It Management Fees – This page is digested. It is a combination of different blogs that they discuss. Each title is related to the original blog.

+ FREE HELP AND FAST DEAD! Convert a partner to I need help: Option Chhisik Option ($ 200 K $ 1b $) (1b $ – $ 10b) Technology Founder/CTO Growth of their sales marketing service business analysis of more than 155K Angels and 50 K VC Increase with global. We use our artificial intelligence system and introduce you to investors through warm identity! Send here and you will get the collected % 10 discount: 10 K-50K $ 50 k $-150 k $ 500k $ 500k $ 1m-3m $ 3m $ 3m $ 3m-$ 5 million more than $ 5 million Choose the dollar. : 150k $-500k $ 500k $ 1 million $ 3m $ 3m $ 3m $ 5m $ 5 million annual $ 5 million annual income: $ 1-10k $ 10-25k $ 25k-50k $ 50-100k $ 100k $ 100k – 200k How much did you invest in your organization?* How much is your monthly burn rate?* How many rounds are you planning to extend? If that happens then how much are you looking for a collection in the next 3 years?* Are you trying to get closer to investors? Cold or hot? What results have you achieved? ** It becomes a technical founder to help you create your MVP/prototype and provide full technology development services. We cover the % of the cost of each stock. Here the post lets you get $ 35K free business packages. Estimated Development Expenditure: 15k-25k $ 25k $ 50k $ 50k-$ 150k $ 500k $ 500k-1 million budget technology available: 15k-50k $ 50k-150k $ 150k $ 150k. -500k $ 500k-1 million Do you need to raise money? Yes no, we choose, review, review, review, the business plans, financial models, the whitepaper and/or others! What materials do you need: Choosing the financial model of the Earth Deck Financial Model, what kind of services you are looking for: Re -examine the review, we help to fund the big projects worldwide. We work with real estate projects, construction, film production and other industries that need a lot of money and help create proper ND donors, VCs and proper budget resources to stop their budget quickly! You have invested: 50k -500k $ 500k $ 2 million dollar -$ 5m -5 million dollar -$ 100 million dollars $ 100 million -$ 500 million Dollar -$ 50 million -$ 500 million $ 100 million $ 500 million $ 500b $ 1b $ 1 -10b annual: 0 $ 50 k -100 k -100 k -200 k -200 k -200 k -500K $ 500 K $ Invest in your company so far? If that happens then how much are you looking for a collection in the next 3 years?* Are you trying to get closer to investors? Cold or hot? What results have you achieved? ?* We help you to study market, customer, contestant, SWT analysis and the feasibility study in others! The zones I chose in the market selection study are all other budgets available for competitive analysis of SWOT feasibility study: $ 4000 – $ 4000 $ 6000 US $ 6000 – $ 8000 we offer a full sales team online and 50 % Covers Cover your Name, Email and Phone Number 10 Get a FREE List of Possible Customers. Which services do you need? Sales Sales Sales Sales Sales Sale Sale Sale Sale Sale Sales Increase Other Existing Budget Budget Increase Your Sales Increase In Your Sales: 30 K -50 K $ 50K $ 350 K $ 150 K -$ 1m -1 Million Millions we work with you. In terms of content marketing, staying on social media and helping you to look for specialist marketing counselors and provide 50 % expenses. Which services do you need? Digital marketing marketing social media marketing services SEO Service Service Service Marketing Strategies All other things for your marketing activities: 30 k -50K $ 50K $ 150 k $ 500 k $ 500 k -1 million full name name The name name is named Watsup Company named Land Deck or Business Program WhatsApp option will be answered in 1 or 2 business days. Post Personal Email Sending will be longer

It Management Fees

Management expenses are an important part of investment in cross -funds, Exchange Exchange Funds (ETF) and other types of investment vehicles. These expenditures are used to manage funds for investment research, trade, administration and other expenses. The expenditures are generally expressed as a percentage of fund -managed funds (AAM) and may vary from one fund to another. Understand how to calculate the cost of management and what causes can affect them.

Total Cost Of Ownership For An Investment Management System

1 The cost of management is usually based on the percentage of management resources. For example, a fund of $ 1 billion resources and annual management spends $ 10 million on investors funding investors.

2 Management expenses may vary from one fund to another. Some can pay less than 0.10 % of the cost of managing, while others can spend 2 % WARD.

3 The cost of managing funds can affect the cost of managing. For example, actively operated funds that need further research and business are more operated by their passive index funds.

4 The cost of management can affect the investment return over time. Higher expenditures can be especially long -term. For example, 1 % difference in management costs can lead to a significant difference in the overall return for more than 10 or 20 years.

What Is Aum? Assets Under Management

5. It is important to consider management expenditures when choosing funds for portfolio. Although the expenditures should not be the only reason that is not considered, they should be an important issue.

Suppose you invest $ 10, $ 1000 and more $ 10 for a 1.0 % ratio at a cost of 0.25 %. Suppose both funds earn an average annual return on average, 30 years later, a lower -cost fund will be about $ 57,000 more than a high expenditure ratio.

It can be very important for any investors to understand how the operating expenses and how they affect their investment returns. Investors can maximize their long -term returns by choosing the right funding for proper management.

Private stock fund management costs are usually calculated on the basis of a combination of funds committed funds and the net value (NAV) of the fund. These expenditures are intended to supply funds to fund management and to provide continuous assistance for portfolio companies. Here is the details of how to calculate the cost of management of private stock funds:

Adding A Management Fee

1 Basic Management Expenditure: Basic management fees are usually calculated as a percentage of funds committed by funds. This expenditure is spent annually and is financed to provide public operational fees, including pay, office rent and other administrative expenses. The percentage charged as the cost of base management may vary depending on the size and complexity of the fund but usually about 1-2 % of the capital is committed.

2 Management Cost Compensation: In some cases, the cost of management can be offset by the expenditure or observation expenditure of other expenditures paid by funds. This means that the amount of charges has been reduced as the expenditure of management by the amount of this compensatory expenditure. The purpose of compensation is to ensure that fund management teams are inspired to produce transactions and observations, as they are often a significant source of funding.

3 Discounts and Expenditure discounts: Fund management teams in certain situations may ignore or discount the basic management fee. This can be done to attract capital from investors or to align the interests of the management team with investors. For example, if funding is trying to raise funds, the management team may refuse to pay or reduce basic management fees to make the fund more attractive to potential investors.

1. High water marks: Many private stock funds include a high water mark on their expense structure. This means that the cost for management is only the cost of the fund that exceeds the highest NAV’s highest. In other words, if the functionality of the fund is reduced and the NAV is under the previous high water mark, the cost of operating until the NAV is reached on the previous high water mark will not be. This is just to ensure the award of the management team to produce positive returns for funding investors.

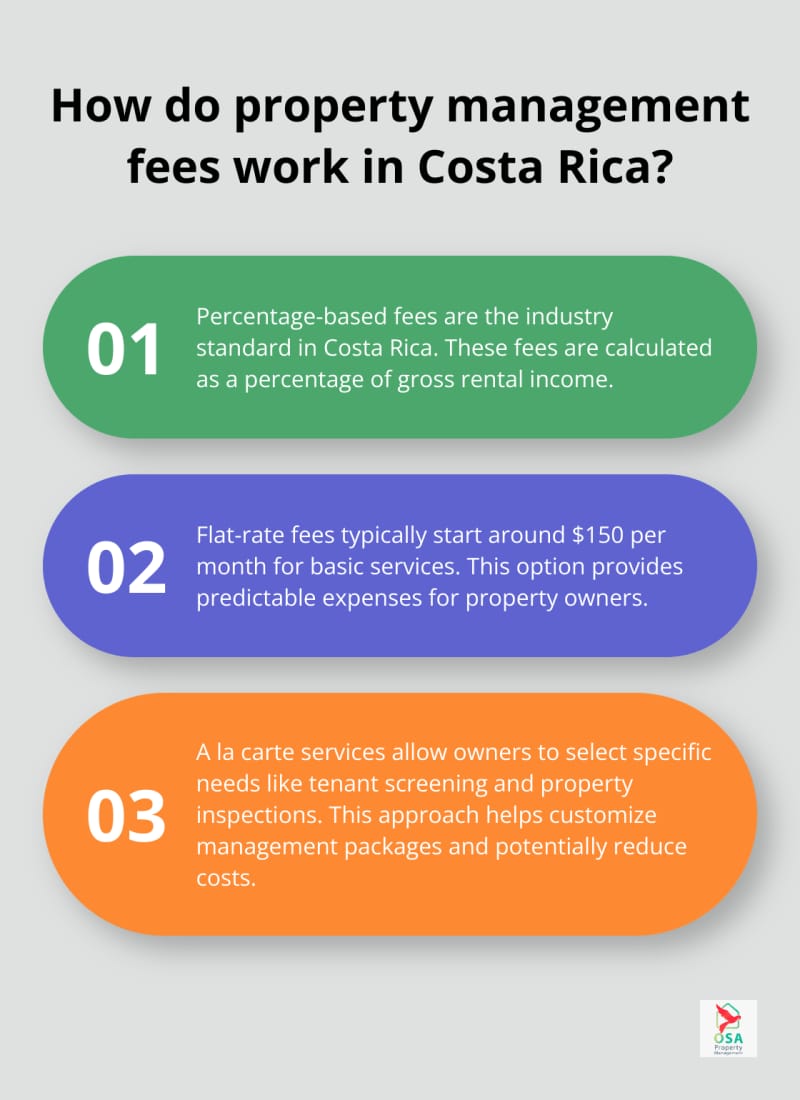

Understanding Property Management Fees In Costa Rica

5. Duration of Management: Management costs usually spend a certain period of time, known as the time of management costs. The word is usually 10 years but it may vary depending on the specific condition of the fund. After the expenditure of management, the fund can enter the “crop” stage, at this time the cost of management is reduced or usually eliminated.

It is important to note that the cost of management is only an element in general