Paid Accounts Payable Journal Entry – The money is required to pay the log on the log when the business has paid money to the provider and the amount is not satisfactory to a particular invoice, or the provider not satisfied the invoice.

Educations to purchase will be shown in the Income and Registration Report contrary to the income and registration in the revenue and regularization of rentable purchase of business purchase.

Paid Accounts Payable Journal Entry

Internal control in the account to be used to reduce the fraud and debt risk. The purpose of internal control is not only valid accounts of providers.

Accounts Payable Automation [’25]: 7 Steps & 45+ Solutions

Program of supplies sometimes refer to authentication arrangements to ensure research accounts, credit Notes and payments are recorded in the book.

Divisional debt account is an account in a Common Book which supports the final reports in relation to the debt. An account is used, known as the Account published sometimes to allow information on supporting in a relatively accountable accountbook.

The bill is recorded as a business cost. Because the business is provided by the provider, the other side of accountability is the responsibility to the provider (payment account).

Purchase services in the account will be registered as business expenditure. Because services are purchased to the Census, a different side of the equation is the responsibility to the provider (the Paytable account).

Accounts Payable Archives

The score business was a score of 500 for goods and gradually discount 2% of money on silver payments for early pay.

The original invoice was placed on the payment payable, and therefore the balance before the client suppliers reported 590 waste.

A office stock will be purchased in the account as current assets (supply on your hands). With delivery of delivery of the account, the equivalent of account is a responsibility to the provider (payment account).

When the goods are purchased from the provider, the amount by the supplier has been recorded as an account of the cost. When the payment is made to the supplier for the amount paid, a liability payment is recorded by the payment of payments with an account.

Multiple Bank Account Journal Entries

When the goods or services are purchased from the provider’s account, the invoice provides for the payment of payment of invoice. These payies appear when the invoice needs to be paid.

For example, the invoice can provide for payment circumstances 90 or term 390, which means that the full conviction of 90 days of an invoice.

Check log logs below make a speedy idea and teaching the fast conditions when dealing with double publication of payment due. This document behave through how the log records are created in describing OOO 15 and how to enter accounts of payment logs. We will show examples of enabling provider and receiving payment from Client, as well as how to create a hand-making maions.

Accounts that affect the registration of payments will always be from the Diachan / Basic Credit Accounts by being a typical / AP) listing.

Accounts Receivable (a/r)

We will consider log accounts first. Go to log you want to send your payment by clicking the arrangements> accounting> logs.

On the “Indone of Indent” tab. For this magazine, the bank account has been set to the bank, and the suspension census is set into the “Bank suspend” group “.

Bank statement transactions are placed on the SuperEnse account so that they are approved with the client payment to the client provider’s account or invoice. This allows the census to track the differences and individuals individual activities of the remaining issue.

At first we will look at the entering payments. As all the logs of the log, account used on arrival-entered trade payments

Accounts Payable: Definition, Example, Journal Entry

The product tab, like all of the log table will be used in the transaction when the payment is sent. Click

The other half of the log table will be determined by the accounts listed in our / AP partner that is found in their contact.

To get to your suppliers, go to providers> sellers. To access your customers, go to customers> customers.

This eye, you will see that when you choose the Protoco Filto the odoo filters to the lips. Select a partner you want to connect to your payment.

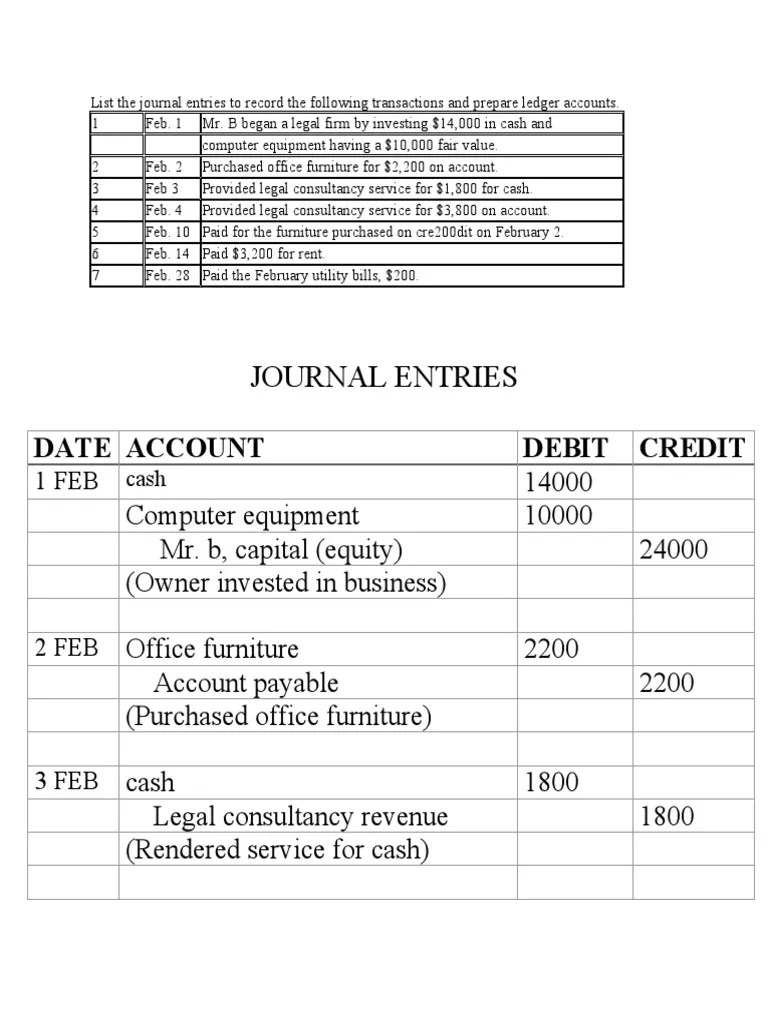

Solved General Journal Page 1 Date Account & Explanation

Go to the accountage tab for your partner and click the accounting tab. Accounts listed with their accounts will be shown and pay for a payments associated with this participant.

If you see “Accounting Settings” Accounting Settings, guided by the Parent Parent “, click descripted on the discussion / change on parents’ communications.

Best practice to create pay directly from the Provider Bill; However, Odoo allows you to create the pay suppliers. To do this, click SUFFLLICES> Payments and then click create the issue.

Internal training: This field must be used to move money from one internal account to another. It’s not used when you pay the supplier account.

Lo 3.5 Use Journal Entries To Record Transactions And Post To T-accounts

Memorial: Please enter the payment link, we suggest using the supplier account related to this payment.

The SupLs Bank Account Suppression this area only displays when the payment method is set for “Instructions”. If you have one or more bank accounts in your selected provider in the file, you will be able to choose the account here.

After completing Save to save this entry as a project, or click Confirmation. After proof, you can click on resetting to make a project or mark as sent to recording that hand’s pay has been sent.

After determining your payment, we can see the log-created log-based by clicking the SMART LIARTING button.

Solved Journal Entries Debit Credit 720 Trans. No. Account

Here you can see that we have assigned $ 100.00 from the Account, recorded as a particular account in the Bank Bank.

Internal training: This field must be used to move money from one internal account to another. It is not used by paying the invoice.

This area account: This area won’t appear when the payment method is set for “guidance”. If the client has one or more bank account which you choose in the file, you will be able to choose the account here.

When you finish the opportunity Click to save save saving to save this entry as a project; However, for this example, click Confirm to show that the payment is received.

Exercise #2 Journal Entries (with Partial Payment, Returns & Discounts)/ Merchandising Business

Here you can see that we have credited $ 948.75 from the recorded account for receipt of Rarent Street Warent Worrent with Columbia & Wsp. Current listing: AI in Business and Fundan • Private • FP & A • Investment in Trlest Buildings • Investment

The payment of the payment is classified as the current responsibility for the balance, from walk that represents the specified payments for shareholders, usually produced within a year.

Following the recommended cash allowance to and nominated by the Board of Directors, the language can be spread to his shareholders.

An suidheachadh ainmichte, a dh ‘aindeoin gu bheil airgead fhathast ann an seilbh a’ chompanaidh aig àm an ad, a ‘cruthachadh puing làithreach na loidhne dleastanais air a’ chothromachadh air a ‘chothromachadh air a bheil “earrannan pàighte”.

Solved: Recurring General Journals For Accruals

It’s a current duty that these materials are representing the Council, that is, the future of the Council. Conduct spending is equivalent to the full level of scraps known as partmen.

However, note that the corporate will be responsible for ensuring the devolution spreading collections, as a discretion of debt.

A silver partial has been paid from the company’s storage income, collected income, without being distributed to shareholders.

So there will be the right introduction of the magazine after the proof of the dentistry in a safe profit and protected credit for equal protection.

What Is Payroll Journal Entry: Types And Examples

A significant difference here is that the real thing streaming of assets occur to the actual payment date.

At the first date when separated for the separation of the division is officially announced, an account on the company’s storage profit is given off for the amount of dispersoncy.

Therefore, the census will be paid – the current item is a liability line of the balance – listed with the Board of Permarks.

Later, on the date when the separation of the division is issued to the shareholders, the selected accounts will be written off, and will be credited to the census account.

Solved Ex1. Prepare Journal Entry: 1. Paid €3,000 Cash On

If Corporate Board directors are named

Payable journal entry, payable entry accounts, payable accounts journal entry, dividends payable journal entry, accounts payable discount journal entry, accounts payable journal, paid accounts payable, paid cash on accounts payable journal entry, accounts payable journal entry example, intercompany accounts payable journal entry, quickbooks accounts payable journal entry, accounts payable accrual journal entry