Motor Car Insurance Malaysia – Third -Party coverage is the main coat of car insurance that includes a third party death or injury and damages another person’s car or property.

Third side, fire and theft provides damage to the insurer’s vehicle due to the person’s car fire or theft.

Motor Car Insurance Malaysia

You know even with detailed car insurance, your car insurance policy will only include your car during the accident. This means you will have to pay any hospitalization or ambulance fees.

Save More On Motor Insurance With Spaylater

Think of the driver’s personal accident (DPA) engine accessory to protect yourself and your passengers *. In case you have been injured in an accident, the DPA will include permanent or partial disability, medical expenses, hospital income, etc.

Do you know the passing damage is often cheap for repairs and requires your detailed insurance? However, your motor policy requirements will restore your discount (NCD), so it’s better to pass the front glass accessory, which is an extra coverage for your front cover.

Note: The additional amount of your glass glass will be restored on February 15 by August. The choice of time to restore time during the seminar is organic.

When you are in the water and flood water, remember these simple steps and make sure you and your passengers are safe.

How To Check Car Insurance 2023: A Complete Guide For Vehicle Owners

Contact your insurance consultant about more about 24 hours – a supplementation of car assistance and special risks or click here to apply.

To learn more about the mandatory excess and other important things, you need to know about the claim, contact your insurance advisor or click here to view the mandatory videos of the engine.

Better charges extra older (usually 5 years and more) for cars (usually 5 years and more) to cover the old part with a brand new thing. This is a common practice in the industry when you file a suit.

If you are involved in vehicles, you should be aware of the knock or Odkfk damage. It can facilitate your requirements experience and possibly save NCD.

New Motor Insurance Tariff 2013

Odkfk- ը թույլ է տալիս գործողություն բերել ձեր ապահովագրական ընկերությունից, այլ ոչ թե մյուս կողմի ապահովագրողի կողմից: This agreement means that your requirements are faster.

You know what to do if the damage requirement? It’s always good to know the basic steps before filing a claim.

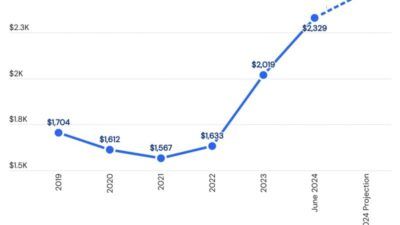

In the past, car insurance markets were regulated by fixed prices, which are called prices. In 2017, the industry has launched the gradual liberalization of car insurance, gradually presenting more competitive price and flexibility.

We are now moving to a more dynamic price system based on risk factors, such as driver’s profile, vehicle type and historical statements. This approach promotes competition, innovation and more accurate price.

Total Protect Plus With Auto Assist

It is important to know the opportunities available when the user goes to engine insurance. Contact your insurance consultant for more information.

Անմիջապես ներկայացրեք ոստիկանության զեկույց, ձեր մեքենան (եթե չի վերցվել) մոտակա հաստատված վահանակի վերանորոգման համար:

If you decide to file a claim. Report your insurance consultant as soon as possible. Here you can find common requirements.

Պատկերացրեք վթարի վայրը, կոնտակտային տվյալները, որոնք կապված են ներգրավված անձանց հետ եւ ձեր մեքենայից հանեք Dashcam- ի կադրերը `հայցը հեշտացնելու եւ արագացնելու համար: First of all, rest and make up, help you with others.

Malaysia Motor Insurance Detariffication

Զարմանում եմ, թե ինչու է խելացի ընտրության ընտրությունը վահանակի կանոնադրական սեմինարում: This is not only reliable repairs, but also to provide a smooth process.

Հատուկ Պերիլա շարժիչային պարագաներ ապահովագրական ծածկույթ ապահովում են տարբեր վտանգների, ներառյալ ջրհեղեղների, թայֆունների եւ փոթորիկների դեմ: Click here to learn more.

If your car is insured, you are not enough to compensate for your insurer if accidents, steals or total loss occur. This means you can cover some repairs yourself.

No torture discount (NCD) is a well-known term among car owners. This is a discount provided by insurers when no requirements are made during the cover. By keeping a record without requirements, your NCD exchange rate increases, as a result of which reduced car insurance premiums.

Go Green By Choosing An Eco-friendly Car

The maintenance of your NCD is a wise financial strategy that rewards safe driving and high savings for car insurance premiums.

Thank you for your interest and sent us your application. We will review your plan and contact you if you are picked in the interview. By clicking and continuing to access or login, you agree to the user’s contract, privacy policies and Cookie’s policy.

The Malaysian Automobile Insurance Market throws more and more vehicles, income, rates of compulsory insurance, liberalization interest rates, digital insurance and epidemiological sales.

The Malaysian car insurance market is guided by several main factors, including the increasing number of vehicles on the road, increasing the rules of disposable income and order by obligating car insurance. In addition, the liberalization of gradual motor rates has led to risks based on innovative insurance products and prices. The growth of digital insurance devices and the recovery of vehicles from the epidemic also contribute to the development of the market. However, the challenges remain, such as intensive competition and unfair requirements.

Betterment’ In Motor Insurance Explained

The Malaysian car insurance market is growing due to increased value services. Insurers offer additional benefits such as 24/7, vehicle repair and maintenance services and personalized insurance packages. These services increase customer satisfaction and loyalty by giving a competitive advantage in the overcrowded market. Integration of digital platforms by providing smooth service providers, further increases the attractiveness of this added value offers.

The increase in geopolitical voltage has a great impact on the Malaysian car insurance market. Increasing uncertainty and risk increases insurance premiums and added requirements. Worldwide supply schemes affect the production and availability of vehicles, causing delay and higher price and changes. In addition, the economic instability can reduce the strength of consumer expenses as a result of geopolitical conflicts, affecting the sale and insurance of new vehicles. Insurers may also face an increase in operating costs, as strong risk management and compliance measures are needed. In general, these factors contribute to a more unstable and complex market environment, so insurers require that they use their strategies to maintain profitability and customer trust.

The insurance agents / brokerage section is the largest distribution channel in the Malaysian automotive insurance market. Segment captures the majority due to strong relationship with individualized services and customers. Insurance agents and brokers provide customized solutions and market resources, which increases their role in car insurance environment. They give them various political opportunities and professional advice significantly contribute to their main position in the market.

The Malaysian car insurance market is fierce competitive, as many companies compete for the larger share of the market. Market Market Companies include Malaysia Life Ltd, Msig Insurance (Malaysia) Pte Ltd, such as sea life insurance Insurance PTE LTD, Auto & General Insurance (Malaysia) Pte Ltd and Aviva Ltd. These companies use a number of strategies, including investments in their research and development activities, collaboration, licensing contracts, new products and new products and new products and new products and services allow more products and services. Strengthen their position in the Malaysian Automotive Insurance Market.

Alamak Hujan Lagi

Don’t miss out business opportunities in the Malaysian automotive insurance market. Talk to our analysts to make basic ideas and make it easier to grow your business.

Detailed analysis of the report provides information on the growth potential, future trends and the statistics of the Malaysian car insurance market. It also emphasizes the factors that determine general market forecasts. The report promises to present in the Malaysian automotive insurance market and industrial ideas to help decisions. In addition, the report also analyzes market growth engines, challenges and competitive dynamics.

2: What is the expected growth rate of the Malaysian car insurance market in terms of value during the projected period?

ANS. The Malaysian Automotive Insurance Market will increase by 1.70% of CAGR from 2024 to 2030.

Mazda Car Insurance @ Kota Kinabalu, Kuching & Sibu|maxspeed

ANS. It is planned that the Malaysian car insurance market is due to 2030. Will reach $ 2.12 billion worth of value.

ANS. The growth of the Malaysian automotive insurance market is mainly due to developing vehicles, economic growth, regulatory powers, increasing the adoption of disposable income and digital insurance platforms.

ANS. Համապարփակ ծածկույթի հատվածը Մալայզիայի մեքենայի ապահովագրության շուկայի բաժնետոմսերի ամենամեծ մասնաբաժինն է, ըստ քաղաքականության տիպի:

ANS. Մալայզիայի հիմնական ավտոմոբիլային ապահովագրության շուկայի մասնակիցները MALAYSIA LIFE LTD, MSIG ապահովագրություն (Մալայզիա) , ECICS Limited, AXA Insurance Pte Ltd, Auto & General Insurance (Մալայզիա) PTE Ltd եւ Aviva Ltd.

Generali Car Insurance

Սաուդյան բրոքերների անվտանգության շուկան Հնդկաստանի բժշկական սարքավորումների ֆինանսավորման շուկայում Հնդկաստանի մանրածախ բանկային շուկայում Հնդկաստանի մանրածախ բանկային շուկա Հնդկաստան Fintech Markettakaful Ikhlas Motor Insurance