Life Insurance Policy Pre Existing Conditions – Although most of the Canadians, who have previously existed, can get life insurance in Canada, there are still several ways to influence. What is accepted as a pre -existing condition is how these conditions can affect the politics and denial of these conditions, what kind of policies are adapted for Canadians with medical conditions, and more with this comprehensive guide.

When applying for life insurance, a pre -existing situation is any medical condition in which you have or diagnosed symptoms before applying for a life insurance policy. There are a wide range of medical conditions that life insurance companies think of when receiving an application and does not affect less serious medical status conformity or premium rates.

Life Insurance Policy Pre Existing Conditions

If you are looking for information about a particular situation, feel free to check any of our comprehensive guides for some of the most common conditions in Canada:

Life Insurance With Pre Existing Medical Conditions

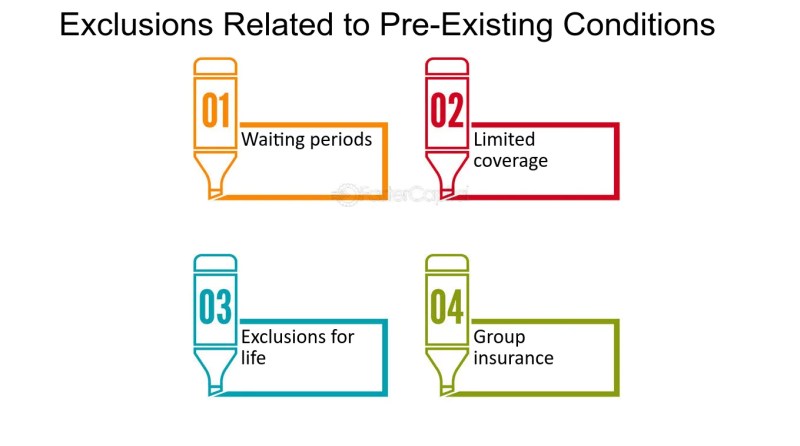

Fortunately, common medical conditions with less severe symptoms do not typically affect life insurance. However, more serious medical conditions that significantly affect your health and welfare can make the process of applying for life insurance more difficult. The reason for this is that insurance providers consider the risk of each applicant and unhealthy can increase your risk of insurance.

Having a high -risk applicant due to a pre -existing medical condition can make it difficult for traditionally written policies to be approved and lead to higher premium costs for life insurance. However, even the most challenging individuals can get life insurance with life insurance policies with guaranteed problems. This special policy type approves and does not require applicants to enter medical examination or medical questions. However, these policies tend to be more costly to take into account the increasing risk for the insurance company.

If you have a pre -existing condition, some factors can be taken into account by insurance providers, including insurance providers:

If you have a pre -existing situation, a quick view of different factors that may increase your risk of insurance:

Life Insurance With Pre Existing Medical Conditions

Individuals with pre -existing conditions, slightly affected by their symptoms, participated in treatments or drugs, and otherwise good, can often take a life insurance policy that is traditionally loaded with standard rates. Canadians, who are more seriously affected by a medical situation, may encounter higher rates and have more difficulties to qualify for traditional life insurance policies.

If you have a less serious situation in advance, you will be entitled to all standard life insurance types available for Canadians. However, it may be recommended to examine the guaranteed problem for individuals who are more insured and simplify life insurance policies. These policies are designed for Canadians who have difficulty in obtaining life insurance and do not require medical exams.

What kind of life insurance for you will depend on your scope needs and financial goals. For Canadians with pre -existing conditions, the existing types of insurance are as follows.

Guaranteed problem life insurance, medical conditions, penalty history, dangerous professions and so on. Unlike traditionally described policies, the expression of a physician (APS) or medical examination is not required as part of the application process. In addition, the guaranteed problem life insurance policies often do not require applicants to answer any medical questions to qualify. However, due to the increasing risk for the insurance company, such a scope tends to be more costly and offers less maximum scope than a fully written policy.

Does Pet Insurance Cover Pre- Existing Conditions?

Simplified Problem Life Insurance is another great option for Canadians with pre -existing conditions. This is because the guaranteed problem is similar to the Life Insurance, that the type of policy does not require a medical examination or a doctor of participation (APS). However, contrary to the guaranteed number of life insurance, such insurance requires applicants to answer limited medical questions to qualify. Therefore, the simplified problem life insurance policies typically offer more maximum guarantee and lower premium rates than life insurance. This is, health, professions, lifestyles and so on.

Life insurance is a type of life insurance that usually offers a scope for a certain period for 10, 20 or 30 years. You pay monthly or annual premiums with the term life insurance, so if the policy is still active, your beneficiaries receive a death aid. Generally, these policies can be renewed for a new term up to a certain age and can also be converted into permanent insurance. This kind of insurance is the most popular in Canada, because it allows you to scope when you need it most and is also the most affordable option for life insurance. Life insurance can be traditionally underneath or can be presented as a life insurance policy as a simplified problem that is not required for limited medical questions and medical examination.

Permanent life insurance is a type of permanent life insurance that includes you in the rest of your life, unlike a certain period. Such a policy also has the potential to accumulate cash value through universal or all life insurance policies. Due to the permanent nature of such policies, premiums tend to be more costly than life insurance policies. Permanent policies can be traditionally loaded or presented as a guaranteed problem, or there is no need for medical examination without any medical questions.

A useful overview of $ 200, $ 200-70, for male and female-free Canadians aged 200-70, $ 200-70, for the monthly life insurance rates from two different insurance companies to the Canadians who have a pre-existing situation interested in life insurance.

Does Group Health Insurance Cover Pre-existing Conditions?

It is important to be correct and clear about the pre -existing conditions you have when applying for life insurance in Canada. Although it is fair to worry about the increasing costs or rejection of application caused by something other than your control, such as the medical situation, providing incorrect information about your current health can lead to many problems beyond the rejection of the application.

Life insurance providers directly collect personal and health information from the applicants, and traditionally made policies will require applicants to take a medical examination and submit a participant doctor (APS). APS is a survey that a insurance provider will require your doctor to complete a summary of any medical information from your health records that the insurance company considers important. Insurance providers can also access databases such as MIB (Medical Information Office) to confirm the medical information they have collected or collected from the applicant.

It is very important to ensure the accuracy of the information you send to a life insurance provider. If your insurance provider determines that the information is incorrectly reported or neglected, it has the right to terminate your policy and refuse to pay a death aid to your beneficiaries. In addition, if it is determined that you deliberately offer significant incorrect information, it can be considered as fraud and may affect your ability to obtain life insurance in the future.

If your life insurance application is rejected, it may make it difficult to receive life insurance in the future, so it is important to make sure you apply for a policy you are suitable for.

Life Insurance With Pre Existing Medical Conditions 2025

Once an application has been rejected, there are three steps to take before applying again:

Once your application is rejected, the first step you need to take is to communicate with the life insurance provider to question the cause of the denial. Determining why you have been rejected will help you better understand which steps will progress. Your application is lifestyle, health, financial reasons and so on. If it is rejected, you will probably need to re -evaluate the type of life insurance you are suitable for and apply for a different policy.

If your application has been rejected for reasons other than your control, the next step is to access and discuss your options with a licensed insurance agent or broker. An insurance agency directly works for a particular life insurance provider and a life insurance broker represents consumers and can help you determine which policy is the best of various providers, or can explain which policies represent from the insurance provider.

By talking with an agent or a broker, you can get an expert idea of your special situation, probably advise which policies you will be entitled to, and get help in the application process to reduce the risk of rejection of another application. Since a commission is paid from the life insurance provider you have decided to take a policy to life insurance brokers, this can be done free of charge to you.

Guide To Choosing The Right Visitors Insurance Plan

If you want to discuss your situation with an expert financial advisor, you can always contact us online or call on phone number 1-877-654-6119 so that we can help you discover