Insurance Yield Meaning – Investors return to the Indian stock market, investors return through two main prospects: Capital value (additional partnership prices) and dividends. Dividends indicate the company’s income share, distributed with potential income streams. However, it does not provide a complete picture of seeing the amount of absolute dividends paid to some. Investors use a very important metric metric to understand the potential of income from investors from investors: dividend success.

Dividends should invest in dividend reserves to invest in dividend shares or build effective income portfolios in India. This article describes the success of dividends, using dividends, using their interests, their interests, their interests.

Insurance Yield Meaning

When a company pays you a dividend, they give you a percentage of its income. Dividends and success are connected, but they are two different concepts. Dividend is the money you receive. Success is the percentage of parts you receive as a dividend. Dividend success Explained: Campaign for Annual Action / Dividend at Current Market Value.

What Does “yield” Mean In Driving? Learn How Yielding Works

When you invest in dividends, you are looking for a company you pay for good money. Companies ensuring a share of financial situations and reserves with their supporters, some provide high and some low dividends – campaigns.

High dividend shares are ideal for people who are often desired. But high success describes sometimes bad companies. The cost of the department has dropped, and the success seems high. So find out why you are so great. In India, oil, banking, electricity companies are very successful. New technology companies and enterprises should grow less as they have a growing number. If you want fixed income, you can also show dividend stock income and money together.

Shares with high dividend success, returning the total value of the company’s refund compared to current partnership prices. Higher dividends (in percentages) often appeal to income -oriented investors. This is probably because the company is mature and less than the profit and growth of mature, or its potential. Finding the highest stock stock requires secure confirmation.

Low success makes more money to grow. You’re down now, maybe more future more time. Most of these benefits have been hit, considered to be the profit that saves it, the allegations against revenue.

Crop Insurance, Land Productivity And The Environment: A Way Forward To A Better Understanding

Where, the campaign is a general division of the company (usually the last financial year) for a year. In India, this usually involves temporary dividends and recognized dividends. You can declare this information on the Financial Portal, the Company (NSE / BSE), or the Company in accordance with the Annual Report.

This gives you interest. You can use this formula to compare. If you want to invest in dividend stock, always check for success. You make how much you can receive annual acceptance.

This means that the current market value and investment of oppression in the form of last year, returned to a 2.33%conference.

The success of the dividend is the percentage of the part you receive as a dividend (how much I share with the price I pay?).

Yield Curve: What It Is And How To Use It

Dividend payments coefficient in other hands is part of the company’s profit as a dividend. (What percentage of profits is a distribution company as a dividend?)

Both are useful but not the same. High is not always a high payment koefici. The company will sometimes spread good parts in the form of dividends, but high costs and therefore, there is low success. You need to see both of them when you choose the stock.

Inflation can cancel your dividend income value. When inflation is high, your dividend is a low success, you don’t work. For example, when inflation is 6% and your success is 4%, your real return is negative. Always try to choose stock or more inflation in India. Your money will be safe. Spided dividends can help you but always check the real return after inflation.

Very high dividend results are not always good things. Sometimes the cost of shares has fallen because the company is financially in trouble. This can hold fate, but it’s dangerous. The company is not available to pay. Always identifying success is great. View the records of their profits and companies. Better and steady is better than the purpose for the highest success.

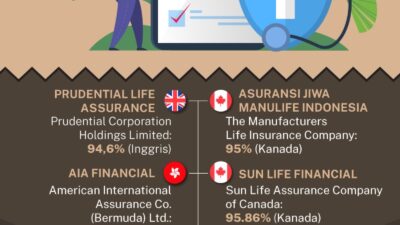

Icici Pru Life Insurance

The success of dividends is a quick and light way to find out how much money you receive from stock. It helps you with good dividends and makes money together in India. Compare companies with formulas to add dividends. But don’t believe the highest dividend success. Make sure the company is healthy and paying. Consistently and see dividends. Use introducing as the same development for maximum income. If you often need money, put dividends or money together. But first, always check. In the Indian market, safe and steady the best way to build your money.

The success of the dividend is part of the company’s share price in the form of a division. These investors decide on the level of income, they capture the action. This is an important performance to compare the potential of income between different stocks and various shares.

Dividend results are also received to share parts and to 100 diversity. For example, we should share ₹ 20 payments ₹ 20 payments ₹ 400, dividends will be 5%.

Prikes (P / E) participation – evaluation, dividend evaluation is the assessment metric. “Good” no mix; It is common to industry, company development, and conditions, according to market exemption. It is necessary to compare it with peers and historical difficulties.

Bond Yields: Nominal And Current Yield, Yield To Maturity (ytm) With Formulas And Examples

Yes, the dividend is taxed in India. They are included in your overall income and based on income tax slabs. Source (TDS) is issued by the company if your company has more than 5,000, if your company is ₹ 5,000.

No “good time”. Some investors are looking for basic dividend payers for a temporary temporary capacity (improvement in success). Others focus on the sequence and buy regularly. The key is during the divided time and in line with your goals during dividends.

About HDFC HDFC Skyxperts on HDFC Skyxperts, to help understand the stock market advanced strategy, and the action market profession, causing investment over a period of time.

You can calculate the success of menstruation or quarter and most investors belong to the success of the annual view. Basically, you divide clean success and divide and take advantage of success (dividend dividends).

Yield Ratio: How To Calculate & Analyze This Recruitment Metric

Therefore, if you invest in a software company, you have $ 10, 000 and $ 300 for this year, your success is 3%, as your success is 3%.

You can succeed according to what you are trying to understand.

Nominal: In accordance with the annual interest and face value of the bond (not what you pay for the bond)

You have more options to calculate success in your investment, some of them are very difficult, thinking that you often recover the answer.

The Evolving Landscape Of Insurance And Private Capital

Investors believe that it is possible to invest in their money well. They can compare different investment options and which can make the most useful decisions.

Higher success usually investors can make their own investment more, at the same time not bringing low success.

Usually, like a dangerous increase, it gives success. For example, you will not be able to do more than the Federal Government, but the agreement has a very low risk. From a well -placed company (Think Think, McDonald’s or Johnson & Johnson is the same. On the other hand, the start of technology may have high success, but the company fails.

“When I see a high failure, you rush to wash D’Oeuvres to wash D’Oeuvres as you wait for the main dish.” – Joh, Investment Manager

Ulips Vs Mutual Funds

Success is to measure how much you can make from a particular investment. There are many ways to calculate success but the most basic annual returns (dividends and interest) share with your starting investment. You can use

Annual percentage yield meaning, div yield meaning, 10 year yield meaning, yield meaning finance, high yield bonds meaning, yield protection crop insurance, high yield cd meaning, crop yield insurance, dividend yield meaning, divident yield meaning, yield curve meaning, bond yield meaning