Insurance Vs Assurance – Insurance and insurance are often offered products in the market, but they vary in their offers in spite of compartment of similar purposes. This article is about to explore the distinctive features of insurance and insurance, lightly to their contrasting characteristics and how they are distinguished from each other.

Both insurance vs assurance are popular choices in the market; Let us discuss some of the great differences:

Insurance Vs Assurance

The Premium Amount received is not the investment in other investment watches to generate the bonus.

Guaranteed Income Plans: Best Guaranteed Return Plans In India 2025

The premium received by the insurance company is invested in other financial instruments to generate an investment bonus, which is increasing, in turn increase the value of the policy.

Insurance companies offer both the products and insurance, which inclines the customer. Many insurance companies offer a wide range of insurance and investment policy and have a sales agent to make customers to buy them. One should be cautious than he or she buys policies like this like this, who depends on the long-term plan and the customer’s financial status and the customer. An individual must try to choose a financial planner as an insurance adviser for him and his family who must long been to be practiced, after he has gone to stay in a healthy financial position.

This has been a manual for the top difference between insurance vs Assurance. We also discuss the insurance vs insurance signs differences with Infographic and the compulatable table. You can also take a look at the following articles to learn more. We open about 200 slots open every day. Choose a time and we will call you at your convenience.

If you have much rather prefer to have texting at your own pace, just beat us on whatsapp. We do not promise spam and a decision-free experience.

Insurance And Assurance: Exploring Their Fundamental Differences

Many of our customers at Ditto are often confused between the conditions “insurance” and “insurance”, and for a good reason. These conditions are often used interchangeable, and yet they are two completely different understandings. While both of the two of the safety names are against unforeseen events, their structures, purposes, varieties, and benefits significantly. So, in this article, let’s understand the difference between the topics – insurance and insurance.

Friendly reminder: It is easy to make compared comparison and premiums. Instead of passing hours on it, why not get personal insurance vision of Ditto? We offer free Talk with null spam! Just 30 minutes to clarify all your doubts. Book now a call! Definition of insurance

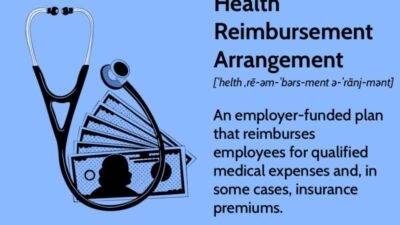

Is a contractual arrangement where an insurance company protects its policy protects against losses or damage. There are several types of insurance poles, such as health, term, TERVEANS, ENT, please let you pay an insurance company, such as inconveniences, fresh, natural disease, or health change.

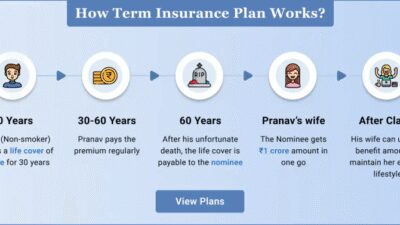

. For example, health insurance includes medical expenses that are made due to illnesses or injuries, while term-care providing that financial protection of your beneficiary when you continue in a specified period. In both cases, the event trigger the payout of the payout not sure and not guaranteed.

Difference Between Surety And Insurance

, usually associated with events that are certainly avoiding, like death. Unlike insurance, which deals with uncertainty, insurance provides a final payout.

Life Insurance Policy, as a whole of life, as much would know, are examples of this. This policy make sure you get a predetermined on your death, no matter if it occurs, provided the policy. This guaranteed payout is what understood the principle of

The term ‘Insurance’ (Unable to consider term insurance) consists of various categories, each designed to handle one specific risk. Let’s see a couple of them now:

In these kinds of policy (and many others) you pay the premium to reduce your risk in a specified period. While some policy offering a return of premium on fur if you don’t make a claim, do not offer all insurances this and it often comes with higher premiums to start with.

Assurance Vs Ensurance: Meaning And Differences

While insurance provides a security net at a specified period of time, plans of life insurance plans guaranteed benefits. Let’s take a look at two of the most common now:

In insurance policies, you charge the premiums for a guaranteed payout, provide financial support for your family or personal goals after retirement. Well, of course, you can wonder what the premises for this fare have against other insurance plans.

If it comes to compare insurance and insurance, the only fair comparison to see after term insurance and entire life plans as they are from a similar nature – cover for death. So, let’s take a look.

At Ditto, we have helped more than 3, 00, 000 customers choosing the correct insurance policy. Why customers like tanmay underwear from us:

Home Insurance Or Real Estate Protection Document Contract Signed Vector Illustration, Flat Cartoon House Protected Shield And Agreement Policy Paper Assurance, Property Deal For Homeowners 32184635 Vector Art At Vecteezy

You can book a free consultation. Slots run out, so make sure you are booking for a call now!

Well the ultimate question is what you need to choose – insurance or insurance. As with every financial product it all depends on your goals and how much you are willing to spend on premiums. Suppose your primary goal is to protect yourself from potential losses, resulting from unforeseen events, such as health problems, accordingly, or property dam. Insurance policy offer a safety net, make sure such unexpected incidents lead to financial hardship. On the other hand offer life insurance of life insurance policy, a guaranteed payout, although with higher premises that may not be worth it.

Many modern treatments no longer need overnight hospital, but they can still be precious. This guide explains how the treatment of the day helps in health insurance to cover this short procedures, what is included, how claims work, and which plans offer the best support.

Section 10 (10d) of the income tax return: understand the tax efforts on life insensation of life insurance, including term insurance and clips, etc

Characteristics Of An Insurance Contract

Insurance of personal accident provides critical financial protection against accidental injuries, disables, and even dead. In this guide we also break his features, species, benefits, benefits, and claims process.

Talk to us and we will seavigating the complex world of insurance. It’s free and we’ll never spam you. Pinky Promise! The world of life insurance navigating can be a challenge, especially if you don’t know what you are looking for. One of the biggest bargain blocks is knowing the difference between life insurance and life insurance. If you want to make sure that your family is being protected, if you are away when you are away, you can automatically start search for a life insurance policy. But is that the correct policy for you?

While both forms are of protection that will pay as you once you are pitiful, they work very different. This guide uses our expert advice, including the differences between life insurance and life insurance, and what means to you and your family.

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg?strip=all)

The term and policy that you will be most familiar with life is life insurance. Most people recognize the importance of having a life insurance policy in place to protect their loved ones when they are no longer here. But it is important that you know exactly how they work and how much protection they offer.

What Is Autonomous Assurance?

The most important thing you need to know about life insurance life insurance is that it is designed to protect the policy holder and cover for a specified period. This means that if you die in the term of the policy, a lump sum is paid to whom you mentioned.

One example of an effective life insurance policy is someone who covers you for the same amount of time as your mortgage. This is where you pay a monthly premium so you step down in that time, the policy does the rest of your mortgage off. However, there are several life insurance policy that you can be known with. It is also possible to have a number of life insurance policy in place at the same time.

Ferming – this type of life insurance pays out less about time. This is often used for mortgage when the total balance of your mortgage reduces time when you reduce the balance.

But which policy you go, do you remember that life insurance covers you only for the duration of the policy. So if you don’t die in time that stated in the policy in the policy, it will not pay out.

Insurance Crm Vs. Agency Management System

Life insurance is a form of life insurance that lasts as long as you have to make the monthly payments. It is a policy that is guaranteed to pay out, no matter if you leave. Life insurance policy do not have a term or double losses and instead will last until you die. This can see it referred to referred to if you referenced the entire life insurance; While you are treated for your whole life.

This type of coverage is members references that you have an insurance that will pay out the policy – no matter if you die. Due to this guarantee you will find that they are usually more expensive than life insurance policy.

If you take the policy you need to decide how much you want you to love you when you are away, and then you will need to pay monthly premiums to pay the