Malaysia Car Insurance Special Perils – You may only need a standard motor insurance to protect your vehicle. In Malaysia, natural disasters such as flooding and landslides can cause severe damage to your car and do not include it under standard policies. That is why the scope of special risks is very necessary.

This blog post describes the advantages of the range of special risks. You will learn what it covers, how to get it and the real life scenarios that will benefit you.

Malaysia Car Insurance Special Perils

Special risks are an add-on for standard motor insurance policy that provides additional benefits and protection for motor vehicles. Special risks are designed to compensate for damage or losses caused by natural disasters or other specific risks that are not covered by standard motor insurance policies, such as floods, landslides, earthquakes and other cramps of nature.

Salesman Already Advised Buy Special Perils (natural Disasters) Coverage For Car But Degil…

Frequent places targeted by all motor vehicle owners or natural disasters that live in high -risk areas should be considered a range of special risks.

For example, you have a risk of living in flood -affected areas, so if you have a range of special risks, your insurance company can compensate you. In accordance with your insurance plan, the solution involves the cost of your car’s current damage repairs and replacement parts. Repairs of flood -prone vehicles can be expensive, so this range can help ease the financial burden.

Floods and landslides are frequent in the monsoon during in Malaysia. However, many Malaysian cars are not adequately protected from these natural disasters.

In December 2021, we realized that the destructive flooding was more important than ever for our cars to get flooding. The Flood of the year will only cost RM1 billion due to floods that year, the Malaysian Statistical Department reported.

Insurance Is A Scam? Flood Insurance May Not Cover As Much As You Think

With this incident, the Malaysian General Insurance Association (PIAM) recommends that all automobile owners review their insurance policies and ensure additional scope of natural disasters such as flooding. The good news is that more and more people are starting to realize the importance of this range, and Piam subsequently reported that most people bought it in 2022 in 2022.

Special risks involve only cramps of nature, so do not include other events such as strikes, riots and civilian bustle.

Insurance protection differs depending on the insurance company and the policy you selected. Please read and understand the policy details to find out what your special risks are add-on covers.

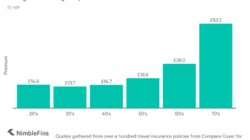

Depending on your insurance company, you can add special risks to your car insurance policy for an additional premium of about 0.2% to 0.5% from the vehicle’s insurance. This means that if your car’s insurance amount is RM50, 000, you will only pay an additional premium of RM100 from RM250. As a standard motor insurance, a small government service tax is usually applied to the insurance reference.

Pos Malaysia Berhad

If you are a customer, you get a more competitive rate for special risks when you update your car insurance with us. Furthermore, you can choose less than 20% of the full range (100% insurance of the vehicle amount) or partial coverage options. However, the full range (100% insurance of the vehicle) is recommended as the damage to the flood is very expensive.

First, decide whether your current motor insurers give special risks to your existing policy as an add-on. Commercial range can be called special risks, cramps or flood insurance protection.

If your current insurance suppliers do not give a range of special risks or you are unhappy with their plans and benefits, you can compare insurance plans by other insurers.

Comparing the range means taking into account the scope and price. You want to ensure that you get the most widespread range you can. Make an understanding decision by reading and comparing the terms given by the scope details, exclusion and the rules given by different suppliers.

Your Ultimate Guide To Car Insurance In Malaysia

Many Malaysian insurers provide this range independently as an add-on or extension to your standard integrated car insurance policy. So, when you update your car insurance, it is time to choose the add-on after you decide on your main car insurance plan.

Whether you are new or existing customers, you can add a range of special risks during policy renewal and choose the amount of insurance you want. Once you have added a range of special risks, your final premium will be set automatically.

If you have chosen our Auto 365 Comprehensive Premier Policy, the add-on of special risks is called “aura of aura”.

Generally, the process of special risks is the same as the usual car insurance rights, but it can turn to different insurers. Be sure to read the policy details and understand how the rights process works before you buy a policy.

🚨 Did You Know? In 2023 Alone, Vehicle Losses Due To Floods Amounted To Rm22.3 Million, According To The Department Of Statistics Malaysia (dosm). Many Assume Their Vehicles Are Covered For Natural

You need to provide the documentation of damage to your insurance company. Then your insurer will judge the damage and see if it is covered.

The answer is yes; If you assert vehicle damage or total loss, it is considered a regular right and will be affected by the NCD.

The best way to keep your car safe is to reduce the chances of something. By understanding the risk, we can achieve it on the road, especially on the road. Although we cannot control the mother’s nature, we can always be careful and avoid driving under dangerous conditions. Be safe!

Disclaimer: This blog post is strict for information purposes and should not be taken as any suggestion. This article denies all responsibility for any losses that depend on the information contained in the article.

A Guide To Flood Protection For Both Your Car And Your House

Liberty General Insurance Burhad Purbadanan Invance Deposit Malaysia (PIDM) is a member. PIDM protects the benefits paid under the eligible policy. Please see pidm’stips brochure pidm’swebsite, or contact our Customer Service. You usually find three basic car insurance options in Malaysia. Third -party cover insurance is a basic policy, and you can extend it with a range of fire and theft. Finally, the integrated cover provides greater protection as it includes third and first-party damage. Apart from these major transactions, vehicle insurance policies include various add-ons. These are the additional scope of protecting you in some cases where your standard policies are not included. You will find a wide range of add-ons, and one of them is an additional range for special risks. Let us check what this add-on means.

According to vehicle insurance companies, special risks are unexpected natural disasters. Unfortunately, these occur across Malaysia. A natural disaster can be an earthquake, which suddenly happens and makes us all guarded. An earthquake can cause a tree or another object to fall on your car. It can damage the vehicle or destroy it completely. Another example of the natural disaster is the sinking of the soil. This can occur as a result of heavy rains, but also earthquakes. Regardless of the drowning of the soil, the landslide can damage your vehicle. Storms and flash currents are another potential disaster, which rarely happens but will destroy your car. The term “special risks” have been chosen for a reason. Because these events rarely occur. That’s why you find this add-on low premium. The smallest difference in total insurance costs is why many vehicle owners choose to be on the safe side and apply for this additional coverage.

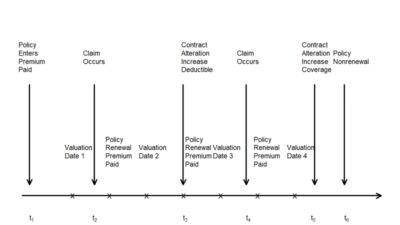

The solution you deserve depends on the contract you have signed. However, we give you a couple examples. For beginners, you can choose a range of special risks or only partly. This table describes details:

Policy details may change depending on the insurance you have chosen, so please use the table above. Now, as you can see, the partial range has a cheap premium. However, the rate has increased in high insurance agencies. In our example, this is 0.4% of the amount insured for partial coverage, but you only pay 0.25% for full coverage. Another thing to note is that it is worth to have a full range in the event of natural disasters. Special risks often occur, but they usually cause great damage. If you choose the full range, you will receive 100% of the repairs cost up to the amount you have insured. It gives you the peace of mind, and the difference in the total premium price is not significant.

Cheapest Car Insurance Malaysia 2025

The answer is yes, and this applies to all additional coverage. You will need to apply for any add-on with the same agency you signed for the initial insurance agreement. Special risks should apply to the add-on until your policy remains. If your vehicle is damaged by unexpected disasters, make sure to reach and submit the right as soon as possible. In Malaysia, it is the need and need of a motor insurance law when you buy a new vehicle as a way to protect you as a car owner. Most car insurance offers an additional range of special peril, windscreen, additional driver, tires and rim repairs and so on. In this article, we will discuss special peril covers for your vehicle when unexpected facts occur. What does it mean by a special peril cover? The special dangerous range indicates more depending on the special dangerous coating provided by unexpected natural disasters such as floods, storms, landslides, earthquakes, sludges and more insurers. This additional range will compensate you