Life Insurance From Social Security – Indexed Universal Insurance Policies (IUL) can help you build wealth while leaving death benefit to your family. These policies place some of the premium payments of the policy toward an annual renewable term life insurance, and the rest of the policy is added to the deduction of the policy of the policy. On a monthly or annual basis, interest on the cash value is based on increases in an equity index.

While IUL insurance may be valuable to some people, it is important to understand how it works before it buys a policy. There are a number of advantages and disadvantages compared to other types of life insurance.

Life Insurance From Social Security

IUL insurance is often a cash value insurance policy that benefits from market-free market gains the risk of loss during market downturn.

Woman Suddenly Loses Social Security Benefits, Gets Hit With $20,000 Bill

When you buy a IUL insurance policy, you are getting permanent cover as long as premiums are paid. Your policy includes death benefit, which is paid out with your designated benefits or beneficiaries when you go away. But the policy can increase value during your life through a cash value component.

The cash value part of your interest policy is based on stock originally market index performance. For example, returns can be linked to Standard & Poor’s (S & P) 500 composite price index, which tracks the movements of 500 U. companies. As the index moves up or down, so the rate of yield makes a component of money for a policy.

The insurance company issuing the minimum rate guaranteed rate policy. There may also be a ceiling or rate on return cap.

IUL insurance is more dangerous than fixed universal life insurance policies, which offers a guaranteed minimum result. But it is not as dangerous as universal variable life insurance, allowing you to invest money directly in mutual funds or other securities.

Social Security In Japan: For Nationals & Expats

You may be able to borrow against the cash value accruing in universal universal life insurance policy, but any outstanding loans would be deducted when you go away from death benefit.

As with any type of universal life insurance, it is essential to thoroughly research any potential firms to ensure that they are among the best life insurance companies currently operating. With this in mind, here is a hope of including some of the main advantages of IUL in your financial plan.

These policies leverage call options to obtain exposure upside down your equity indexes without risk of loss, and complete life insurance policies and universal life insurance policies only provide a small interest rate that could not even be guaranteed. Of course, the annual return you see with IUL insurance policy will depend on how well its basic index operates. But your insurance company can still offer a guaranteed minimum result on your investment.

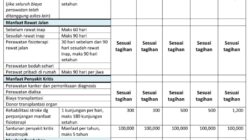

IUL insurance can offer flexibility when compiling a policy designed to meet your investment targets. Policy holders can decide how much risk they want to take in the market, adjust the amounts of death benefits as required, and choose among a number of riders who make the policy adaptable to their needs. For example, you can choose to add long -term care wheels to cover nursing home costs if this is necessary or as accelerated death benefits wheels, which can pay out benefits if you become ill.

Epic Insurance Series: Why Do I Need Life Insurance?

Capital Gains Tax applies when you sell an asset or investment on profit. Universal Life Insurance Policy Holders do not pay capital gains on the increase in money value over time unless they abandon the policy before it matters, but other types of financial accounts may tax capital gains when withdrawn.

This benefit extends to any loans you may take from your money value. If you have a smooth source of money that you can borrow, it may be attractive if you are trying to encourage taxes and penalties to withdraw early from 401 (k) or IRA.

Unlike 401 (k) or traditional IRA, there are no necessary minimum distributions for accumulation of money value in universal indexed life insurance policy.

Social security benefits may be an important source of income when retired. You can start making social security as early as 62 years old or postpone benefits to the age of 70. Benefits can be given before your total retirement age to reduce your amount of benefit, and benefits can be obtained. You are not allowed to earn so much a year before you reach a full retirement age before your benefits are reduced.

Calendar • Medicare / Social Security Seminar (cancelled)

As with any permanent life insurance policy, the accumulation of cash value from the IUL insurance policy would not depend on the earnings thresholds, nor would any loan amounts you remain on loan. So you could take a loan against your policy to supplement social security benefits without being involved in your amount of benefit.

IUL insurance, such as other types of life insurance, can provide your family death benefit. This money can be used to pay funeral and burial costs, cover outstanding debts, such as mortgage or student loans, fund college costs for children, or pay for daily living expenses. This death benefit can be forwarded to your tax -free beneficiaries.

Financial experts often indicate that they have a life insurance coverage equivalent to 10 to 15 hours of annual income.

There are a number of disadvantages of IUL insurance policies that critics are able to say quickly. For example, a person who establishes the policy over time when the market may operate badly with high premium payments that do not add to the value of money at all. The policy could then obsolete if the premium payments are not made in a later time in life, which could all refuse life insurance.

Security Mutual Life Insurance Company Cut Out Stock Images & Pictures

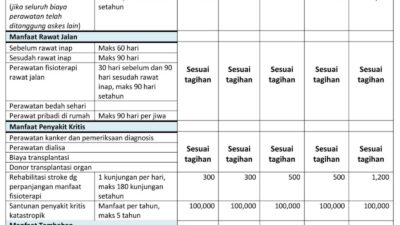

Insurance companies can set participation rates for the amount of index return you receive each year. For example, tell us that policy has a 70% participation rate. If the index grows 10%, your cash value return would only be 7% (10% x 70%). While some policies give you 100% of the index return and even more, others set maximum participation rates below 100%.

In addition, returns on maximum equity indices are often placed. Policy may say that your maximum return is 10% per year, no matter how well the index operates. These restrictions can limit the actual rate that is credited to your account each year, no matter how well the policy of the policy.

In that case, you may be better off investing in the market directly or thinking about a variable universal life insurance policy instead. But it is important to reflect on your risk and investment concession goals to ensure that either of them is in line with your overall strategy.

Full life rate insurance policies often include predictable premium amounts for the lifetime of the policy. On the other hand, IUL policies provide returns based on an index and have changing premiums over time. This means that you have to be comfortable riding on fluctuations in returns and at the same time budgeting higher premiums.

Life Insurance & Social Security Benefits

All these fees and costs associated with the rate of return provided by your policy. That’s why it is important to research the best life insurance companies so that you understand what you are paying for cover and going back.

Unlike other types of life insurance, the IUL policy value is connected to an index attached to the stock market. This means that the returns may vary, depending on the performance of the basic index.

While a universal indexed life insurance policy can provide a good way to provide for your people, it is generally not an appropriate investment strategy for most people. High premiums and additional fees mean that it may be difficult to keep indexed policy in the long term, and you could lose the money already spent if your policy goes out. While this may be suitable for some people, others may be better off stocks or bonds.

Universal life insurance policy includes death benefit, as well as a component attached to a stock market index. The growth of money value depends on the performance of that index. These policies offer higher returns than other types of life insurance, as well as higher risks and additional fees.

Finding A Life Insurance Policy After The Death Of A Loved One

Universal indexed life insurance and 401 (k) have their own advantages. There are more investment options at 401 (k) to choose from and it could come with an employer game. On the other hand, Death Benefit comes with IUL and additional money value that the policyholder can borrow. However, there are also high premiums and fees, and unlike 401 (k), they can be canceled if the insecurity stops paying into them.

IUL insurance can also help you meet your families’ needs for financial protection and money value. However, these policies can be more complex compared to other types of life insurance, and they do not need to be right for all investors. Talking to a life insurance agent or an experienced broker can help you decide whether universal life insurance is indexed