Insurance Vul Meaning – Life Universal Life (VUL) is a type of permanent life insurance policy with a built -in savings component that allows for cash value investment. Universal Life (VUL) is a type of permanent life insurance policy that allows investing the financial component to produce larger earnings. Like Universal Life Insurance, Vul is combined between the savings component with a separate death feature, providing greater flexibility in policy management. While VUL insurance provides more flexibility and growth for traditional cash sale or a whole life insurance policy, documents must carefully evaluate risk evaluation before purchasing.

Life Universal Life (VUL) is a type of permanent life insurance policy with a built -in savings component that allows for cash value investment. As the world’s standard life insurance, the premium is flexible. VUL insurance usually includes the highest and highest minimum earnings on the investment revenue associated with the savings component.

Insurance Vul Meaning

Vul insurance includes a sub -computer for an investment that allows investment of cash value. A sub -calculations post is similar to a shared box. Commentation with market variations can produce significant gains, but can also lead to significant losses. This insurance is named from the changing results of investment in the hanging market. While VUL insurance provides more flexibility and growth for traditional cash sale or a whole life insurance policy, documents must carefully evaluate risk evaluation before purchasing.

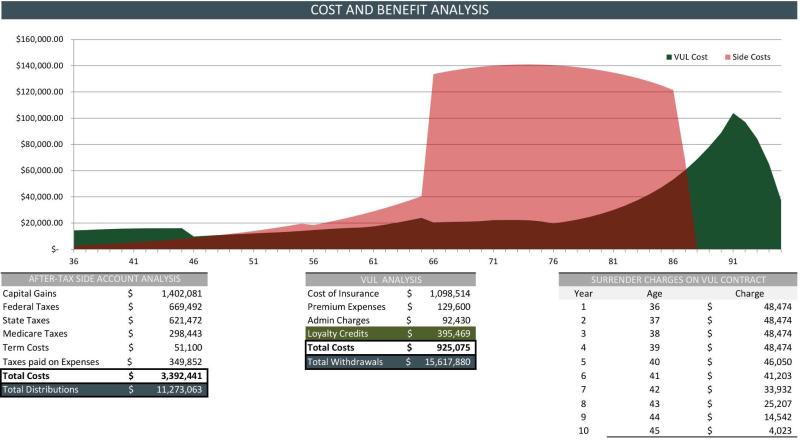

Limited Pay 10-year Vul Plan

Like Universal Life Insurance, Vul is combined between the savings component with a separate death feature, providing greater flexibility in policy management. Insurance premiums are paid in the savings component. For the Vulva insurance banquet, the savings element includes separate managed accounts, referred to as “sub -accounts”. Each year, the insurance company deducts what you need to cover deaths and administrative costs. The rest remain in accounts other than to gain more benefit.

In the whole life policy, the life insurance company takes the risk of investing by ensuring a minimum growth of cash value. By separating the savings component and mortality component, the insurance company transfers the risk of investing into the VAL policy to the insurer. The believer must assume that a separate account can produce negative returns, which will reduce the cash value. Great and continuing losses to settle the cash value. As a result, the insurer may need to transfer higher payments to cover the cost of insurance and rebuild the cash value.

By separating the savings component and mortality component, the insurance company transfers the risk of investing into the VAL policy to the insurer.

A separate sub -account is scheduled, like the Joint Investment Funds family. Each one includes a set of stock and bond accounts, along with the cash market option. Some policies limit the number of transfers inside and outside the funds. If the document holder exceeds the number of transfers per year and the account in which the money is poorly invested, they may need to pay a higher allowance to cover the cost of insurance.

Vul Is A Swiss Army Knife For Small-business Owners

In addition to the standard control fees and mortality paid by the document holder each year, sub -griscidents disappear from control fees that can range from 0.05 % to 2 %. As sub accounts are warranties, the Life Insurance Representative must be a licensed and registered product for the Financial Industry Regulatory Authority (FINRA).

The cash value growth of the Fulva insurance policy is the tax delay. Document owners can reach their cash value by withdrawing money or borrowing money. However, if the cash value decreases to less than a certain level, additional installments must be made to prevent policy from expiration.

Revised Life Insurance is a full -life hybrid insurance scheme that allows document owners an option to manage policy features. Read more

Burial insurance is a fundamental form of life insurance used to pay for funeral services and goods costs. Read more

Understanding Variable Universal Life (vul) Insurance

The value of cash surrender is the amount of money paid by the insurance company to the document holder or the account owner when the policy/account is surrendered. Read more

The deaths are considered a payment for the beneficiary of life, pension, pension or pension when the insurer or generator dies. Read more

AWES is added to a life insurance policy to help pay the serious costs of the disease, such as cancer or stroke. Read more

The family income traveler is an addition to life insurance that gives the beneficiary equal to the monthly income of the document holder if the believer dies. Read more

What Type Of Life Insurance Incorporates Flexible Premiums?

The Financial Industry Regulation Authority (FINRA) is a non -governmental organization that writes and sets centers for brokers and brokers. Read more

The Life Insurance Group is a life insurance provided as the employee’s benefit. The basic amount is often covered with no fees, with the option to add more. Read more

Safety insurance is a small full life insurance policy without medical questions or examination. Read the various life insurance for buying a world -eous world, any permanent life insurance is one of the biggest financial decisions you will ever make.

Before making a final decision, you must review your current position in relation to your connection, family and money. Furthermore, you need to wonder how your loved ones are affected after your death.

Universal Life Insurance

If all you want is a quick quote, you can do this here: get a quote What is the whole life insurance? You simply protect the whole life as long as you live. It doesn’t matter when you pass, as long as you continue to pay your payments completely, and on time, you can be assured that the beneficiary will receive the death payments.

By purchasing the whole life insurance when you are young and healthy, you can lock a low rate that will never change in the future (even with life change and your health situation changes).

The elasticity of a world -wide life insurance that attracts many people. For example, if you have a financial barrier, such as losing a job, you can stop your insurance installments or reduce your payment using your cash value.

Note: You need to have enough cash value to pay for your unique payments. If you do not, your policy will expire. So, what is the varied part? Global Life Insurance uses the investment variable to help develop cash value.

A Young Professional’s Guide To Variable Unit-linked Plans

The unique thing about changing world -life insurance is the way in which the death component and the savings component combine. This not only allows more flexibility in your administration, but also provides an opportunity to develop your cash value over time.

All prestigious batches are paid in the savings component, where the life insurance company takes the money required by the scope of administrative costs.

However, it is still a world -life policy with all its flaws. Subcounts, not one of the most changing world life legends is that your money invests. While this is a bit true, these policies use sub -calculations.

Sub accounts are organized in the same way as a group of joint investment funds, which means your money invests in different bonded shares and accounts.

What Is Variable Life Insurance?

As these are not considered “real investments”, higher fees are associated with changing world -life. The cost of insurance and separation of every world life policy has something called the cost of insurance. This insurance cost is taken every year of the cash value. Also, this insurance cost increases every year.

As you get older, what can happen is that your insurance cost is very high that your cash value stops growing and starts to reduce.

When the cash value reaches zero (or before), you will receive a notice from your insurance company that you will need to pay a higher bonus, or your policy will disappear. This is called a “break”.

When the policy is launched, you will have no more attention and there is no other cash value, and you will lose all the installments you paid in the policy. If you currently have VUL or UL, make sure you check to find out how it is expected to perform. Make me a quote, what is the difference between life insurance completely against the overall variable? These policies have common aspects such as cash value, but are completely different. The whole age is a more conservative product without great potential in the upward direction. However, in a changing world life, you will have a better chance to save politics. As we mentioned, the rap is when you do not have enough money to protect politics.

How The Life Insurance Industry Works

If you want higher capabilities but you are willing to get higher risks, you can get a changing world quote here:

What’s the difference between vulgar and iul? The main difference between these two world life is how they deal with the negative side and the upscale side of the investments.

Also, the general indexed life can have a ceiling on how much money you can make in your investments. Although a world variable does not limit the size of your upward trend. Although the world life is not changing. Here is an article that compares the whole life insurance against Iul. Be careful with unrealistic projections, world life is often sold to encouraging customers with promises of unrealistic projects. The agents tell the horizons of something

Benefits of vul insurance, vul insurance pros and cons, vul insurance quotes, veeam vul, vul insurance, vul policy, vul, vul insurance meaning, vul life insurance meaning, prudential vul, vul insurance policy, vul meaning