Insurance Works – What do you mean from insurance? Insurance is a financial protection promise that reimbles people / organizations for all losses arising from an unknown event. For example, Hurricane Ian strike Florida on September 28, 2022. Most of the commanders held the vibrant policy, so in the statement of the insurance. Mentioned that the amount is from $ 60 to $ 70 billion.

Although people demanding protection is insured, insurance provides. The insurance cloth paid the insurance premium number. This amount is relevant to political guarantee values. Because many companies sell the contract, it is available with available award.

Insurance Works

One of the real-Cristiano Ronaldo’s examples have an insurance from $ 90 to $ 100 million (90-100 million euros). Since her is the property for the team played, “Real Madrid FS” she bought a policy for her.

How Does Life Insurance Policy Work In India

Steve bought a new car two years ago and received insured for 15 years through services. Premium calculation is $ 15,000 a year, and the insurance value is $ 1 million.

Travel with families, they meet in an accident that broke the car. The cost of repair is $ 500,000. According to the contract, the compensation to compensate for damage.

Suppose Steve does not have to demand the policy during validity, and Steve received $ 1 million to repay. The amount of taxes will be $ 775,000 after total premium ($ 15,000 * 15) of $ 1 million.

MARA MARIALK PURCHASE Health Care $ 500. This gives you $ 1 million. The next few years she was diagnosed with cancer. However, it stresses policies, and the company paid full medical treatment.

How Insurance Works: Understanding The Basics Of Risk Protection

Daily life brings for the risk of financial losses such as theft, natural disasters or sudden death. Because it can affect the life and expensive, insurance helps protect them from this hazard. This provides financial aid to harm, harm or injury. In addition, tax benefits, depending on the coverage plan.

Answer: This is a mechanism for protection from the financial losses that occur due to harm, harm or injuries. The five most common types of living, home, loans, health and vehicles.

Answer: Non-PROFITS protection individuals / organizations of promotional scenarios claiming responsibility. Organizations that are not -Profit face volunteering claims, donor, government employees and regulators because of accident, supervision or misunderstanding. They receive the proper court or appreciation.

Answer: A small business insurance is a risk of turnance to the risk that protects the lawsuit, potential statement, business loss and more.

How Life Insurance Works

Answer: A different company provides a variety of insurance options. Thus, the buyer can buy according to your needs and preferences. There are cases, health, victims and financial warrants. Some insurance insurers are well with Berkshire ghosts, progressive insurance groups, group of countries and restricted personal treatment insurance.

This article conducts you insurance. We discuss the definitions, types, benefits, tax law, etc. To find out more, read the following article,

This website or a third-party tool uses the necessary cookies for operation and need to achieve the drawn objects in cookies. To close this banner by scrolling this page, click on the link or continue to see, you agree with the privacy policy – Contracts to receive policy from your insurance company. Risk of customer’s ball to make more payments access to your insurance. Most people have some insurance: car, home, health or life.

Insurance policies protected from financial losses due to accidents, injuries or property. Insurance also helps cover costs associated with responsibility (legal responsibility) for damage or injury caused by third party.

How Insurance Works?

Many types of insure insurance policies are available, and almost everyone or business can find insurance ready insurance companies – at a price. The personalized type of personal insurance is car, health, owner home and insurance. Most people in the United States are at least one of these types of insurance, and car insurance is a state of law.

Business receives insurance policy for local risks, for example, a fast restaurant policy can cover employee injuries from cooking fryer. Health Insurance Insurance Redemptioning the injury or death causing the telephone taste of health professionals. The company can use the record broker to help you manage your employees policy. State law may require a business to buy a particular insurance layer.

There is also an insurance policy available for special needs. The coverage includes a working business through civilian, rejection, extron (K & R), insurance and wedding insurance and wedding insurance.

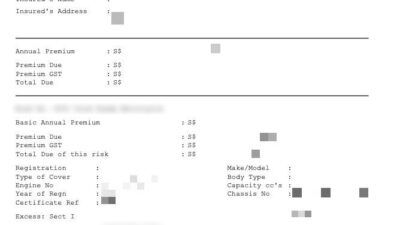

Knowing how insurance work can help you choose policy. For example, comprehenhensive layers may not include the correct auto insurance types for you. Three components of any insurance type of insurance, policy limits and pieces.

How The Heck Does Health Insurance Work?

The policy gift is the price, as a rule, cost per month. Often, insurance assume some factors for setting premiums. Below are some examples:

Many depend on the insurance perception of your risk. For example, supposed to have some expensive cars and have a history of driving. In this case, you will be best to pay more for automatic policies than people have a perfect sedan and a perfect driving entry. However, different insurance can fill different bonuses for the same policy. Therefore, find the price that is suitable for you to require some jobs.

The limitation of the policy is the maximum amount given to the company that will pay for the policy coverage. Maximal can be set for time (eg, annual or political term), for damage or injury or during the maximum, well known for the maximum.

As a rule, a higher limit has higher award. For a general insurance policy, the maximum amount of maximum to pay is called a nominal cost. This is the amount paid for the beneficiaries after death.

How Does A Trade Credit Insurance Policy Work?

AFORDABE Federal Assistance (ACA) prevents the ACA plan to introduce the Lifong limit to the benefit of the significant health care for the development of family, pregnancy and child treatment.

The calculation is a certain amount you pay from the pocket before the insurance to pay the claim.

For example, a piece of $ 1,000 means you pay for the first $ 1,000 for any claim. Suppose for your car is $ 2,000. You pay for the first $ 1,000 and your insurance pay $ 1,000.

The pieces can be applied by policy or claim, depending on the insurance company and the policy type. Health Plans can have franchise and family easily reduced. The high franchise police is usually lower because the highest pocket costs usually cause small claims.

How Health Insurance Works

Insurance Commissioners Association (NAIC) is complaint index for insurance companies. This information comes from the state insurance regulator. Then NAIC compared to the amount of complaints with the insurance market.

Health insurance helps to cover regular and fast medical costs, often with the ability to improve vision and dental services separately. In addition to the annual pieces, you can also pay additional and the recount coin or percentage of medical benefits after the cut. However, many prevention services can be covered free.

Health insurance can be purchased from insurance companies, Insurance Agencies, Federal Health Insurance Market provided by employers or medicare drugs and Medalica drugs and coverage of the Federal Medalica.

The Federal Government does not require Americans have health insurance, but in some countries, such as California, you can pay the tax penalty if you do not have insurance.

What Does Contract Works Insurance Cover?

If you have any chronic health problems or need a regular medical treatment, look for low health insurance. Although the annual prizes are higher than higher policy with lower cutings, more expensive medical help in all year long, may be compromised.

The homeowner’s insurance (also known as the home insurance) protects the home, another property structure and personal property against natural disasters, theft and vandalism. The owner insurance will not cover the flood or earthquake to be separated separately. Supplier tends to add a special layer or event and regulations that can help reduce the amount removed. This supplement will get additional premiums.

Lender or landlord needs to have home insurance. If you are concerned, you don’t have a coverage or not stop to pay your insurance account, what your mortgage credit you are allowed to buy your home insurance and charge.

Auto insurance can help you to pay for the claim if you are damaged or damage to the car accident, helps you pay the accident’s improvement in a vehicle or repair, if it is stolen or damaged by natural disaster.

How Life Insurance Works

Instead of paying from the pocket to crash the car and harm, people pay annual car insurance appreciation. Company and then pay all or most of the cost of coated cars