposed a fine (and then forfeited) on every violation of the False Claims Act. This means a lawsuit for false claims under Volume 31 of the United States Code. §§3729(a)(1)(a),

Each separate bill, voucher or other “false payment requirements” constitutes a separate claim that should be confiscated, which is factual, although there are many such claims that can be submitted to the government at once.

Be Sure To Insure

S.Rep. 99-345, pages 9-10, reprinted in 1986 in 5274. Often, a single fraud plan generates many, even thousands of false claims, and each fraud plan requires a fine. For example, in health care fraud, statutory punishment usually comes from every false form. therefore,

The doctor who fills out a separate Medicare claim for each patient under treatment is liable for the forfeiture of each form containing false entries, even if it can be submitted to a financial intermediary at one time.

“All Medicare claims or all Medicare claims filed on behalf of a physician who is not eligible for the program” can result in a fine when a physician is not eligible for Medicare,”

Under the contract, each claim obtained by a loan guarantee or by any violation of any statute or applicable statute constitutes a false claim. For example, all claims filed under the contract obtained under the Act are false and can be litigated under the Act.

Will 3 Demerit Points Raise Your Insurance Rates

In the U.S. v. Bornstein, the government sued Model Engineering, a tube manufacturer under the False Claims Act. 423 U.S. 303, 313 (1976). The model sold the faulty tube to United, which was then used to make the radio kit and subsequently sold to the army. The government prosecution model is because it “caused” false claims in an earlier version of the False Claims Act. Bornstein, 313.

The Supreme Court agreed that the False Claims Act “allows the restoration of multiple confiscations” (fines). Bornstein is 309. However, the defendant argued that it was only responsible for the civil penalties of each person

In such cases, the amount of confiscation is equated with the number of contracts, almost always without confiscation, regardless of how much fraud the subcontractor may have committed. This result is not only inconsistent with the legal language. This will also defeat the statutory purpose. Such restrictions would convert the bill’s forfeiture clause in the government’s brief language to a $2,000 license that subcontractors cheated.

Bornstein in 311. Instead, the court ruled that when the subcontractor “caused” the main contractor made false claims, the FCA penalty was the number of causal actions.

Anatomy Of An Sr22 Insurance Filing

If United proposes a bill that makes the model make false claims, then this is clearly responsible for a single forfeiture. . . . On the other hand, if United commits three separate causal acts, even if United only filed one false claim, United will be liable for three forfeitures.

Bornstein in 312. It is important, however, that the government prosecution model is only intended to create false claims. Justice Rehnquist wrote a separate consent, explaining that the False Claims Act also requires FCA fines to violate 31 U.S.C.’s misrepresentation. §§3729(a)(1)(b). These civil penalties are “the quantity of false bills, certificates, affidavits, etc., made or used or caused or used.” Bornstein at 323 n.6.

In numerous federal cases, the principle of statutory fines, fines or forfeiture against the False Claims Act is maintained. Some examples:

Once you figure out how many statutory penalties should be imposed, the second step is to find out the fine for each violation. The False Claims Act sets fines between $5,000 and $10,000, each violation. However, subsequent federal laws regularly adjust inflation. As of July 3, 2025, the FCA penalty ranged from $14, $308 to $28, ranging from $619 per violation.

How Much Will My Insurance Go Up After A Speeding Ticket?

The False Claims Act of 1986 sets the fine for each violation from $5,000 to $10,000. However, subsequent federal laws changed these payments to adapt to inflation.

The False Claims Act fines range from $5,500 to $11,000 for actions that occurred from September 30, 1999 to November 2, 2015

In 1990, Congress passed the Federal Civil Currency Fines Inflation Adjustment Act of 1990, Pub.L. 101-410. The law provides that every five years, federal agencies will update FCA penalties for violations occurring after this date. In 1996, Congress revised the law to increase the initial penalty to 10% of the maximum penalty. 110 Stat. 1321–373 (April 26, 1996).

In 1999, the Ministry of Justice adjusted the scope of fines for the False Claims Act for the first time. The amendment applies to violations that occurred after September 29, 1999. In other words, this only applies to basic behaviors that have occurred after 1999. For these violations, it raised the FCA civil fine range to $5,500,500 to $11,000 to $000.64. Reg. 47099, 47103 in §85.3.

Understand The Law Relating To Driving Without Insurance

The 2015 Bipartisan Budget Law, Public Law 114-74 (November 2, 2015), once again revised the method of adjusting inflation amount FCA fines. As a result, the government adjusts the scope of civil penalties every year. Additionally, the 10% cap is replaced by A%150 CAP, meaning that the fines in the False Claims Act could increase by 2.5 times within the previous FCA fines range.

Now, the new adjustment applies to all violations in November 2015. In other words, for actions that occur after November 2015, after November 2015, the FCA civil penalties are determined by the last (latest) adjustment when the court imposes the fine.

The False Claims Act’s fine inflation adjustment was published in the Federal Register. They have since compiled in a chart in Chapter 28 of the Federal Regulations. §85.5.

From November 3, 2015 to July 31, 2016, the False Claims Act fine (still between $500 and $500 and $11,000)

What Happens If You Get Caught Driving Without Insurance?

The Justice Department has not adjusted the FCA fine for nearly a year after the Bipartisan Budget Act. The statutory penalties imposed during this period, the behaviors that occurred after November 3, 2015 continued to range from $500 to $11,000.

In June 2016, the Ministry of Justice issued a rule to adjust the scope of civil penalties for the False Claims Act for the first time since 1999. 81 Federal Reserve. Reg. 42491. The rule was affected on August 1, 2016. It has been a long time since the False Claims Act has been adjusted, and therefore a significant increase has been made. The FCA penalty assessed after August 1, 2016 was assessed for behavior after November 3, 2015, doubled to $10,781 to $21,563.

In February 2017, the Ministry of Justice adjusted the scope of fines for the 2017 “False Claims Act”. 82 Federal Reserve. Reg. 9131. Therefore, the FCA penalty assessed after February 3, 2017 for the actions of $10,957 to $21,916.

In January 2018, the Ministry of Justice adjusted the scope of statutory penalty for FCA in 2018. 83 Federal Reserve. Reg. 3944. Therefore, False Claims Act fines

False Claims Act Penalties: A Complete Guide

Meaning violation, parole violation meaning, compulsory insurance violation, hipaa violation insurance, mva insurance violation, moving violation meaning, ordinance violation meaning, insurance violation, non moving violation insurance, hipaa violation meaning, gross violation meaning, moving violation insurance