Zurich Car Insurance Hotline Number Malaysia – The payment company is responsible for the entire strategy of the Insurance Sector in the United States, the insurance leader, which at the same time adopts the field of canvas practice of the company to serve the Deloitte portfolio.

During his 30 -year career, Carley has widely served financial services and insurance industry, providing them with a good understanding of the most complex and key consumers questions. Carl has the experience of working on Deloitte’s audit, advisor and counseling, which allows him to bring the best to our customers. He served as the leader of the practice of transformation of insurance and the leader of the FSI company.

Zurich Car Insurance Hotline Number Malaysia

The US vision as an insurance leader is inspired by our customers and professionals to identify a significant impact of insurance sector based on intent through personal and commercial risk management, safety and security services and products, and long-term creation and maintenance of property.

Zurich Insurance Group

He currently serves as a leading advisory partner for the leader of our global insurance sector and one of his biggest accounts, James works in our financial services group. He is also a strategic partner in the Canadian Deloitte Practice monitor.

During his career, James, James, has led a number of strategic, operational and transformative ties with local and global insurers. Its focus includes a corporate and business unit strategy, consumer renewal, business development and major business changes.

Speakers, James, often enjoys setting up all things in industrial programs, including a Canadian national insurance conference, a Canadian financial forum and a professional Northwind Institute. At the University of Toronto, he won the MBA in Rotman School Management for Management and Air Force.

Michelle Canan is the head of insurance research at the Deloitte Center for Financial Services. As a specialist in the insurance industry, Canan produces thought dishes on current and future trends, including strategies and solutions for our customers. Recently, some works have been written, the insurers of life and the anuithetes are considered to be less travel: the modernization of the system of the system becomes part of the table and 2024. Global insurance: insurance companies develop to address the variable operational environment and eliminate more social influence.

British American Tobacco

The Jim Deloitte Financial Services Center is the Director General, where he is responsible for determining the market status and the development of fame and the main activities of the Center. Jim is often the main speaker in the main industry and clients’ conferences. Before joining Deloitte, Jim served in the role of several research and advisory leadership in Towergroup.

Insurance is the basic component of the economy and society: it takes into account progress and helps to safely be powerful. However, the nature of the insurer culture and their focus on margins and solvency have generally strengthened restraints in terms of their own innovation and modernization.

This results in an unhealthy or non -optimal strategy to respond to low predictable spikes or immerse in specialized professional lines and profitability. For example, inflation inflation and more and more irregular damages associated with the climate is pressure on the profitability of non -iconic insurance lines in the last few years.

Furthermore, as interest rates are increasing, life insurance and annuity carriers are joking to use the buyer’s interest in products associated with savings for saving status on the ground. These short -term strategies helped in the first quarter of 2024 in 2007 to run the results of the year of the year for the property and occasional (P&C) carriers,

The Organisation For Economic Co-operation And Development

However, such risks become more complex and unpredictable, and consumers are more empowered, especially with fingertips that generate AI tools, insurance companies will not be able to evaluate the risks by the rear view mirror. They should continue to develop the way they work on insurance and the way they communicate with customers and distributors. It becomes more important for carriers to improve technical and operational excellence, innovate product solutions and expand the insurance value proposal – the security network of insurance makes a more reliable, more affordable and more elastic. Modernization and pruning in infrastructure, performance and professional models, insurers can develop more anterior access to modeling risk, estimate, analysis and inconvenience.

According to insurers, they develop their professional Dello models, it will be important to maintain confidence with customers and serving markets. For example, after the customer’s “Shock Sticker” from the great life premium,

The first stakeholders may need to recreate goodwill to support the industry. Indeed, machine learning and AI can collect and analyze large quantities and sources of data, but insurance companies should provide transparency and painting that help customers and regulators accept these approaches.

Furthermore, customers and technological progress preferences can make it difficult for one competition. Creating or acquiring new products and ability can be long -lasting, uncertain and capital intense. It may be necessary to cooperate with suppliers who can alleviate the pace of both economic, geographical political or climate unrest needed to satisfy the demand for customers and distributors.

Cyber Insurance: Risks And Trends 2025

In the midst of this change, it is expected that new tax rules will present challenges and opportunities for insurance tax on compliance, including data collection, reporting, visual planning and a corporate restructuring strategy. Insurers will also need to consider changes in prices, costing the optimization and strategy of M&A in the light of uncertainty about the influence of tax reliefs and the impact of new tax laws.

Famous risks also increase unknown risks. But insurance companies should become an elastic source of financial security in the atmosphere of changes and uncertainty. This will require the adoption of fresh, innovative operational network models and advanced techniques. As the speed of change, insurers should consider becoming fresh and fresh to quickly and effectively adapt the way they communicate with consumers, distributors, government agencies, ecosystem partners and their own workforce.

How can each field be a quick change in order to create opportunities for long -term growth and involvement in 2025 years? Life (wealth and accident) field

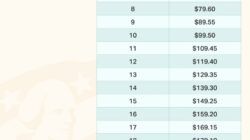

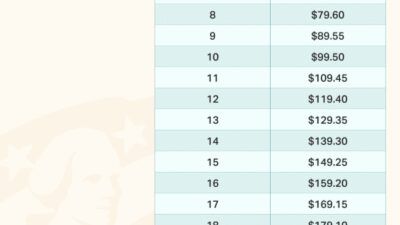

Overall, 9.3 billion US dollars in the first quarter of the non-life insurance sector (P&C) in the United States received an insurance in the amount of $ 9.3 billion-8.5 billion US dollars in last year’s appropriate quarter.

2025 Global Insurance Outlook

The combined industry ratio increased to 94.2% in the year each year, which is more raised in the sector of the individual lines, which led to the cost of the request.

Operational pregnancy revenues increased by 24 33% to $ 30 billion, which was in the first quarter of 2024, which encouraged an increase of 33% benefit of the year, insurance profits and earned net investment revenue.

Net premium growth in this area.44% Growth, which, with 2.2% reduction in damage costs and loss coverage, strengthens its financial position in the same period.

In the commercial line, the US insurers should consider increasing trends in areas such as liability insurance for work practice and decide to approach some of the quality segments, such as the responsibility of the director and official.

Zurich Zone Cafe In Palayam,thiruvananthapuram

As a social inflation – an increasing cost of insurance requests as a result of the plaintiff’s lawsuit due to a large financial relief for injuries – leads to large settlements and jury verdicts, insurers force their responsibility to become more pressure.

Although this history in the United States is an increasing question, now Australia Strally also has signs of the challenge of social inflation.

Geographical political tensions, especially in regions such as Russia-Ukrain and the Middle East, increase the risk assessment. This encourages insurers to test more careful items in Cyber, political and maritime contact.

For the first time in six years, the loss of American dollars from the natural Worldwide Insured Subject suffered a loss of US dollar without any event, which is the cause of US $ 10 billion.

This indicates a wide spread of small and yet expensive events. More geographical areas come in high risk zones, as they reflect the need for careful control industry and removal of insurance practice.

Economic losses from natural disasters reached 357 billion US globally in 2023. However, only 35% of these losses were secured, which left 65% or 4 234 billion gap of protection.

Globally, the actual conditions in non -life premium 2023 increased by 9.9% during the year, in part because the insurance companies increased the compensation rate for increasing claims.

In the UK and Australia Strally, for example, the growth of the premium of personal wealth and car insurance leaves behind the growth of inflation and available income in the last three years.

In Germany and Japan, wealth insurance premiums exceeded the increase in revenue and inflation, and the premium with auto fingers became more normal.

This strategy seems to improve the profitability of the insurer. But for consumers, the increasing frequency and intensity of disaster can make it difficult to cover the coverage possibilities.

Insurance regulators and many government institutions around the world seek greater transparency that the risks of the climate are in their strategy of investment from insurance providers. They also focus on insurance insurance available and accessible to consumers, especially in more sensitive communities.

Working group, carbon detection project and global reporting initiatives on voluntary ads, such as financial ads related to climate, continue to form a landscape.

However, the recent regulatory updates are aimed at promoting transparency and investors’ confidence and provide a stronger strategy to evaluate progress (Figure 2).

The reason for optimistic may be that non-live sectors can improve in 2025. A recent increase in the intensity of the request, which is guided by a greater lack of inflation and supply chain, is decaying.

This is expected to ensure a large rate increase and a rapid growth of a written premium in investment in investment.