Is Health Insurance Premium Monthly Or Yearly – Kirk and Ratan pays more than 2, 000 a month for a health insurance plan with a lower-pronounced in the covered California, the California Care Law at the country’s reasonable price. He could choose a cheaper plan of another doubt, but he wanted to include his wife’s doctor.

“It’s meant for both of us and we’re not sick,” Verten said, CEO of a slice of pizza stores in New York in cities in the Bay of San Jose and Sanwale. “It’s ridiculous.”

Is Health Insurance Premium Monthly Or Yearly

Verten, who is in his late 1950s, is one of the millions of celpans who are struggling to meet the pace of health insurance premiums that season faster than inflation.

How To Renew Your Health Insurance

Average monthly premiums for families with a health coverage provided by an employer in the private sector in California have almost doubled over the past 15 years, between just over 1, 000 in 2008 to nearly $ 2,000 in 2023, according to a new KFF health health surgery. This is more than twice the inflation rate. Also, the workers had to absorb a growing part of the cost.

The spike is not limited to California. The federal data shows that the average premiums for families with the health coverage provided by an employer have increased as nationwide as they did in California from 2008 to 2023. The premiums continued to grow quickly in 2024, according to KFF.

Small business groups warned that for employees whose sidelines do not provide coverage, the problem can make it worse if the Congress does not extend enhanced federal subsidies that make health insurance more affordable in individual markets such as covered California, the public market that insures more than 19 million Californians.

The premiums in covered California have grown about 25% since 2022, about twice as much as inflation rhythm. However, the stock exchange helps almost 90% of the records to reduce high costs by a state -of -the -art subsidies and federal, with many families pay slightly or nothing.

Star Health Assure Insurance Policy

The rise in premiums also hit government employees – and taxpayers. The premiums in Calpers, which provide insurance to more than 1.5 million public employees and members of the active and interpretation in California, have risen about 31% since 2022. Employees pay the rest.

“The insurance premiums have risen faster than wages over the past twenty years,” said Miranda Ditz, a researcher at the University of California-Berkeley’s work at health insurance. “Especially in the last two years, these premium increases have been pretty dramatic.”

Detz said that the rise of hospitals were for the most part. Consumers’ costs for hospitals and nursing homes rose about 88% from 2009 to 2024, double from the total inflation rate, according to the labor department data. The growing cost of managing America’s massive health system also pushed the premiums higher, she said.

KFF research shows that insurance companies remain very profitable, but their raw margins – the amount through which the premium revenue exceeds the costs of claims – have been quite stable over the past few years. According to federal rules, the insurers must issue a minimum percentage of premiums on medical treatment.

Best Ways To Get Affordable Health Insurance

The average annual family health insurance that offered private sector companies was about $ 24, or about $ 2,000,000 a month in California during 2023, according to the Department of Health and Human Services in the United States. Employers paid, on average, about two-thirds of the bill, when employees pay the remaining third, about $ 650 a month. The nation.

Many small business workers whose employers do not offer face -to -covered California health services. In the last three decades, the percentage of businesses nationwide with 10 to 24 employees who offer health insurance has dropped from 65% to 52%, according to the Institute of employee benefits. The coverage has dropped from 34% to 23% among businesses with less than ten employees.

“When a small business employee is unable to access health insurance with their employer, there is a higher chance of leaving this employer,” said Bianca Bloomquist, a California manager in most small businesses, a defense group representing over 85,000 small businesses across America.

Kirk and Ratan said his pizza store employs about 25 employees and operates as a workers’ cooperative – a business owned by its employees. The small businesses are lacking in charge of demanding discounts from insurance companies to cover his employees. The best that the store can do, said, there were precious plans that would make it difficult for the cooperative to operate. And these plans would not offer as much coverage as the employees could find themselves through covered California.

Short-term Health Insurance: Explore Affordable Coverage Options

Mark Slig, a California blue defender spokesman, said raising costs to stay in a hospital, doctors’ visits and prescription drugs exert pressure on the premiums. Blue Shield has created a new initiative, which he says is designed to lower drug prices and transfer consumer savings.

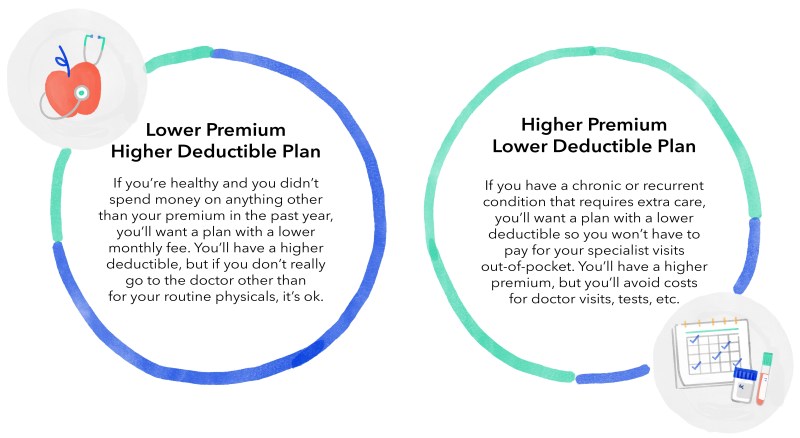

Even in California companies that offer insurance, the percentage of employees registered with deductibles has doubled in about 20 years, and rises to 77%, according to the federal data. Self -participation is the amount that an employee has to pay for most types of treatment before their insurance company will start paying part of the bill. The average annual deductible for a family health insurance program transferred by employer was about $ 3, $ 200 in 2023.

Over the past two decades, the cost of health insurance premiums and California deductible has increased from about 4% of the median income of the household to about 12%, according to Berkeley’s work center, which conducts research on work and employment.

:max_bytes(150000):strip_icc()/GettyImages-91497199-56cf42c03df78cfb37ab0168.jpg?strip=all)

As a result, the center has found many Californians choosing to delay or give up health services, including some preventative treatment.

How Does Life Insurance Work?

California is trying to lower health care costs by determining the growth hats of state expenses, which official officials in the country hope will destroy the rise of premium. Recently, the state has established the Ministry of Health training, which set a five -year target for annual expenses of annual expenses, and dropped to 3% until 2029. Failure to damage goals can cause immune fines for healthcare organizations, although it will probably not happen until 2030 onwards.

Other countries that imposed similar hats saw that health care costs cost more slowly than states they did not do, Ditz said.

“Does it mean that health becomes cheap people?” question. “No. It means it’s not getting worse at the same speed.”

You have to upset us as the original advertiser, with hyper -link to our site. Whenever possible, please include the original news of the author and the KFF “in the line. Please keep the hyper -links in the story.

Solved Families Usa, A Monthly Magazine That Discusses

Importantly, not everything Fon is available for re-publication. If a story is marked “all rights reserved”, we cannot grant permission to re -publish this item.

Thanks for your interest in supporting Kaiser Health News News, the leading news room in the country that focuses on health and health policy. We distribute our press for free and without publication using media partners of all sizes and large and small communities. We appreciate all our readers and listeners, and welcome your support.

KHN is an independent KFF (Kaiser Family) program. You can support KHN by contributing to KFF, a non-profit charity organization unrelated to Kaiser Parmana.

Click the button below to switch to KFF’s donation page which will provide additional information and widespread. thanks! My health insurance premiums cost over 56%next year. This is the biggest annual growth in the monthly premiums I have ever had – no doubt.

Life Insurance And Health Insurance: Can You Tell The Difference?

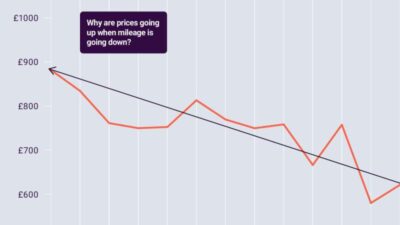

A few weeks ago, I thought about how Obamacare could have been a major US election. It certainly has not been beneficial to me in recent years. Please refer to my 2005 insurance fee chart below.

The chart above speaks for itself. Because the affinity for reasonable treatment law will be implemented over the past few years, I watched my health insurance fees. In addition, my insurance company – Medica – has reduced my coverage, lowered the amount they will pay for prescription drugs and increased my deductible.

In 2017, I will pay 455% or 5.5x more each month for my health insurance premiums than I paid in 2005. I understand that I got older and I understand that a higher age means higher premiums. But a 455% increase is absurd.

So what causes these smuggled prices? There are dozens of factors, but two are prominent: 1) supply and demand, and 2) lack of efficiency.

Lic Premium Calculator For Life Insurance Term Plan & Health Plans

I believe that people who created and supported the reasonable treatment law were good intentions, but unfortunately they were not financially acute. The ACA added a number of costs to the health care system without taking into account supply and demand. There are a relatively regular number of hospitals, doctors and other health workers. So when you increase the number of people who have full access to suppliers and staff, the supply remains the same, but demand is increasing. The result? Prices rise.

Healthcare costs are rising throughout the board, ie medical device manufacturers, pharmaceutical companies, hospitals and doctors can all charge more. And how much