What Does Xs Mean In Insurance – Additional responsibility is the additional insurance policy, which is the number one of your current ‘primary’ insurance policy, to provide you with the overall cover limit.

Excessive accountability in the current insurance market is especially important because the insurer (especially for business compensation and general accountability) has the low ability to give a higher limit to single strategies. If you need a higher limit than to provide your insurer, take the additional accountability policy to provide you with the additional security for contract reasons.

What Does Xs Mean In Insurance

There are various situations that need additional accountability policy;

Piercing Pattern: What It Means And How Traders Can Use It

For example, you may have a business compensation insurance policy, which may have a limit of 5, 000, 000 for a claim. This range may be the highest you can get from your insurer, but because you take a big plan, you need to make sure you need a higher limit, and you are protected enough.

You get an additional $ 5, 000, 000 cover limit with another insurance company. Overall, now we have insured each claim for a maximum of 10, 000, 000.

Using this example, if you demand $ 7, 000, 000 against your business, the claim will act as follows;

Excessive responsibility insurance is sitting on top of the existing policy, and most of the maximum responsibility depends on the original principle. Basically, the additional responsibility strategy will provide security such as a base ((primary “) insurance policy. Therefore, nothing excluded under the primary insurance policy is not included by the principles of high responsibility.

Rsi Indicator: Meaning, Formula, And Application

In some cases, additional exceptions can be used for the principle of additional responsibility for some insurance cards who do not want to follow the excessive accountability insurance policy.

Taking only two policies with different insurance companies should understand that you do not mean ‘double card’. Additional responsibility insurance is a certain type of insurance, and you need to be set up to ensure that you have the total limit you need. We always recommend investing insurance brokers services to this type of insurance scheme.

Yes. You can usually take several additional accountability strategies to achieve the total range of the claim you need. Basically, it is like ‘stacking’ principles, which spread the risk among many insurers.

By taking several additional accountability policies, see the visual map below for the examples of getting $ 10, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000, 000.

Insureful: Shipping Protection

To consider whether the relevant insurance companies can provide maximum accountability insurance, they are generally needed;

To determine if they are convenient to provide more limitations than this policy, the additional responsible insurance must review the full details of the card issued under the Basic Insurance Policy.

To learn more about excessive responsibility insurance, please complete our online form or call us at 1300932 237.

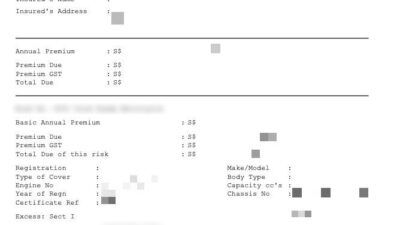

New Insurance Code or Renewal for BDAA members providing a building design or energy evaluation (or similar) service. Most insurance policies maintain mandatory or voluntary additional additional, which is a definite amount you have to pay if you request your insurance policy. In progress, insurance companies have increased the premium than inflation, so they are now common to accumulate a lot of money, which means that you can pay more money on your policy for relatively small claims.

Eonfine For Iphone X Case,for Iphone Xs Case, Built-in Screen Protector Full Body Protection Heavy Duty Shockproof Rugged Cover Skin For Iphone X/xs 5.8inch (black/clear): Amazon.co.uk: Electronics & Photo

For example, if your claim is £ 900 and your policy is £ 500, your insurance provider will only pay £ 400, which will keep you up to £ 500. Here the maximum safety adds the actual value, the additional strategy will pay you an additional premium, for example for $ 500.

The impact of the premium charged in the main insurance policy is common to the volunteer volunteer. There is a high risk for the chief insurer, ie reduction in the cost of insurance insurance. It is worth checking whether these two combinations can reduce their total insurance costs, that is, if you choose the maximum and get them, you can go better; Nevertheless, you will always be responsible for paying more fee for the policy without insurance.

There are 5 types of additional (XS) policies, please click the relevant product link below to the maximum you want to hide.

You are protected for the maximum amount compared to each settlement claims in your major motor vehicle insurance policy only in the context of the claims that arise from the motor insurance claim.

What Is Rate On Line In Re/insurance Industry Is Very Important Thing To Consider In Deciding

A motor vehicle can be a private car, motorcycle or a mild professional vehicle, which is registered at your home address, used for social and home purposes, and travels to your regular workplace, created for a passenger car and their effects and not over seven passengers, you own or you own.

This personal vehicle only occupies a motor vehicle in the XS policy, and the vehicle may not be insured by the chief expert/naval insurance policy (you need to remove the personal light professional XS policy).

A cover is issued to the maximum repayment of your motor insurance policy after a solution claim to the motor vehicle used for a motor vehicle:

Within six months after issuing a valid claim against them under your main insurance policy, you failed to retrieve the highest price from the third party. Cover benefit option £ 250 – between £ 2000.

Maksud Coverage Expired Pada Iphone

Claiming is an easy and fast way to claim the website, because the web solution allows you to enter all the details to solve your claim: https://www.excesclaim.co.uk, but you can contact the helpline at 0345 600 0034 if you do not have access to the Internet.

You need to cite your project code, which will find out how I can create the claim section of the word.

Total cover or clam benchrot is the maximum total total, which can be filled in one or more claims without achieving the total, which means that the total XS cover you choose. Look at the following questions, “Can I claim my XX policy more than once?”

If you are involved in a fault non-car-catching accident, you can usually restore your excessive cost from a responsible party (or their insured).

This Is Generation X’s Biggest Retirement Worry — And It’s Not Money

If you are unfortunate and if you have a wrong accident, this XS policy cannot be re -defined, but do not repay your exaggeration within 6 months.

The main reason for excessive insurance is the highest payment for the policy if you claim it.

In some cases, experience has proven that the principle of the main policy is significantly reduced if the risk of the insurer is reduced if maximum money is low. This offers an opportunity to pay for XS insurance, which can show the overall savings even if you fill 2 policies.

Yes. You will be given a large amount of money according to each solution of your policy to the annual total limit.

Hands-on: The More Powerful, More Durable, And More Expensive Apple Iphone Xs And Xs Max

You can take more XX security than your main policy. In that respect, if you make many claims, you will have the highest cover. If your total excess is £ 500, you can take x 1, 000 XX security. If you have made two claims with your insurer, you can request your XS security policy twice if you have to pay your maximum. However, once the total limit of your XS card is reached, you cannot make further claims.

Only in the context of the claims that arise from the motor insurance claim will only be given to you in the context of each settlement claim in your police committee policy.

This principle only covers a motor vehicle and should not be insured by the main professional or active insurance policy (if any, you must remove the XX policy of a personal light professional vehicle).

Within six months after issuing a valid claim against them under your main insurance policy, you failed to retrieve the highest price from the third party.

How To Read A Certificate Of Insurance

No, you can only claim the solution of your main insurance policy that violates the principle of policy.

You