Journal Entry To Clear Accounts Payable – Financial data is generally registered for storage in Ledgers. The magazine entry to pay accounts is the system of registering the data to be paid in the public ledger. The accounts to be paid are registered in the balance sheet under the current loans. So the goods or services obtained under the loan will be transactions against the current loans. Registration of financial transactions in Ledger helps the best budget and forecast and helps your company’s financial health.

Accounts to pay are the amount that a business has to pay for its vendors or services purchased for its sellers. Accounts to pay according to the predetermined schedule that the customer and seller agreed are usually resolved. Therefore, it is recorded as the current responsibility in the General Ledger.

Journal Entry To Clear Accounts Payable

Once the goods are purchased from the seller, this amount is registered as a debit from the purchase account and credited to the AP account. When the seller is paid, the amount is deposited from the AP account and credited to the seller.

How To View Journal Entries In Quickbooks Online

A magazine entry contains all the details of a transaction made within or out of the company. The following information is usually registered:

Accounts are registered in accordance with the type of journal entry transaction to pay. It can be registered against a transaction for the fee of your accounts from the cost account.

The purchase purchased for a freight or once purchase will be deceived against freight or purchase accounts respectively.

In cases where the damaged items are returned to the seller, this amount is adjusted against the next purchase from the seller or is immediately credited to the buyer’s accounts. In this case, the money that is parked in the account is credited to the return account.

T-account: Definition, Example, Recording, And Benefits

In case of occasions manufactured from a seller, other than freight purchases, this amount is marked as a debit against the account of the relevant property. It has been credited to accounts to pay.

If the purchase made from the seller is for a service, the cost will be charged against the relevant cost account. This type of entry is added to the Ledger if a sector requires legal or consultation services on credit from a seller.

When responsible for the seller, the amount is deposited from the accounts to pay and the loan or the seller’s bank account is marked. Accounts to pay later decreases to the company.

The accounts to be paid start with the generation of the purchase order. Purchase Order is the request of the buyer for goods or services to the seller. A responsibility is referred to only after the purchase is issued and sent by an invoice by the seller.

Closing Entries In Accounting: Everything You Need To Know (+how To Post Them)

The invoice is sent by the seller after the purchase is issued. It consists of an invoice number, the amount to be paid, the payment terms, the appropriate date and the delivery description. It is usually sent via mail or e -mail.

After obtaining an invoice, it is usually reviewed by accounts to pay for any contradictions. This includes the performance, entering the invoice details in the accounting system, and the re -raising the wrongdoles for the seller. Implementation of AP Automation helps this process to automate the invoice details.

After the invoice is verified for the errors, it is sent to the relevant business leaders for approval. This ensures that the services mentioned in the price list are acknowledged and paid to the seller. If a bill is irregular, the commercial approval can be rejected, and the AP team elevates this issue to the seller.

Once the invoice payments are verified, it is registered in the accounting system. All invoice details and payments are responsible for paying under accounts in the general Letter.

Introduction To The Full-cycle Accounts Payable Process

After the invoice is calculated, it is paid to the seller. At this point, the accounts to be paid are reduced, and the amount is credited to the seller’s bank account via ACH, COCH or wire exchange.

A furniture company purchased raw materials from a manufacturer on 22 August 2023. The company received an invoice from the manufacturer after supplying raw materials on August 24, 2023. According to the invoice, the seller will be paid to the seller before the date of September 1, 2023.

After the bill is paid, the debt is created as follows from the accounts paid to the debit and the seller’s bank account.

An IT company purchases office distributions worth 20, 000 from its seller on 20 August 2023 with NET 30 fare terms. The company notes the press entry for the transaction as follows:

Accounting Basics: T Accounts

After receiving the goods, the company felt that there were no standard standards of 000 3000 worth of goods. Since the seller cannot change the product in a timely manner, the company returns the product to the seller and reduces the accounts that need to be paid simultaneously.

Once the seller is repatriated, the final press entry for the transaction is registered, discussing the full amount from the account to be paid.

The magazine entry process that has to pay accounts is often a thrilling and walking. Manually entering the data in the Ledger can leave space for manual errors, which can lead to a missed transactions or invoice twice. Corporate Resource Planning Software Costs reduces the manual loads of the paid accounts automatically. This ensures that you can calculate before paying your expenses, avoiding any surprising costs. Somip Automation Sellers automatically synchronize with accounting software and ERPS to calculate a cost when a bill is received. You can also calculate the invoice at the tax item level accounting, several cost centers and GL accounts.

Press Entrance Accounts to Pay Accounts for Purchases made on Debt under current loans. After discussing it from the relevant purchase or cost account, it is marked as a debt against the AP account. AP responsibility is reduced when a bill is paid against the money or seller’s bank accounts. The accounts that pay are available from the invalid, reviewing the invalid, obtaining approval, accounting for the invoice and finally, the invoice payment. The use of tools such as AP automation software or ERP software can reduce the workload of manual magazine entries from accountants and accurately calculate the costs of the costs.

Solved Prepare Compound Journal Entries For Each

Magazine inputs for accounts to pay for sellers or credit providers pay for the purchase of goods or services against the loan. These purchases are registered under the current loans in the balance sheet.

When an invoice is received from the seller, this amount is credited to the accounts to be paid after discussing from the relevant purchase account. Once the bill is paid, the amount is re -paid from the account that the amount is re -paid and is credited to the seller’s bank account, depending on the payment method.

Yes, the accounts that pay can change magazine entries, especially if there are errors or if the responsibility is no longer valid. Reverse inputs are adjusted to repair mistakes or changes in situations.

The final-to-the-end AP process includes all the steps in the accounts that need to be paid from the invalid, reviewing, approval, calculating it in the Ledger, and finally, paying the seller the bill.

Accounts Payable Journal Entry: Full Guide With Examples

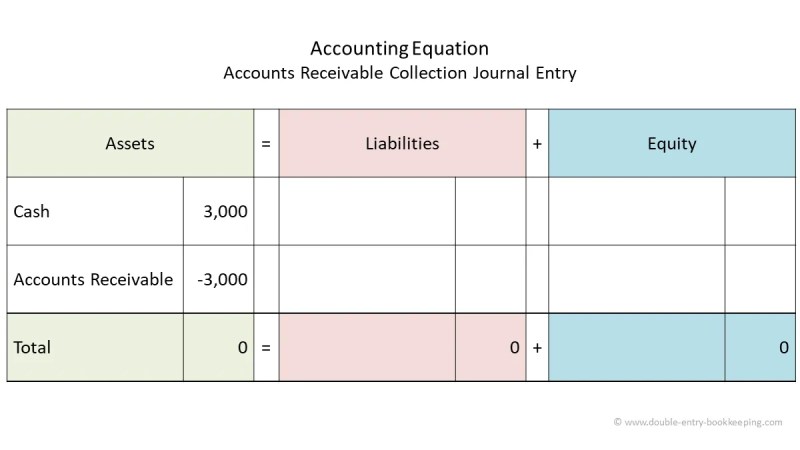

Accounts to pay refer to the money to pay for its suppliers or sellers, while the accounts that are obtained by its customers indicate the money it has to pay to the company. Both are important in managing liquidity. When we introduced the stairs and credits, you learned about the benefit of de-calculations as the graphic representation of any account in the general Letter. But before transactions are published in D-calculations, they are registered using special forms that are originally called

To monitor their business transactions. Information is entered in a magazine accounting system. A magazine is often referred to as the original entry book because it is the location of the information first to enter the system. A magazine has a historical account of all registered transactions involved. In other words, a magazine is like a diary for a business. When you enter the information in a magazine, we say that you are making an entry magazine. The entry is the second step of the accounting cycle. Here is a picture of a magazine.

You can see the columns labeled Debit and Credit in a magazine. Debit is on the left side, and the debt is on the right. We will see how we use a magazine.

When filling a magazine, there are some rules you need to follow to improve the entry system.

Accounts Payable Vs. Accounts Receivable: Differences

An example of the newspaper entry form follows. This is not taken from previous examples, but with the intention of standing alone.

Please note that there is only one debit account and a credit account in this example, which is considered a simple entry. A joint entry is listed more than one account under the debit and/or credit column of a newspaper entry