The Insurance Company Of The West Indies – When the courts condemn or charge him to drive under the influence (dui), or to what some states refill to driving in a state of and intoxicated, financial and legal headaches that follow could be quite Severe and Long. To ensure that he is complete prepared for what follows, it is important to retain a qualified dui lawyer who will help with his legal process.

In Case You Choose To Submit A Statement of Guilt In The Hope Of Reducing Charges, A Dui Lawyer Still Requires Its Judicial Presentations. It is the best for his interest to hire an expert in dui who knows the california law, he knows the juditial system and the judge respects the judge.

The Insurance Company Of The West Indies

While people talk about SR-22 Policies, Insurance companies do not write specific driving under investions insurance policies, although they may seem to market somethite like that. If it is involved in a dui, the policy that will be civil liability policy of Motor Vehicles, but with a monthly cousin in the responsibility policy issued to a driver who has a clean management history. In addition, the Insurance company must present an SR-22 Form in its name with the california motorized vehicle vehiccle department.

10 Biggest Insurance Claim Payouts Of All Time

California’s Law Requires Dui Sentence to Remain In Its Handling History for 10 years. If he enjoy some special Privileges of the Insurance Company Before The Conviction, Such as The Diving Discounts, They Will Discovery Once His Insurance Discovers With A DUI. This is because Its Insurer Will Have Updated Their Driving Record and Placed It In The High -RiK Category.

You can expect a driving under the conviction of influence to impact your car’s Insurance rates for approximately 7 years. While retains in your management history for 10 years, every year it passes Witistration negative Mark in your registration, less weight has the conviction regarding the calculation of your rate. Once your dui has been removed from your management history, it is advisable with a new carrier who has no Knowiction so you can get the best possible rates.

Obtaining a condition for Driving under the influence Expelled or Eliminated from Your Driving Record is an option. In California, a deleted conviction can still be considered suffix evidence of a previous conviction. The Dui Can Affect The Insurance Rates Of Your Car Even Afta Being Eliminated If It Remains With The Carrier Who Is Already Aware Of His Conviction. These infractions Eliminated will not normal be visible for credit inSurers or Others who May Be Trying to Crossy Out a check in the Conviction, It does not have an item expelled, since they Alread KNOW.

The drivers Convicted of Driving Recklessly, Driving Under The Influence or Driving Without current insurance are required by the Court So That They Have Motorized Vehicle Insurance Policies Required By The State Of California. Evidence is required to comply with these minimum of insurance before you can restore your license. The Required test is california insurance sr-22.

The Insurance Company Of The West Indies (cayman) Ltd.

An SR-22 is a certificate that demonstrates its financial responsibility and is a documentation that its insurer must presentment of its california State (DMV) as proof thatrage. In case you allow your policy to beat, lose a payment or even cancel your car policy, your insurance company will review the sr-22, which makes your license be placed again again.

When You Need to Send the California SR-22 Certificate, Make sure the carrier is aware and can present the sr-22 in your name. While binging for an insurer, he must ask about this, since the Inability to do so will cause him a lot of time and frustration, and possibly also Money.

There are currently only two States in the us that require the filling of Insurance Fr-44: Virginia and Florida. The Fr-44 Acts As Evidence of Sure Certificate That The Driver Requires That The Liability Limits That Are higher in their motorized vehicle insurance policy Due to a state of Poisoned Sentence. California does not require that you present a fr-44, an SR-22 is supply to meet the minimum requirements of the state.

If you are no longer the owner of a motor vehicle, Obtain Non-Owner SR-22 Insurance Could Become a Good Method to keep your premiums updated Without Eliminating your budget. Prices ARE GENERALLY Lower Because These Types of Policies Only Provonsibility Coverage Of The Motorized Vehicle.

Caribbean Information And Credit Rating Services (caricris)

In almost all states of the United States, a DUI SENTENCE will be transferred outside the state to its Native State. For example, if you were convicted by a dui in Iowa, But Since Then he moved to California and is now Convicted of a New Dui, Once California Discovert His Previously In Iowa, The State Will Treat Its New Conviction as a second crime.

The fastest way for a state to find out about its management history is through the national driver Register (NDR). State DMVS are required to Update The NDR with respect to all revocations, suspensions and denials of Licenses no later than their update within the system.

Auto Insurance After A Dui Can Be A Challenge. No matter the result of the DUI, the insurance rates of your motorized vehicle will increase once your insurer finds out. The best Defense you can assemble when facing a dui is to accetting the results of your actions, ensure legal representation and consult an SR-22 Insurance Professional and the Long-term Impact of Having a Dui in your registry.

Talk to an expert in Breate Easy SR-22 who can help find the best dui insurance rates and Return to the road today! Call Now 833-786-0237! Wawanesa has the cheapest sr-22 Insurance in California, at an average cost of $ 136 per month or $ 1, 632 per year. That is 67% cheaper than the state average, which is $ 4, 881 per year.

Quote N Buy

The other companies that offer cheap Insurance in California If you need an SR-22, Include General and National Mercury. But Car Insurance with an SR-22 costs much More than average and rates can vary Widely, SO be sure to compare rates before Choosing a Policy.

We find companies with cheap insurance sr-22 in California by Calculating the Average Rate for drivers with a suspended license, dui or an imprudent management appointment.

Our Sample Driver was 30 -Year Male Driver from a Toyota Camry LE 2017 with Average Credit that had a policy with the following limits:

Some Operators May Be Represented by Affiliates or Subsidiaries. The rates provided are a sample of insurance costs. Your Real Appointments May Differ.

History Of The British West Indies

SR-22 Insurance is not really a type of car insurance, it is a form that your insurance company presents for you that shows that you have an active policy. An SR-22 In California Must Demonstrate That It It Has At Least The Following Amounts of Coverage:

You may have SR-22 Insurance After a License Suspension or Serious Violation. In California, Some of the Reasons Why Your License Can Be Suspended Without Insurance, Obtaining A Dui, Driving Recklessly, Careers or Obtaining Too Many points in your license in a short period period periodion of time.

California Generally Requires SR-22 Insurance for at least a few years, but the exact time depends on his violation. Your Insurance Company Will Notify The State If You Drop Your Coverage Early And Face Fines and Need An Sr-22 for A Longer Time.

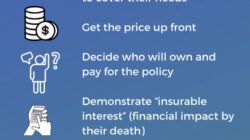

Once He Knows That He Needs An Sr-22, You Can Follow These Steps To Find SR-22 Car Insurance Affordable in California:

The Insurance Company Of The West Indies Limited (icwi)

If you have a license but not your own car, it is possible that you should obtain Non-Owner SR-22 Insurance if your license is suspended or commits.

The Owners Insurance Basically has the same coverage as a regular insurance policy, apart from the integral and collision coverage (Since there is no car to protect). An SR-22 Policy does Not Usually Have Lower Limits Than Regular Insurance, SO IT CAN Beer.

On Average, SR-22 Insurance in California costs $ 407 per month, OR $ 4, 881 per year. That is High, but many companies offer cheaper coverage, so be sure to buy.

On Average, Wawanesa has the cheapest Insurance in California for Drivers who need an SR-22. The National General and Mercury Also Offer SR-22 Insurance Cheaper Than The Average in California.

Insurance Company Of The West Indies Jamaica

It depends on why he had to present an SR-22 in the first place, but whenever he does not allow his insurance to have a sr-22, his car insurance company will eliminate it after the required periodorse.

Andrew Hurst is a former senior editor who has spent his entire career writing about life, disabing, home, car and health insurance. His Work has appeared in the Wall Street Journal, the Washington Post, Forbes, USA today, NPR, MIC, Insurance Business Magazine and Property Casualty 360.

Anna Swartz is a superior administration