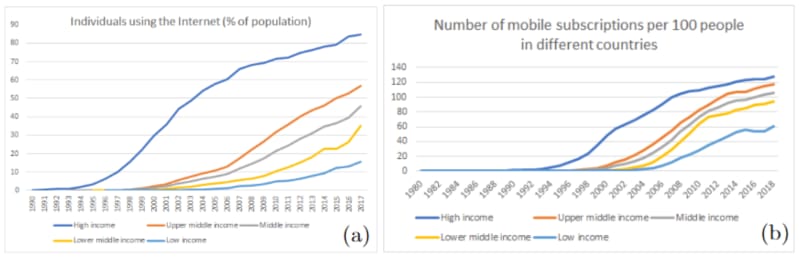

Technology Adoption S Curve – The life cycle of technology implementation (TALC) is a graph that all alarming investors should be familiar with. Talk claims that at the moment when different people accept new technology, follows the distribution of crooked bells. At first, some enthusiastic and seer accept technologies. The vast majority accepts at some point in the middle, and few skeptics take poorly close to the end of the life cycle.

Nevertheless, the number of new adoptive parents is not as relevant as the total number of users when predicting products sales. Users can be divided into customers for the first time that they make initial purchases and existing customers, making purchases of replacement of the product. When we reach most stages of conversation, customers first begin to flood the market, quickly increasing global sales. In most cases, a turning point appears in the sales of products, as the rate of new customers begins to slow down, which also reduces the growth rate of sales. Finally, all sales come from the replacement of products, but since now there are so many customers who have accepted technologies, sales are still or about a high time.

Technology Adoption S Curve

Since the conversation creates polls, we can use the following general equation of the curve for the growth of the model. If you are interested in how I received this equation, explain here in more detail.

Pricing Strategy For The Technology Adoption Lifecycle I Ibbaka

Remember that TAM, K and B are constant, not variables, which means that they do not change over time. This can be easily evaluated in order to easily evaluate it, but K and B are an arbitrary constant, for which we will need to solve. The method for this is quite simple and will be explained in the next section.

Now we will use the aforementioned equation for modeling the EV implementation curve. To do this, we will have to make two assumptions.

The annual sales of total vehicles amount to about 80 million. However, from a smaller number of EV parts is more reliable than a gas car, which will reduce the number of sales of purchases of products. However, taking into account the growing population of the world, I think that it is fair to preserve 80 million there. Another assumption that is connected is that EVS will represent 100% sales of vehicles sooner or later. Given the fact that they will soon become cheaper than gas cars will have better performance and more stable, I will come to this assumption.

It is more complicated. The choice of too early time, like 2005, will overcome growth rates. On the other hand, the choice is too late, like 2020, would underestimate him. Later we will play with this variable, but we will still choose 2015.

What Rewiring America’s Pace Of Progress Report Teaches Us

Now we have placed our algebra hats and begin to look for certain values on the basis of the equation for the constant TAM, B and K. Tam are 80,000,000,000 from the first assumption. In addition, out of 540,000 cars sold in 2015, and we assume that 2015 is the beginning of polls, we know that R (0) = 540, 000.

We have more information that 3.24 million additives were sold in 2020. Since 2020 after 5 years after 2015, we know R (5) = 3, 240,000. Using this and value B that we just found, we can decide the missing Constant, K.

Now let’s rewrite the final equation using the values B and K that we find and see how it looks when it was graphic.

Figure 3: model of a curve of annual growth of electric vehicles. X -is the number of years after 2015. The y axis is the number of cars sold this year. The schedule was obtained by schedule of the previous equation in Desmus.

Predicting The Next Tech Disruption

Figure 3 is a graph of the previous equation. Pay attention to how the interception and graph is 540,000, which is the number of additives sold in 2015. Point (5, 3 240,000) is also on the schedule, which represents 3.24 million cars sold in the 5th year (2020). In addition, we can predict global EV sales this year about 4.58 million people. For all goals and goals, the levels of the curve are about 25 years. Since we started in 2015, the 25th year will be 2040.

As promised, now we will adjust the year when the curve S. begins in the next table, the forecasts for future sales are shown, and the year in which the levels of the curve are closed. The calculations were made in the same way as above. Unfortunately, 2010 is the first year when I was able to get accurate data for the EVS number sold this year, so I did not simulate a single year of start until 2010.

The purpose of modeling a function with different years of departure is not to generate various sales forecasts by 2021. Instead, it is intended to emphasize how changes in the initial year can sharply affect the results.

Remember that the initial year is the beginning of the S. curve for EVS, the curves did not begin in 2018 or began in 2015 or 2012 to this issue. The exact year is controversial, but 2010 is as close as we reach the start of the examination for electric vehicles. This means that if we want an accurate projection of future sales, we must use 2010 as a starting point.

One Equation To Rule All Startups (and Other Stuff Too) — Gavrilo Bozovic

Using points P (0) = 24, 500 and P (10) = 3, 240,000,000 (where t is the number of years after 2010, therefore t = 10 average value 2020) for resolving permanent b and k, as shown earlier, We get the following equation.

To predict sales for 2021, leave T = 11 and evaluate the expression. You need to get about 5, 192 000. Please note that since the statistics used are measured vehicles for complement, which include hybrids. The number of clean electric vehicles sold will probably be lower than this. You can also record this using graphic technologies to see how the review is considered and predict EV sales for each year. Just remember that T is equal to the number of years after 2010.

Do not take into account the potential restrictions on the proposal, demand restrictions, the Wright Act, or how robotaxis can affect sales, may be the reason that this model is incorrect. However, in order to take into account the above factors, you must make more assumptions. When you make assumptions, this increases the risk of your model incorrect. The only assumptions that this model made is a common supply market, and when S. Both of these budgets begins with a good degree of confidence. This does not mean that this model is more accurate than everyone else, it just cannot be discounted.

This is due to the fact that more factors affect the sales of a particular company than the factors affecting the global industry. At some point, many destructive innovators will be limited, which means that the company cannot produce enough products to meet all demand. This will make sales turn off the standard curves. In addition, unforeseen competitors can remove the share of the market for existing enterprises (just imagine that use surveys to model Nokia growth trajectory in 2007).

2023 Will Be A Chaotic Year For Martech, Yet The Start Of A Massive Wave Of Growth

3. On the topic of electric vehicles, this model can be used to predict a gigafatorial output over time

Since projects such as the production of newly constructed factories often model the curve A, the model used in this article can predict how many cars are the month in a month. You do not even need to assume when the curve begins, because it begins as soon as the factory begins production. As for the total canceled market, this becomes production capacity as soon as the plant reaches full power.

I want to complete the comparison between this model and forecasts of ARK Invest with respect to the EV market. ARC believes that technological achievements will reduce costs as a result of the act of Wright and reduce $/loading. These positive deflation forces reduce prices and contribute to demand. In January 2020, ARK Investing expected 37 million World Sales EV in 2024. My model is a little more conservative, and sales reach 37 million in 2025. On the other hand, many traditional analysts do not even see sales that reach 37 million for the end of the decade. I don’t know how much my model will be, but I know that yours are completely false.

From electric vehicles to editing the genome, from FinTech to 3D print and from blockchain to space research, innovation at the door. Although exponential growth is indistinguishable from early linear growth, you know that again and again the speed of new technologies follows the curve S. In addition, you know that, despite your defects, a simple equation here will allow you to simulate the growth of new industries more accurately than many traditional analysts. Pressing “continue joining” or “entrance”, you adopt a user agreement, a privacy privacy policy and a cookie policy.

Timothy Peterson On X: “most People Don’t Know About Metcalfe’s Law But Networks Follow It Anyway. Technology Adoption Follows A Well-known Pattern Called An S-curve. Once You Know The S-curve Path, You

Almost all technological revolutions tend to follow a similar growth scheme: the S. curve Crush S is a very recognized model for