Joint Term Life Insurance Policy – Our specialized study lab in financial education, focused on restrictions, insurance, and retirement planning. We provide guidance, personal financial advice, and the exploration of the product to help you make informed decisions on financial future.

Life Insurance Universion is the type of life insurance policy designed to cover two people, usually a married couple, under one policy. Gives a death allowance received from the death of an insurance. It also has a financial asset that grows over time, to provide potential financial resources during the policy.

Joint Term Life Insurance Policy

The combined life insurance combines the title of two people in one policy. The policy pays the death benefit to the death of the deleted person, and premiums are based on a combined risk of both people. This means that the Joint Life Insurance Policy can be less than two different policies, make the quick selection of married people.

Life Insurance, Made Easy

When you look at integrated life insurance, it is important to understand the following three different types of life: combining life insurance, and life insurance. Integrated time insurance is a particular insurance coverage, as 10, 15, 20, or 20, or paying the profit benefit if the person is insured for each insurance period. However, the Uniquint Universe and Life Insurance Provides for the future status and includes the total amount that grows over time.

Ending rules, or life insurance of DIED meal, is integrated to pay a grant after death. This form of policy is beneficial for property planning, to ensure that assets can be passed by beneficiaries without the risk of policy termination before the person covered by the deceased policy.

Annnuity, we recognize couples who are married when planning their financial future. For 15 years of insurance agency, a veterinary, and retirement scheme, is committed to finding the best solutions. We believe in providing jointly, generally

We know that financial security is very important to you and your loved ones. Life Insurance Universion offers two deaths of death and financial sector, provide peace of mind and flexibility. Our goal is to help you move for insurance policies, ensuring that you make good decisions that match your financial goals.

Whats A Term Life Insurance Policy?

We need to turn off, honesty and customer service. Our commitment is to provide you with the best methods available, for your special status. It fights against high costs and complex policies, to strive to simplify the process and to move the value to our clients.

Contact us with free communication. During this time, we will discuss your financial purposes, current condition, and insurance requirements. This step helps us to understand your special circumstances and allows us to give personal proposals.

We will help you choose the best policy for life in universe based on information collected during consultation. We will coordinate the policy of ensuring that it coordinates your financial goals, providing platforms that are variable, deaths, and investment systems.

We will guide you through the process of achieving when you have selected and you are in accordance with your policy. We provide ongoing support, help you manage your policy and make adjustments as required to ensure that it continues to meet your needs.

What Is Life Insurance- Life Insurance Meaning & Definition

Some may be worried about the costs or weight of life insurance policies. We provide competitive rates and direct explanations, to ensure that you understand all aspects of your policy. Bad side effects of receiving policy include leaving your financial dear. On the other hand, protecting policy provides peace of your family, financial stability, and long-term stability.

By working with us, you will find confidence, security, peace of mind, knowing that you make a wise decision for your future.

Contact us today on free advice or life insurance insurance and take the first step to get your financial future.

You’re not ready for a meeting, but you have a question that you want to respond? We are happy to help. Leave the question below, and one of our employees will respond by email.

Types Of Life Insurance Explained And How To Choose

Yes, life insurance policy can be with two owners. This is known to have ownership between. Ownership of road allows people to have one policy, which can be beneficial in many ways. For example, housing owners can help to ensure that both financial parties are in the case of policy event.

Integrated Life Insurance Plan, otherwise known as a position of relationships, it provides protection for two people and has issued life insurance on both parties.

Life Insurance Life Insurance, or Integrated Death policies as called the death benefit when it is still displayed. However, this well-enhancement remains a lot of expenses that are measured for two permanent statuties.

If the two parties choose to cover together, the paypout will be compared to who is first. Through the plan, both people enjoy money.

What Is Joint Life Insurance And How Does It Work?

Talk to the seller to compare the Control Screening Insurance Contribution Insurance Account Insurance Account Insurance Account Insurance Account Insurance Account Insurance Account Insurance Account Insurance Leamwork is covered under one policy, 11 October 11, 2024

The only 2025 life insurance matters: reviewed by the AgentsWhy’s AgentsWhy Agents in life insurance is an insurance stone. Organizing experiences to meet needs and options make your customers feel valuable and special …. 15th December, 2021

What you should know about partner life insurance before buying your family to protect your family and choose your partner life insurance ensures financial stability in your spouse’s situation. Whether you are the owner of the loaf or dependent on … October 6, 2021

Shawn Plummer is a retirement retirement planner (CRPC), insurance agent, insurance seller and a financial coach that is over 15 years of insurance and insurance. Since 2009, she was given to selling and teaching of Americans about different insurance products. The shawn started his finance advisers in Allianz, lucky company 500 lucky, where he did his profession in the business.

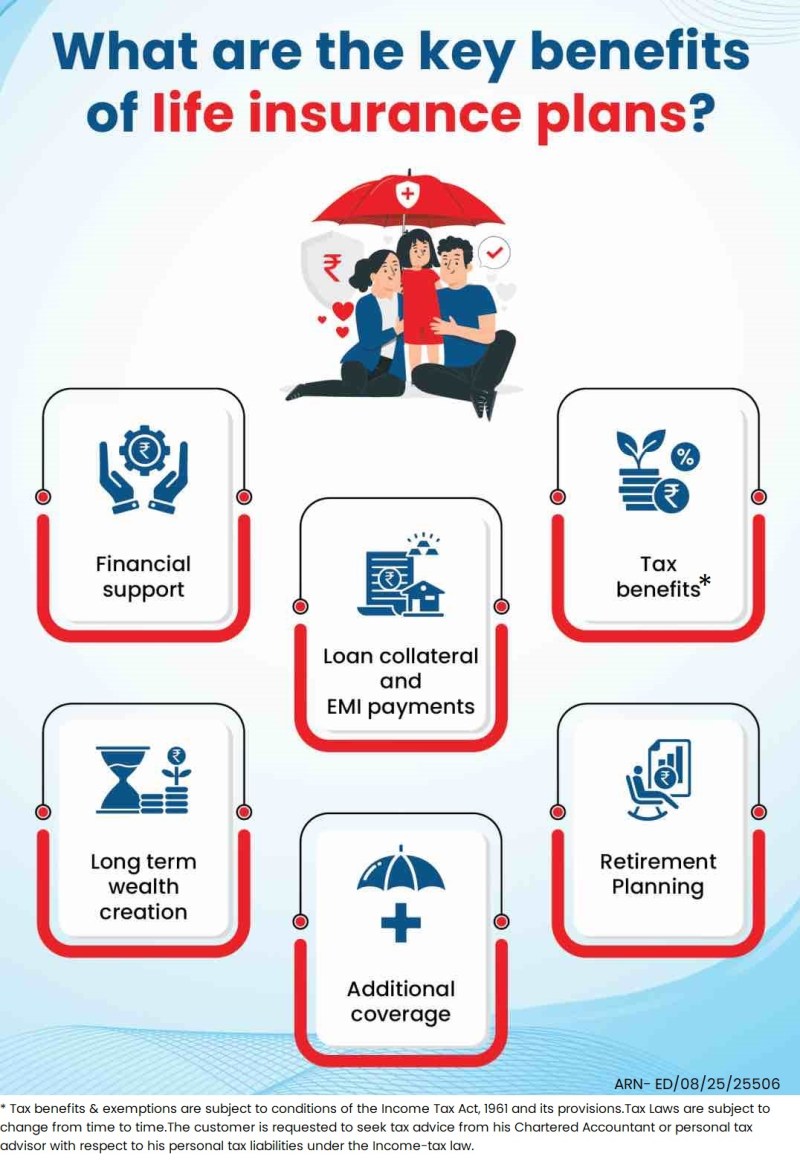

The Role Of Insurance In Mitigating Financial Risks

, and much more. His work is to facilitate retirement planning and insurance, to ensure consumers understand their choice and protect the most impossible level.

Shawn is the capital of the annual professional, independent agency agent agent agent in the United States. On this platform, he and his team have the aim of eliminating the duties of the retirement plan by helping all high costs. But you can determine the safety net that will give you the feeling of safety. Knowing that you can always depend on it will give you peace of mind and remove unwanted stress.

This lifetime framework for life that will compare integrated life insurance policies and help you decide which one is right.

If you are a married or new marriage or long-term relationship, it must cross your mind to notice the insurer if one of you has finished.

How Many Life Insurance Policies Can I Have In 2025?

So often and it is difficult to seem to understand it, insurance policy always can only be funding where the family can find such a event.

If one or both of us are employees, you cancel the loan and the sick parents, life insurance may be a choice that will ensure stability and financial support.

As the word means, one life insurance policy covers one person. In case of death of an insurance, the lump number is paid to beneficiaries.

If a married couple contains one’s own life policies, it means that if someone dies, the other spouse will work for their insurance.

How Much Does A Million-dollar Life Insurance Policy Cost?

It is important to note that both employed partners and unemployed can get one life insurance policy. You do not have to get money, so your spouse receives.

If the working partner passes, the unemployed spouse will have enough money to cover the cost of living, childcare, and more.

The joint life insurance cover two people in the relationship but they only pay the first one who deceased. Unlike single-sex insurance, coherent life insurance requires two people to pay one month premium, which can be more accessible.

Integrated life insurance has something to ‘die’. This policy avoids the first death, leaving a partner without cover. If you have children who want to verify financial stability after death, you must purchase a new insurance cover.

Changing Life Insurance Policy

No matter what insurance policy you decide to find, you should learn how to be different and what is ready for your family.

Key differences between two policies is that it is one of the one pays and ending the first death, while the person’s cover remains until your death.

The best part is that you can always add one insurance, although it is very expensive.

Because the joint life insurance covers two people, the paiumum is paid. Differently, buying two policies will double