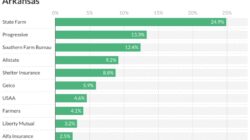

Top Auto Insurance Companies Usa – Top 25 largest private passenger car insurance companies in the US- according to the report from the National Association of Insurance Commissioners (NAIC) entitled “2023 Marketing reports for real estate/accident groups and companies”, there are 25 largest private passenger insurance companies in the United States. These private passenger car insurance are still popular in the US and many customers have trusted these car insurance companies.

Private passenger car insurance is the insurance products that can be used for private passenger cars (vehicles are used for private needs and not for business use). In this context, a private vehicle is used in this context for private purposes such as going to foods/ markets, commuting to and from work/ schools/ universities and other personal activities. The use of private vehicles is not used to transport people or passengers for money such as taxi, bus or other public transport.

Top Auto Insurance Companies Usa

Here are the 25 largest private passenger car insurance companies in the United States. The rank for all information was obtained from the National Association of Insurance Commissioners (NAIC) in its published report entitled “2023 Market share reports for real estate/accident groups and companies”. The National Association of Insurance Commissioners (NAIC) is the US standard setting and regulatory organization founded in 1871. Functionally formed this organization to regulate the insurance industry and protect consumers relating to insurance products.

How Safe Driving Discounts Can Save You Money On Your Auto Insurance

In this article we were ranked according to direct written premium. Direct premiums that are written is the total amount for an insurance company’s written premiums for a certain year without reporting the amount that is CED for reinsurance. At the same time, direct premium has been introduced the part of the premium paid by the insured who has been allocated losses such as the insurance company, costs and profits have erected for a certain period.

State Farm Insurance is one of the largest Bloomington insurance companies, Illinois, U.S.A. Historically, this company was founded by George J. Mecherle in June 1922. Together with business development, State Farm Insurances is one of the largest suppliers of property and damages and the largest car insurance supplier in the United States. In total, by 2023, this company has approximately 57,000 of employees with more than 7.8 million life insurance and annuity policies. When it comes to its financial grades, State Farm Insurance has received a rating A ++ from A.M. Best®, AA1 from Moody’s® and AA from Standard & Poor’s.

Economically, in the annual report from 2023, State Farm Insurance has a total asset of $ 220 billion, but State Farm suffered net loss of USD 4.7 billion. According to the report from the National Association of Insurance Commissioners (NAIC) in 2023, State Farm Insurance received direct premiums written approximately $ 57.9 billion and $ 54.8 billion. Statistically, in the private passenger’s car insurance industry, state agricultural insurance has market shares about 18.31 % in 2023 and becomes the largest than other insurance companies in the same industries.

Progressive Insurance is a US-based insurance company that started in the insurance industry in 1937, and the founder of progressive insurance companies was Joseph Lewis and Jack Green. Operationally has progressive headquarters in Mayfield Village, Ohio, USA together with business development, Progressive Insurance has become one of America’s largest car insurance groups, the largest seller of motorcycle and boat policy, market leader in commercial car insurance and one of the 15 best homeowners. So far, until 2023, progressive has earned more than 37 million customers with employees of 55, 100 people.

9 Best Auto Insurance Companies For Roadside Assistance In 2025 (top Providers Ranked)| Autoinsurance.org

In the case of financial aspects of 2023, the total assets for progressive insurance amounted to USD 88 billion, while total debts amounted to USD 68 billion. In addition, progressive total revenue generated SEK 62.1 billion and reported a net result of USD 3.9 billion. Based on the report from the National Association of Insurance Commissioners (NAIC) in 2023, Progressive Insurance Direct Premier has written approximately USD 48.2 billion with direct premiums earned approximately $ 45.8 billion. In total, 2023, Progressive Insurance has a market share of 15.24 % in the private passenger car insurance industry.

Berkshire Hathaway was founded in 1839 in Cumberland, Rhode Island by Oliver Chace and was built by Warren E. Buffet. Usually, the insurance companies owned by Berkshire Hathaway, namely the state employees’ insurance companies (Geico), General Re, Berkshire Hathaway Homestate Companies, Berkshire Hathaway Specialty (BHSI) and others. Together with the business development, according to the annual report from Berkshire Hathaway 2023, the total Berkshire Hathaway’s total assets are approximately $ 1,069 billion with total liabilities $ 499 billion. When it comes to business results, Berkshire Hathaway received total revenue of $ 364 billion and net profit of USD 97 billion.

Based on the report from the National Association of Insurance Commissioners (NAIC) in 2023, Berkshire Hathaway has direct premiums written by $ 38.1 billion with direct premiums earned $ 38 billion. Overall, this company has a market share around 12.31 %.

Historically, Allstate was formed on April 17, 1931, when the Great Depression happened, and the Americans struggled with the monetary crisis. As a holding company, its operations are mainly conducted through the Allstate Insurance Company and other subsidiaries. Operationally, in its operations, this company has some operations in the insurance industry. The primary operations are in vehicle insurance, property insurance and other (personal umbrella policy, pension, Allstate Health Solutions, Volunteer’s benefits, pets and events). Officially, this company still has a central office in Northbrook, Illinois, the United States based on the geographical market in the United States (USA), Allstate has some markets in some states in the United States, namely Texas about 11.4 %, California 11 %, New York 8.8 %and Florida 7.2 %. Operationally, together with business development, Allstate Corporation has 53, 400 employees, 9, 100 exclusive agents and agent support staff, 20, 200 licensed sellers and 50, 900 independent agents.

Faq: What Are The Top 10 Auto Insurance Companies In Usa?

During the year 2023, total assets for Allstate Corporation were registered to USD 103 billion and the total debts reached USD 85 billion. In the case of business results, Allstate Corporation received revenue of USD 57.9 billion but was hit by a net loss of $ 0.21 billion. In addition, Allstate Insurance 2023 has direct premiums written approximately $ 32.8 billion with direct premiums earned approximately $ 28.7 billion. In addition, this company has a market share about 10.69 % in the private passenger car insurance industry.

The United Services Automobile Association (USA) is one of the largest financial companies in the United States (USA) headquartered in San Antonio, Texas, USA. To date, USA until 2023 has more than 37,000 employees serving more than 13.5 million members. Based on insurance products, USA has many diversified insurance products including vehicle insurance, property insurance, life insurance, umbrella insurance, health insurance and others.

Economically, according to the annual report from 2023, the United Services Automobile Association (USA) shows a strong financial position, with total assets at $ 211 billion and total liabilities of $ 182 billion. In the case of business results, USA successfully generated total revenue of USD 42.4 billion and net profit of USD 1.2 billion. In addition, the United Service Automobile Association (USA) may receive direct premiums written to USD 19.8 billion with direct premiums earned around $ 18.8 billion. Based on the position, the United Service Automobile Association (USA) has market shares 5.92 % in the private passenger car insurance industry.

Liberty Mutual Insurance is an insurance company that has a central office in Berkeley Street, Boston, Massachusetts. Historically, this company was founded on July 1, 1912. Together with business development, Liberty Mutual Insurance Company has hired over 50,000 people in 29 countries and economies around the world. In addition, this company was also included in the Fortune list of 86th rank based on 2023 revenue. Based on its operational business products, Liberty Mutual Insurance runs three business units, namely personal insurance lines, commercial insurance lines and Liberty Mutual Investments (LMI).

Top Auto Insurance Companies In Usa, Uk And Canada

During the year 2023, Liberty Mutual maintained a solid financial basis with total assets of approximately $ 165 billion and total debts of USD 140 billion. In the case of business results, Liberty Mutual received revenue of USD 49.4 billion and a net result of USD 0.22 billion. In addition, Liberty Mutual Insurance received direct premiums written approximately $ 13.3 billion with direct premiums earned approximately $ 13 billion. In addition, this company has a market share of 4.95 % in the private passenger car insurance industry.

Farmers Insurance is an insurance company founded in 1928 by the initiative of John C. Tyler and Thomas E. Leavey. Both have lifelong experience in agricultural sectors because they were raised in rural areas.

So far, together with business development, farmer insurance companies can earn more than 10 million households with more than 19 million individual insurance in 50 states in the USA. In addition, Farmers Insurance has 48,000 exclusive and independent agents and 21,000 employees. Since 1998, Zurich Financial Services has owned Farmers Group.

Economically, from 2023, Farmers Insurance has a total asset of USD 23 billion. According to the report on