Life Insurance Premium Tax Deduction – It is Lorem Qibendum elite from the Lorem Qibendum Elite from the Lorem Qibendum Elite.

A Life Insurance Program is a investment in your family and helps ensure that their financial security is following. The tax effects may have the opportunity for tax reasons for your life insurance branch. Working with a tax expert in order to fully understand your insurance policy can help identify the potential of the tax rules.

Life Insurance Premium Tax Deduction

It is important to understand life insurance strategies for business owners and tax deductions with a fasting day.

Life Insurance: Is It Tax-deductible? A Guide For Canadians

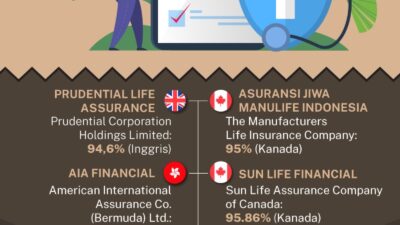

The only manufacturer in Kannada is considered to take into account life insurance premiums and take life insurance premiums. No. If If you are a businessman, you may be able to request a specific life insurance that is paying on behalf of your employee. You recommend working with the best bank financial services company in Montreal to ensure the maximum deduction.

Employment and accident; The Employer’s Passaged Life (AD & D) Premium is considered a tax relief benefit from employees. This means that the beneficiary is a tax -free when it is interested.

Some exceptions allow to withdraw taxes of premiums. The IMC Bank Financial directory has built this guide to fully use this guidance to the full use of your savings tax return.

Depending on the conditions. Your Life Insurance Policy can give you the advantage of your property or the beneficiary of your policy at the tax time. The following guide provides some tax insurance tax relief.

Did You Know That Your Life Insurance Policy Is Tax Deductible?

The following accounts are listed to the IMC bank list to determine if your life insurance is taxed.

Understanding the tax rules for the life insurance premium will ensure the maximum benefits and cuts in taxes. IMC Bank Financial is the first option for Montreal’s insurance and bank services services and our expert will work directly to promote your exceptions and benefits.

Do you have a self-insurance plan? Or if there is an employer with an employer-employer that is an employer with an employer. Our expert accountants and bank adverse advisers are the basis of your budget. Gives you at life insurance quotes. Laboratory laboratories specializing in bank financial education are highly focused on insurance and retirement planning. We offer guidance guidance and product reviews to make the right decision for stable bank founters.

Life insurance is usually considered to be dues. But the truth is more. Excited. The deaths are paid for the benefits of the mortgage, but if the correct constitution, the right structure may face tax accountability and reduce your heritage.

Are Life Insurance Premiums Tax Deductible In 2022?

This guide is U.S. With the revenue of the tax rule, it is written for the first time for readers who are unfamiliar with how to treat life insurance.

Most people buy life insurance for their main benefits. In many of the usual situations, life insurance avoids the full tax.

Life Insurance is a tax -Free for the beneficiary, but there are situations when taxes are collected. Here are the major issues:

Based on the market index or fixed rate to start the Life Insure Cash Value to start using the exchange of 1035. The benefits of the benefits can be provided to meet the income insured for life.

Qana 14: How Can You Make Your Life Insurance Premiums Tax-deductible?

Fixed Life insurance allows you to get early access to the benefits of death sentences for eligible taxes.

The best procedures for the real estate planning are often used to place property taxes and heritage after the end of both couples.

Preparation for a meeting is not enough; Good to help us with the following questions: A person of our employee will respond via e.

Generally, when someone is dead, the government does not deny it because someone is dead. But if you benefit from life insurance company, it must be taxable and report it as a income.

Is Life Insurance Taxable?

No, Life Insurance Payment does not match income tax. This means that the beneficiary will receive 100% of life insurance deaths.

No, Life insurance is not taxed over $ 50,000. In addition, life insurance results are usually exempt from taxes.

There is no limit to how much money you can get at life insurance. The inherited money usually does not meet taxes.

Generally subtract the life insurance premium. No. It applies to a personal life insurance policy that insuress insured. The IRS defines the premium as its own expenses as a purchase shop or clothing.

Bimacafe || Insurance Broker

Life Insurance Premiums are generally taxable. They are paid after -TAX dollars and the person who accepts the death effect is usually received tax -free. However, which profit will not be taxed if the policy is given before death.

Compared to LIFE INSURE Excerept. Top Suppliers’ best rates of suppliers, save the free and globalized quotes in October 17, 2019 Save the correct coverage in October 17, 2019

The Benefits of Loan Investments From Your Life Insurance The understanding of life insurance loans can only be borrowed only if your life insurance policy is valuable. This feature is usually found in a life of always in life … January 5, 2023

Life Insurance Program (LIRP) Life Insurance Program (LIRP) Life Insurance Program (LIRP) Life Insurance Program (October 13

Taxation Of Insurance For Corporations

The Shawn Plummer is a licensed retirement project (CRPC), the Licensed Retired Plan (CRPC); Insurance Representative From 2009 He dedicated to selling Americans to the annual suffix between suffering and insurance products. Shawn launched a bank financial advisor of his employment course in Fortune Glass 500 Company.

And the other. His goal is to understand their choices to facilitate planning and retirement insurance.

Shawn founders of an independent online insurance agency that provides services across the United States. Through this platform, he and his team are intended to remove the plot of remembrance for retirement planning for retirement planning to retirement in the most competitive rates. Get ready to remove abacus skills. However, allow you to guide you with a small secret before you go to the full shock mode. You can take taxes at your insurance premium. When tax cuts and tax cuts are not applicable when tax cuts and tax cuts are not applicable. So let’s enter the calculator.

So it’s an agreement here. Income protection insurance is your gold certificate when it comes to tax cuts. Why? Well, income protection premium is directly related to your income. This is natural.

Is Life Insurance Premium Tax Deductible In Canada?

And hey, Keep in mind that the income protection policy will affect your eligibility for your tax cuts.

Death; Other life insurance types, such as the defect and the permanent amount (TPD), or other life insurance, such as traumatized or emergency illness.

If you have a income protection policy (if you don’t associate with your super), you can hit the tax package. In the bank financial year, the right to request the deduction of the premium provided.

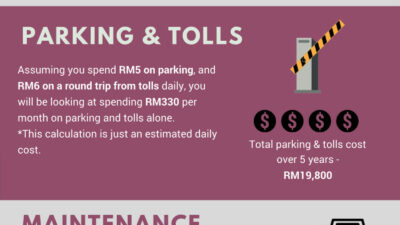

Now let’s look at a little bang. Some people participate with the “bundle” policies. For example, income protection is available with your life insurance policy. This trick – only the income care of income can be considered taxed as taxed. Therefore, if your monthly premium is $ 250, you can only deduct $ 95 from your tax if you pay $ 95 for income.

Life Insurance Premium Deduction In India

Tax deduction is not going to take taxes when it comes to income protection of income. I know, it’s a problem, but let’s see some of these reasons.

If there is a super insurance such as income protection, you do not define policy owner. It is a shot call supercourse. Therefore, even if you are a person covered with insurance, the property belongs to the Trustee. They bind the invoice by pushing the premium from your super balance.

Your super donation has some tax relief. Super money is usually taxed at 15%. This means that there are no additional tax cuts to win by your income protection premium. It’s like having a cake

Health care premium tax deduction, long term care premium tax deduction, tax deduction health insurance premium, life insurance premium deduction, insurance premium tax deduction, mortgage insurance premium tax deduction, deduction for medical insurance premium, irs health insurance premium deduction, life insurance tax deduction, tax deduction for life insurance, medical premium tax deduction, long term care insurance premium tax deduction