Paid Cash On Accounts Payable Journal Entry – Wall Street Prep WSP certificates with COLUMBIA & Wharton certificates now open! Now Registration: AI in Business & Finance • Private Investment Funds • FP & A • Real Estate Investments • Value Investment

Accounts payable are a current liability recognized in the balance sheet for the measurement of unpaid accounts due to suppliers and sellers for products or services collected, but paid for credit rather than cash.

Paid Cash On Accounts Payable Journal Entry

Conceptually, payable accounts – often shortened as “payable” for a short period of time, are defined as priced accounts in a company that has not yet been attributed.

Journal Entry For Money Received From Debtor (with Example)

In the accounting of accrued accounts, the bills payable are listed on the short -term liabilities that a company owes to its suppliers or suppliers for goods and services paid for credit rather than cash.

The account payables is recorded in the current balance sheet liabilities, as the company is expected to pay the supplier’s payment soon, usually within 30 to 90 days.

It is mentioned in simple terms, the bills payable represent a current liability that measures unpaid payment liabilities that are still due to suppliers and sellers from a particular company.

If a company is ordering raw materials and resources from a supplier, receipt of orders and invoice from the supplier requires the recognition of accounts payable to the balance sheet for the current period, regardless of the fact that the company has not yet paid cash.

Basic Accounting Journal Entries Guide With Simple Words And Examples:

The recognized residue of the recognized accounts in a company balance sheet reflects the cumulative unpaid payments due to third -party creditors, namely suppliers and suppliers, by U.S. GAAP.

The first step in calculating the accounts paid to the balance sheet is to determine the balance of AP that opens at the start of the period (or the termination of the balance in the previous period).

In fact, the balance of accounts is increased when a supplier or seller extends the credit and vice versa when the company pays in cash (and fulfills the obligation to pay its creditors).

If a company had to set an order to purchase a product or service, the expense has been raised, despite the fact that the cash payment has not yet been paid.

📚 Accrued Revenue

Given the balance of account payable from the commencement of the accounting period, the two adjustments affecting the end of the balance of the period are credit markets and suppliers payments.

The type for calculating accounts payable starts with the original payable accounts, adds credit markets and deducts suppliers’ payments.

If a company pays its suppliers and sellers in cash immediately after receipt of the invoice, the accounting balance payable would be close to zero.

However, companies are encouraged to keep cash as much as possible and expand the payment process.

Journal Entry For Sales

Why? Cash in hand can be spent on reinvesting, finance daily capital needs and meet unexpected payment obligations.

If a company’s accounts payable is increased, a company’s cash flows are increased (and vice versa)-even though the obligation to pay in full use is mandatory.

In the balance sheet, the bills payable (A/P) and the collection of collectors (A/R) are conceptually similar, but the distinction lies in the perspective (or “view”).

Therefore, while the bills payable are recognized as current liability, the receivable accounts are recorded in the section current assets of the balance sheet.

Solved A. Performed $30,000 Of Services On Account. B.

He said differently, the bills paid to a company (or buyer) are the receivables of the supplier or 3rd party supplier who owes money to goods and services already delivered.

For the purposes of accounting, Payable (AP) accounts are recognized as an account of responsibility that maintains a credit balance, excluding unusual circumstances.

Upon receipt of the invoice, the company records a “credit” in the account payable account with a corresponding “charge” in the expense account.

Suppose a business buys $ 20k in an inventory and agrees to pay the supplier on a later date instead of this date.

Paid Cash On Account Journal Entry

The impact of transaction is a debit status entry to the “Inventory” account, with a credit entry in the “Account Payable” account, reflecting the increase in current balance of liability.

If a company owes more payments in the form of cash than customers paid using credit, the “Accounts Payrs” account is credited to reflect the increased obligation.

On the contrary, if the company is the party that owes cash to a supplier or seller, the payment of the payment to settle this debt is recorded as a charge for the “Account Payable” account.

The credit balance reflects the total amount that is still due to suppliers or sellers for goods or services received, but have not yet been paid.

What Is Accounts Payable (ap)? Definition, Journal Entries, Examples

The account line line (AP) is recognized as a current responsibility in the balance sheet prepared in accordance with US GAAP reference standards.

The balance sheet or “statement of financial position” is one of the key financial statements that a snapshot of the assets, obligations and shares of a company at a specific point.

In short, accounts payable are considered current liabilities because the excellent balance represents money due to a business to its suppliers and sellers.

Current liabilities represent future cash outflows that are expected to be resolved within 12 months, which is a criterion that meets payable information.

Cash In Hand Journal Entry: Rules, Format And Practical Examples

Regarding the results of the results, the costs must be recorded as soon as they are carried out in accordance with the accounting standards, so the timetable of recognition is the period during which the invoice is obtained and not when the company paid the supplier or supplier.

Therefore, accounts payable are classified in the department of current balance sheet obligations, as the accumulation of unfulfilled payment liabilities entails a future “outflow” of cash.

The payment due due to suppliers and sellers from a business will remain stable until the payment obligation is fulfilled (ie the payment is paid in full by cash).

Upon receipt of cash payment, the recorded account that will be paid will be reduced accordingly (and the balance sheet equation must remain true).

Solved Ex1. Prepare Journal Entry: 1. Paid €3,000 Cash On

The excellent obligation to fulfill payment in the form of cash to the supplier or seller for the product or receipt of the service is expected to be paid in full within the next 30 to 90 days.

Why? Payments due to the company are expected to be issued shortly after the invoice has been issued in terms of suppliers and sellers.

If the excellent balance has not been settled in a reasonable period of time, however, the supplier or seller has the right to take legal action to claim the payment due.

The disadvantage of receiving a business client in court, with the risk of declaring the obvious, is that the business relationship between the two is probably irreparable.

Question No 8 Chapter No 5

The change in accounts payable is recorded in the Cash Flow (CFS) statement in the Cash Flow Unit by Operational Activities (CFO).

Based on the increase or decrease monitored in the cash flow status (CFS), the change in accounts payable is the net impact that affects the metaphorical value of current responsibility on the balance sheet.

For example real life, the alphabet (Googl) reported $ 7.5 billion and $ 6.2 billion in accounts paid for Q-4 2023 and Q1 2024, reflecting the reduction of about 21% q/q.

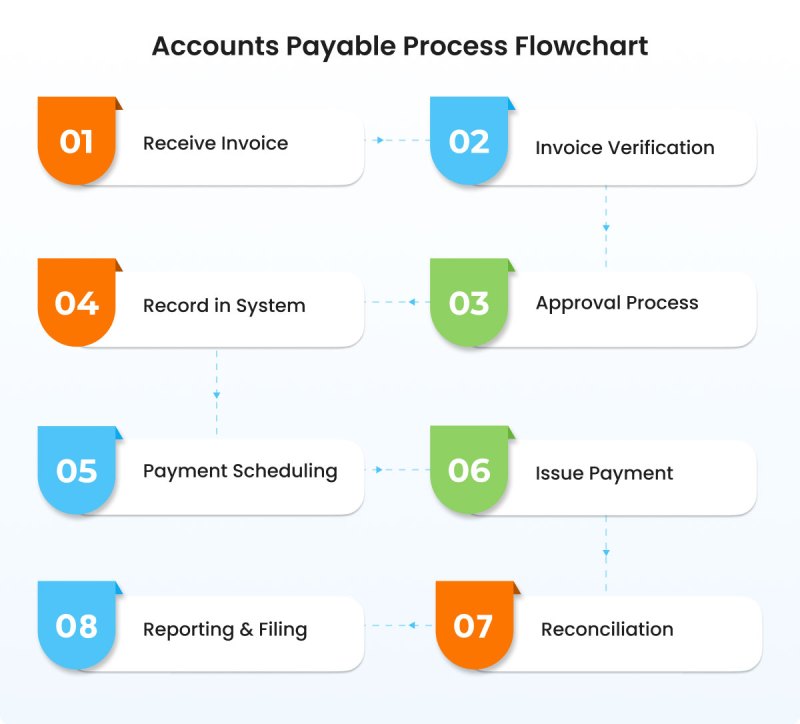

Starting, the account payable process starts after the purchase department of a company issues a purchase order (PO) to a supplier or supplier.

Everything You Need To Know About Accrued Expenses

The purchase order document (PO) determines the desired goods, quantities and prices and serves to start orders (ie the goods are moved from the supplier to the customer).

Upon receipt of the goods, the company records the details of the shipment, including any quantity deviations and damage through a reception report. For example, the items purchased could have reached poor condition or could be sent in the wrong quantity.

Once obtained and processed, the seller issues an invoice to the company, requesting payment for the goods or services provided.

The invoice is obtained from the Department of Company Payable (AP), noting the completion of the invoice management process.

Question No 1 Chapter No 8

If internal bills payable bills and collection policies are effective, the result is the increase in free cash flow (FCF) and a decrease in liquidity risk.

The fewer customer payments are due to a company, the lower the risk of liquidity attributed to a company (and vice versa).

The current voltage of accounts payable should serve as a favorable queue of the industry that contributes to greater operational efficiency, cash reserves and faster collection of timely customer payments (including fewer fraudulent invoices).

In accounting, the accounts and notes paid are any obligations recorded in the balance sheet. But despite the similarities in the name, the two terms are not interchangeable.

📘 Types Of Accounts Payable Journal Entries

Therefore, the concept of trade payable is considered a subset of bills payable, which is more complete in terms of short -term payment liabilities.

In terms of a company (or buyer), there is a clear incentive to reduce the money due to customers who pay credit (and to collect cash collection for products and services already delivered).

The fewer cash -linked cash, the more discreet free cash flow (FCF) are available in the company, which can be spent on reinvestment activity, such as funding to increase and maintenance of capital expenditure (CAPEX) – or the market for fixed assets (PP & E).

If a company’s accounts payable are firmly at the highest fee compared to those of comparable companies, the voltage is considered a positive sign,